This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

The UK’s car finance is under fire as complaints against lenders and dealers have risen. According to the Financial Ombudsman Service, protests related to car finance terms continue to roll in, and over the last quarter of 2024, the numbers have been as high as 18,658.

These highlight a shift in customer dissatisfaction and the crux for this seems to be complex financing terms between lenders and dealers, which have led to cost spikes for consumers. These practices include discrete commission models, whereby dealers secure loans at high interest rates, unbeknownst to buyers.

The FCA and others have reported this as well, stating that commission was paid on 95% of UK car finance agreements and estimating that as much as 40% of these agreements may have been mis-sold. The surge in such issues casts a shadow on the transparency and fairness in car financing, leaving your normal consumer in the dark.

This article aims to educate you about such issues, ensuring you’re fully equipped to deal with today’s challenges as well as any that may come in the future.

In the face of such complaints, consumers turn to online resources to understand their rights and options. Websites have popped up on this subject, aimed at offering guidance. However, with matters related to legal insights, one should be discreet and private. This is where handy tools like a SOCKS5 proxy come into the mix.

These offer security and anonymity to conduct online research, allowing you to access region-wise consumer rights websites without compromising your privacy. Unlike traditional alternatives, SOCKS5 proxy servers support different types of internet traffic and tunnel web requests, meaning full security and no compromised internet speed.

Beyond privacy, SOCKS5 proxies will protect against data trackers, often employed by websites you visit or third parties. With aggressive ad campaigns running around, you can stay sheltered from being a target of one.

You can securely access unfiltered information and control your online research using these proxies, making informed decisions without any unnecessary risks or exposure.

Understanding Common Issues in Car Finance Agreements

It pays to know the common issues that are prone to arise when it comes to car financing. There’s the obvious concern of undisclosed commissions between lenders and dealers where a commission value comes out of the pocket of the consumer, affecting the interest rate. While the FCA has already announced a ban, the past use of these continues to cause unrest.

High interest rates are another drawback, especially for those with lower credit scores. This would affect whether you plan on financing a new car or an old one. Complex financing terms written in agreements are another matter, throwing the everyday customer out of the loop.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Knowing Your Rights Under the Consumer Credit Act 1974

Know that the UK is governed by consumer protection rights, and safeguards are in place for those entering into credit agreements, including car financing. The Consumer Credit Act of 1974 ensures fair practices in lending while offering avenues in case mis-selling occurs.

A 14-day cooling-off period is granted after you agree to an agreement. This means that during these two weeks, you can cancel without any penalties, but the goods must also be returned. You can also terminate the agreement early if you have repaid at least 50% of the total payable amount of the vehicle, so you can return it without further payments being required.

In case any unfair dealings are detected between the lender and you, a claim can be made, which will then be solved in a court of law.

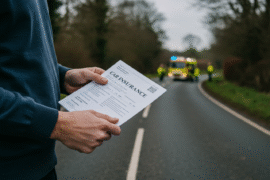

Filing a Complaint with the Financial Ombudsman Service

The FOS resolves disputes between consumers and businesses. This means that those who suspect something is wrong with their car finance agreement can file an official complaint and get to the root of the issue.

Before doing this, contact the car broker to give them a chance to sort things out. If they fail to respond, move ahead with the FOS. You can do this online or by calling them directly, after which an investigation will ensue, and a proposed resolution will be sent.

Remember to keep a detailed collection of documents regarding the deal to support your complaint.

Evaluating Alternative Car Financing Options

Choosing which car financing model can make a difference in cost savings, all while avoiding financial downfalls. The two most commonly available options are the Personal Contract Purchase and the Hire Purchase, but alternatives like personal loans and leasing remain.

Paying in cash is one of the simplest ways to go about it, but it is not feasible for many. In this regard, your options, whether to opt for car finance or buy a car, should be according to your financial goals.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: As Car Finance Complaints Rise in the UK, Here is What Consumers Need to Know

https://fangwallet.com/2025/03/17/as-car-finance-complaints-rise-in-the-uk-here-is-what-consumers-need-to-know/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.