Amex Platinum Promo Code Benefits You can get the chance to earn bonus points, statement credits, and special member benefits by using Amex Platinum promo codes in a smart way. Find good sources for real American Express promo codes. Stay away from old or fake offers. Check out a wide range of promo codes. These

Which Offers Best High-Yield Savings Account for 2025 Choosing the Right High-Yield Savings Account SoFi and American Express both offer top-tier high-yield savings accounts that outperform traditional banks. SoFi is known for its modern financial tools and higher promotional rates with direct deposit. American Express delivers stability, ease of use, and consistent returns without complex

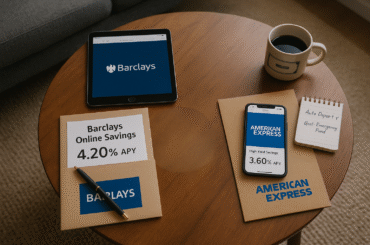

Barclays vs American Express for Savings See how Barclays Bank and American Express National Bank stack up side by side, so you can pick the best high-yield savings account for your money needs. Check out each bank’s interest rates, APY, and what makes each one stand out so you can spot the most appealing offers.

Main Benefits of Amex Gold Promo Codes Unlock higher Amex Gold Card welcome bonuses by using a verified promo code during application. Earn generous Membership Rewards Points on eligible purchases like groceries, dining, and travel. Access up to $240 in combined annual dining and Uber credits with your Gold Card. Apply at the right time

Choosing the Best Credit Card American Express cards offer top-tier travel benefits, including airport lounge access and extended warranties. Discover cards focus on simplicity, with no annual or foreign transaction fees and strong cashback options. Both function as networks and issuers, giving them greater control over their card features. What to Know About Amex and

As we navigate the financial landscape of 2025, choosing the safest banks becomes crucial. Look for institutions with solid capital, low default rates, and strong customer reviews. Your peace of mind deserves a home where your money is truly secure.

A bank account is a valuable financial tool. But suppose you’re holding on to an account just because it’s the one you’ve always had or it’s too much of a hassle to switch. In that case, you may be missing out, especially considering the advantages of online and mobile banking that banks today offer. Settling

Looking to finance a new HVAC system? In this listicle, you'll discover the best options tailored for your budget. From flexible payment plans to low-interest loans, we've got practical tips that make upgrading your comfort more affordable!

In 2025, Credit.com continues to be a reliable resource for managing personal finances. Its user-friendly interface and comprehensive credit monitoring tools empower users to take control of their credit health, making complex financial concepts more accessible.

American Express 5 Rebate Rewards Program The American Express 5 Rebate Rewards program gives people cash back on certain things they buy, like gas and groceries. Get a first-time bonus and more cash back in the first three months. Get rebate rewards as a statement credit once a year, which can help you manage your

Benefits of 0% Intro APR Cards Find the good things about American Express cards with 0% intro APR offers. These cards are great if you need to make big payments and do not want to pay interest right away. Get statement credits when you buy from places that are part of Amex Offers. You just

Introduction Have you thought about why Bank of America does not give traveler’s checks anymore? These checks used to be very common for trips outside the country with people from the United States. They gave a safe way to handle your money in another country. They helped people feel better about not carrying too much

Looking for the best CD rates in Wisconsin? You're in the right place! In this listicle, you'll discover top-notch financial institutions offering competitive rates that can help your savings grow. Let's dive into the details and find your perfect fit!

Looking to secure your finances in retirement? In this listicle, you'll discover the best savings accounts tailored for over 60s. From high interest rates to easy access, we've rounded up options that help you grow your nest egg while ensuring peace of mind.

Looking to secure your child's future? In this listicle, you'll discover the best long-term savings accounts tailored for kids. From competitive interest rates to flexible access options, find out which account will help nurture their financial growth!

Looking for the best credit card for your dining adventures? In this listicle, we'll explore top options that reward you every time you eat out. From cashback to exciting perks, discover which card can enhance your culinary experiences!

Looking to unlock cash from your home? In this listicle, you'll discover the best equity release companies that can help you tap into your property's value. Expect in-depth reviews, expert insights, and tips to find the right option for your needs!

The resurgence of 'Godfather' malware is raising alarm bells as it targets Android banking apps. This sophisticated threat can hijack your financial credentials, emphasizing the importance of vigilance in your digital security practices. Stay informed and protect your data.

In today's banking landscape, several regional banks are making waves with significant buyback initiatives. Institutions like First Horizon and UMB Financial are not only reflecting confidence in their financial health but also signaling strong investor returns.

In a surprising move, a major bank has announced the closure of 20% of its locations, a shift reflecting changing customer habits and digital banking trends. While this may streamline operations, it raises concerns about accessibility for many longtime clients.

The revamped Chase Sapphire Reserve is making waves with its limited-time offer, featuring a generous 100,000-point bonus and a $500 travel credit. This makes it an enticing choice for frequent travelers looking to maximize rewards and experiences.

In this listicle, you'll discover the best strategies to effectively use your credit card for building a solid credit history. From timely payments to keeping utilization low, each tip will help you boost your score and secure financial freedom. Let's dive in!

GameStop could redefine its future by pivoting to become the first Bitcoin consumer bank. With its vast customer base and tech-savvy community, the gaming giant has the potential to merge retail and cryptocurrency, offering users innovative financial services.

Mortgage underwriting is a key step in the home-buying process, where lenders evaluate your financial health to assess risk. To speed it up, ensure your documents are organized, respond promptly to requests, and maintain clear communication with your lender.

Looking for the best banks in Georgia? In this listicle, you'll discover top institutions that cater to your financial needs-offering competitive rates, personalized service, and innovative digital banking. Dive in to find your perfect match!

Looking to boost your business savings? In this listicle, you'll discover the best business savings account rates available right now. From high-yield options to flexible terms, we'll guide you through top contenders that can help your money work harder for you!

Open banking in Canada is on the horizon, with Ottawa promising implementation "at the earliest opportunity." This shift aims to enhance consumer choice and streamline financial services. As we await details, the potential benefits spark both anticipation and curiosity.

Looking for the best credit card to maximize your couple's spending? In this listicle, we'll explore top options tailored for partners like you. Expect detailed insights on rewards, benefits, and how each card can enhance your shared financial journey!

When navigating the world of real estate, understanding the terms "home loan" and "mortgage" is crucial. A home loan refers to the overall borrowing amount, while a mortgage is the legal agreement securing that loan. Clarity on these terms can streamline your home-buying journey.

When considering home equity options, it's essential to understand the differences. A Home Equity Loan (HEL) offers a lump sum, while a Home Equity Line of Credit (HELOC) provides flexibility with a credit line. Alternatively, a Cash-Out Refinance lets you take cash while refinancing your mortgage.