Secured debt is backed by an asset, like a house or car, giving lenders collateral if you default. Unsecured debt, such as credit cards or personal loans, lacks this backing. Understanding the difference can help you manage your finances better.

Consumer debt refers to money borrowed for personal goods and services, like credit card balances or loans. To escape it, consider budgeting, prioritizing high-interest debts, and exploring consolidation options for a manageable repayment plan.

When exploring options for funding your business, you may wonder: Can you find an interest-free loan? While it's rare, some nonprofit organizations and government programs offer such loans to help startups. Always research eligibility and terms carefully.

Financing a car means borrowing money to purchase a vehicle, typically through a loan or lease. This allows you to drive the car while making monthly payments, which include the cost of the vehicle, interest, and sometimes taxes and fees.

A low credit score can feel daunting, but understanding its range is the first step. Scores below 580 are considered poor, affecting loan approvals and interest rates. Fortunately, small changes like timely payments and reducing debt can lead to significant improvements.

In this listicle, you'll discover the best emergency loans that can help you navigate unexpected expenses. From low interest rates to quick approval times, we highlight top options to fit your needs and get you back on track in no time!

Securing a home construction loan can feel daunting, but it's manageable with the right approach. Start by gathering your financial documents, understanding your credit score, and researching lenders. Being organized will streamline the process and open doors to your dream home.

Navigating financial aid can be overwhelming, but there are strategies to maximize your FAFSA benefits. Always file your application early, double-check your data for accuracy, and don't hesitate to appeal your financial aid package. Your college's financial aid office can also offer personalized assistance to explore additional options.

Deciding whether to consolidate your student loans is a personal choice that hinges on your financial situation. Consider factors like interest rates, repayment terms, and your current budget. Consolidation can simplify payments but might cost more long-term. Assess carefully.

Debt is an obligation to pay money owed, often arising from loans or credit. While it can help us achieve goals, like buying a home, it’s crucial to manage it wisely. Understanding debt’s impact on finances can lead to healthier economic choices.

Using your tax refund to pay off debt can be a smart financial move. By reducing high-interest balances, you lower your overall financial burden and can save money in the long run. Consider your priorities but don’t overlook the benefits of tackling debt head-on.

Financing a shed can be straightforward with the right approach. Start by assessing your budget and exploring options like personal loans, home equity lines of credit, or even credit cards. Don’t forget to factor in ongoing maintenance costs for a complete financial picture.

When searching for the best credit union for your business account, consider our curated list that breaks down key features like fees, interest rates, and member support. We promise you'll find options tailored to your unique needs!

401(k) loans can be a lifeline for urgent financial needs, allowing you to borrow against your retirement savings. However, it's crucial to understand the repayment terms and potential risks, as defaulting can jeopardize your future financial security.

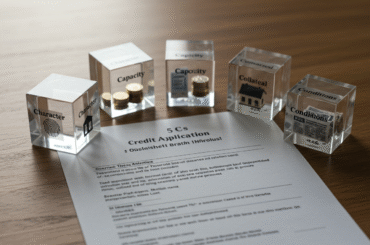

Summary Get to know the 5 C’s of credit: character, capacity, capital, the value put up for a loan, and conditions that help decide if the bank or lender will say yes to giving out a loan. Learn how your credit score and history with money matter to a bank or lender and count

When financing a used car with over 100,000 miles, it's crucial to assess the vehicle's overall condition and history. Interest rates may be higher, so consider a larger down payment to mitigate costs. Always check for reliable service records before borrowing.

Introduction The start of a new school year brings excitement for many families, but the rising cost of school supplies creates added financial pressure. Layaway plans offer a practical way to manage these expenses by allowing families to pay over time without interest. This approach helps reduce immediate financial strain and ensures students are equipped

When considering the best way to finance a pool, this listicle will guide you through top options tailored for your needs. From personal loans to home equity lines of credit, you'll discover practical solutions and tips to make your dream pool a reality.

Attention everyone! You have just 8 days left to claim your stimulus check. If you haven't received yours yet, it's crucial to act quickly. Check your eligibility and gather your information to ensure you don’t miss out on vital financial support.

Top Look at top personal loan choices made for every credit score, good, bad, or in between See how fixed interest rates and loan terms can make payments easier or harder Learn about what 2025 interest rates may be and check out what each lender has to offer Find out how to get better

Upstart offers unsecured personal loans ranging from $1,000 to $50,000. The fixed annual percentage rate (APR) varies from 6.6% to 35.99%, depending on your qualifications. When you apply for a loan in the Upstart marketplace, you can receive an instant decision. Funds are typically transferred by the next business day. Upstart stands apart from

Determining your financial aid can feel daunting. The amount you'll receive depends on various factors like your family's income, savings, and the cost of attendance at your chosen school. Filling out the FAFSA is your first step to unlocking potential funding.

Using life insurance as collateral can be a savvy financial move, but it's essential to avoid common pitfalls. From misunderstanding policy values to neglecting loan terms, being informed can help you make the most of your investment and secure your financial future.

When considering higher education, understanding private student loans offered by colleges is crucial. These loans can bridge financial gaps, but often come with higher interest rates and less flexible repayment options than federal loans. Proceed with caution.

Deciding whether to pay off debt before buying a house can be tough. While eliminating debt may boost your credit score and enhance mortgage options, it’s crucial to weigh your financial situation and long-term goals. Balancing both could lead to a stronger financial future.

In a significant move, 55,000 more borrowers are set to receive student loan forgiveness, easing the financial burden for many. This decision reflects ongoing efforts to address the challenges faced by students and graduates in repaying their loans.

The House has introduced the College Cost Reduction Act, aiming to tackle soaring tuition fees and student debt. This pivotal legislation seeks to provide financial relief for future students, making higher education more accessible and affordable for all.

When aiming to boost your credit score, focus on high-interest debts first, like credit cards. These can harm your score the most. Next, tackle smaller loans or those with overdue payments to improve your credit utilization and payment history.

Navigating the process of securing a loan to buy a business can feel daunting. Start by assessing your finances, researching lenders, and preparing a solid business plan. A clear strategy and understanding of your goals will make the journey smoother.

Managing finances can be challenging, especially when unexpected expenses arise or you want to consolidate existing debt. Personal loans offer a way to manage such needs, and Upstart provides a unique lending platform designed to make borrowing more accessible. Upstart partners with financial institutions to offer personal loans ranging from $1,000 to $75,000. Unlike traditional