Fashion Debt in the United States Fashion debt is more common than many people think. It happens when people keep buying clothes and other fashion items, spending more than what they earn. Reports show that people often spend a lot on clothes and this can put stress on their money and how they manage their

Americor Debt Relief stands out for its high customer satisfaction, with many clients praising their supportive approach. However, potential users should note that their fees are above average, which could impact overall savings in debt resolution.

The recent House policy bill, projected to add $3.4 trillion to the national debt, raises concerns about long-term economic stability. While it aims to spur growth, critics warn the strain on finances could overshadow any immediate gains.

Removing a bankruptcy from your credit report early is challenging but not impossible. Start by checking your report for errors; inaccuracies can be disputed. Consider negotiating with creditors or seeking professional help to improve your credit standing.

When considering home equity options, it's essential to understand the differences. A Home Equity Loan (HEL) offers a lump sum, while a Home Equity Line of Credit (HELOC) provides flexibility with a credit line. Alternatively, a Cash-Out Refinance lets you take cash while refinancing your mortgage.

Consumer debt refers to money borrowed for personal goods and services, like credit card balances or loans. To escape it, consider budgeting, prioritizing high-interest debts, and exploring consolidation options for a manageable repayment plan.

Deciding whether to refinance your mortgage or tap into a home equity loan or line of credit can be tricky. Consider your financial goals—refinancing lowers your rate, while home equity options provide cash for emergencies or projects. Assess your needs carefully!

Wondering if your back taxes can block your passport application? The IRS may issue a "certification of your tax debt" that can complicate things. However, if you’re making arrangements to pay, there are often ways to resolve this issue. Always check with the IRS for the latest guidelines.

Financing your tiny home can feel daunting, but you have options! Personal loans, often quick and flexible, are just one choice. Consider alternatives like RV loans, traditional mortgages, or crowdfunding. Explore each to find the best fit for your dream home!

A low credit score can feel daunting, but understanding its range is the first step. Scores below 580 are considered poor, affecting loan approvals and interest rates. Fortunately, small changes like timely payments and reducing debt can lead to significant improvements.

Credit Karma is a free online service that empowers you to track your credit score, get personalized financial advice, and discover loan and credit card offers tailored to your needs. It's an essential tool for managing your financial health and making informed decisions.

Starting or upgrading a restaurant? Funding can be tough! Our Restaurant Equipment Financing Guide breaks down options, from loans to leasing. Understanding these choices can help you equip your kitchen without breaking the bank. Let's dive in!

In this listicle, you'll discover the best emergency loans that can help you navigate unexpected expenses. From low interest rates to quick approval times, we highlight top options to fit your needs and get you back on track in no time!

Securing a home construction loan can feel daunting, but it's manageable with the right approach. Start by gathering your financial documents, understanding your credit score, and researching lenders. Being organized will streamline the process and open doors to your dream home.

Paying off your mortgage early can be liberating. Start by making extra payments toward the principal or refinancing to a shorter term. Consider reviewing your budget to find more savings; every little bit helps. Remember, it's about your financial freedom!

If you're looking to remove hard inquiries from your credit report, start by reviewing your credit file for inaccurate entries. Dispute any errors with the credit bureau directly. Additionally, focus on building positive credit habits to offset the impact.

Navigating financial aid can be overwhelming, but there are strategies to maximize your FAFSA benefits. Always file your application early, double-check your data for accuracy, and don't hesitate to appeal your financial aid package. Your college's financial aid office can also offer personalized assistance to explore additional options.

Improving your credit score is a powerful way to unlock financial opportunities. Start with short-term strategies like paying bills on time and reducing credit card balances. For long-term success, consider diversifying credit types and maintaining a healthy credit history.

Refinancing student debt with a cosigner can significantly reduce your interest rates. By adding a financially stable partner, you might secure better terms, making monthly payments more manageable. Just remember, both parties share the responsibility for repayment.

Debt is an obligation to pay money owed, often arising from loans or credit. While it can help us achieve goals, like buying a home, it’s crucial to manage it wisely. Understanding debt’s impact on finances can lead to healthier economic choices.

Using your tax refund to pay off debt can be a smart financial move. By reducing high-interest balances, you lower your overall financial burden and can save money in the long run. Consider your priorities but don’t overlook the benefits of tackling debt head-on.

When searching for the best credit union for your business account, consider our curated list that breaks down key features like fees, interest rates, and member support. We promise you'll find options tailored to your unique needs!

Explains the plans behind the snowball and avalanche methods for paying off debt. Shows how paying off the lowest balance or the highest-interest debt first can impact savings and progress. Breaks down the advantages and disadvantages of each method to help individuals choose based on their financial needs. Provides actionable steps for managing

401(k) loans can be a lifeline for urgent financial needs, allowing you to borrow against your retirement savings. However, it's crucial to understand the repayment terms and potential risks, as defaulting can jeopardize your future financial security.

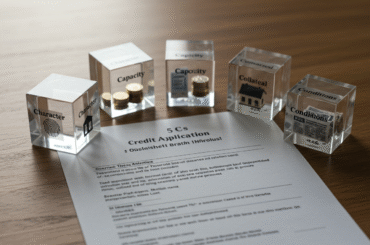

Summary Get to know the 5 C’s of credit: character, capacity, capital, the value put up for a loan, and conditions that help decide if the bank or lender will say yes to giving out a loan. Learn how your credit score and history with money matter to a bank or lender and count

In 2025, building your credit score is easier than ever with innovative apps designed for every financial journey. From user-friendly interfaces to tailored advice, discover the 10 best credit builder apps that can empower your financial future.

When considering the best way to finance a pool, this listicle will guide you through top options tailored for your needs. From personal loans to home equity lines of credit, you'll discover practical solutions and tips to make your dream pool a reality.

Looking for the best credit cards tailored for average credit? In this listicle, you'll discover top picks that offer great benefits, such as cashback rewards and manageable fees. Dive in to find a card that fits your financial lifestyle!

Attention everyone! You have just 8 days left to claim your stimulus check. If you haven't received yours yet, it's crucial to act quickly. Check your eligibility and gather your information to ensure you don’t miss out on vital financial support.

Top Look at top personal loan choices made for every credit score, good, bad, or in between See how fixed interest rates and loan terms can make payments easier or harder Learn about what 2025 interest rates may be and check out what each lender has to offer Find out how to get better