Introduction Have you ever bought something and right away wished you had not? This feeling is called buyer’s remorse. It is normal to feel guilt and frustration when it happens. You might get clothing that does not fit well, or maybe you buy a gadget but then you never use it. These kinds of shopping

Practical Ways to Manage Debt and Travel Wisely If you like to travel and have debt, you may feel some stress. It is important to know there are ways to take care of both. A smart plan can help you enjoy your trips and still keep up with your payments. You do not have to

Top Savings Insights Learn how long it usually takes people to save $1,000 through everyday examples Discover challenges like impulse spending and forgotten subscriptions Explore practical tips to reduce spending and earn extra cash See how a savings account can help grow your money Use budgeting and cashback apps to track progress Understand how small

Air Canada offers an intriguing roundtrip from San Francisco to Casablanca, Morocco, at competitive prices-only $582 for Basic Economy and $802 for Regular Economy, both inclusive of taxes. Discover a vibrant culture and stunning landscapes on this affordable journey!

Looking to maximize your shopping experience? In our listicle on the Best Buy Credit Card Benefits, you'll discover exciting perks like exclusive discounts, financing options, and reward points. Dive in to see how you can save more with every purchase!

As we step into 2025, the allure of 8K TVs continues to spark debate. While their stunning resolution offers a visual feast, the lack of native 8K content raises questions. Are they a worthwhile investment, or merely a luxury for early adopters?

Living below your means doesn't have to feel restrictive. Start by identifying your true priorities-spend on what truly brings joy while cutting back on impulsive buys. Embrace simple pleasures, and you'll find financial freedom without deprivation.

In today's unpredictable economy, financial missteps can have dire consequences. Families often face homelessness due to a lack of budgeting, accumulating debt, mismanaging credit, ignoring emergency savings, and failing to seek financial advice. Awareness is key.

Choosing the perfect place to retire is not an easy choice at all. The cost of living is certainly among the first things you are considering while making this choice. However, you need to consider other important aspects, such as security, amenities, and the overall livability of the city. To make things easy for you,

Many believe willpower is the key to spending less, but it often falters. Instead of relying solely on self-control, consider rewiring your environment and habits. Small changes can create lasting patterns that naturally encourage frugality.

The dream of drift income means financial freedom-many speak of it as a lifestyle reference where spells work for you, throwing income in their name, independent of any active labor. Some avenues have been accepted in the formation of passive income, including real estate, dividends, internet business, and royalties. But even when schemes seem so

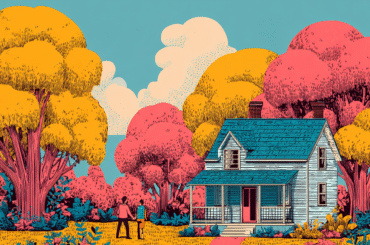

Owning a home comes with unexpected expenses that Realtors may not highlight. From property taxes and insurance to maintenance and utility bills, these hidden costs can add up quickly, making it essential for buyers to budget wisely before committing.

In relationships and financial discussions, the phrase "We’re saving money, right?" can often mask deeper issues. It can become a tool for financial gaslighting, twisting common sense to justify overspending or neglecting important expenses. Recognizing these moments is crucial for genuine financial clarity and health.

When deciding between buying a home with cash or financing through a mortgage, consider your financial situation. Cash offers immediate ownership and may give you leverage in negotiations, while a mortgage can help preserve liquidity for other investments.

In both domestic and commercial spheres from the standard home to commercial environments like medicine, gyms, and retail, there are always ways you can improve your standard of living. From using smart technology to renovating your kitchen, by making these small changes, you can help your family to thrive. If you’re interested in how subtle

Saving your first $10,000 is a pivotal milestone. It not only builds foundational financial security but also fosters a sense of achievement. This initial amount can serve as a safety net, helping you navigate unforeseen expenses and empowering future investments.

Despite both partners earning, many dual-income households find themselves financially strained. High living costs, poor budgeting, and lifestyle inflation contribute to this struggle. To remedy this, prioritize a financial plan, track spending, and prioritize savings.

Ready to dive into Shop Prime Day's 4-Day Sale without the regret? Focus on essentials, set spending limits, and stick to your shopping list. Enjoy the thrill of the deals while keeping your budget in check-no hangover needed!

As a military veteran, I've discovered that many businesses offer generous discounts to honor our service. From retail to dining, here are 15 military discounts worth 10% or more that can help stretch your budget while enjoying great products and services.

How the Cash App Xbox Promo Works The Cash App Xbox 15% discount is a deal for a short time. It helps you save money when you buy Xbox things. You simply need to use your Cash App card when making a purchase at the Microsoft Store. After that, you will get a 15% discount

Important Caesar's Diamond status requires 15,000 tier credits annually Credits are earned through gaming, hotel stays, dining, shopping, and Caesars Visa usage Diamond members enjoy waived resort fees, free lounge access, room upgrades, and priority treatment Partner programs like Wyndham and NCL offer status matches for faster qualification The Caesars Rewards Visa is one

In a world where traditional jobs can feel stale, creativity reigns supreme. From selling vintage sock puppets online to offering ‘pet psychic’ services, there are countless quirky avenues to explore. Embrace your uniqueness and turn passion into profit!

When buying a house, we often focus on aesthetics and location, but the utilities can make or break your experience. Ask about water quality, energy efficiency, and local service providers. These often-overlooked details can save you headaches-and money-down the line.

Paying off your mortgage early can be liberating. Start by making extra payments toward the principal or refinancing to a shorter term. Consider reviewing your budget to find more savings; every little bit helps. Remember, it's about your financial freedom!

Walmart is offering a knockout deal on a lightweight Hoover vacuum, slashing the price from $170 to just $68. Shoppers are raving about its efficiency and portability, dubbing it “the best” budget-friendly vacuum on the market. Don't miss out!

As the holiday season approaches, many of us eagerly embrace the joy of giving. However, the cost of Christmas debt can quickly overshadow that cheer. Financial anxiety from overspending can linger long after the decorations come down, impacting your new year ahead.

As empty nesters embrace their newfound freedom, many are investing in their homes. upgrades include modern kitchens for entertaining, serene outdoor spaces for relaxation, and smart home technology for convenience—transforming their living experiences.

When your emergency fund falls short, it can feel overwhelming. Unexpected medical bills, urgent car repairs, or job loss can stretch finances thin. Explore alternative options—like community resources, flexible savings plans, or temporary side gigs—to navigate these crises effectively.

As you approach retirement, reflecting on your future is crucial. By asking yourself these 15 essential questions, you can clarify your goals, ensure financial readiness, and craft a fulfilling post-work life—avoiding regrets down the road.

When deciding how much to spend on a wedding gift, consider your relationship with the couple. Close friends or family might warrant a higher budget, typically between $100 to $150, while acquaintances may suffice with $50 to $75. Ultimately, choose what feels right for you.