Beyond the Table: Cash App and Venmo The comparison table provides a concise understanding of Cash App and Venmo's core differences and features. The full scope of their utility and impact extends further, encompassing their role in the evolving digital payment landscape, historical development, and nuanced aspects not captured in a direct feature-by-feature comparison. The

Walmart is offering a knockout deal on a lightweight Hoover vacuum, slashing the price from $170 to just $68. Shoppers are raving about its efficiency and portability, dubbing it “the best” budget-friendly vacuum on the market. Don't miss out!

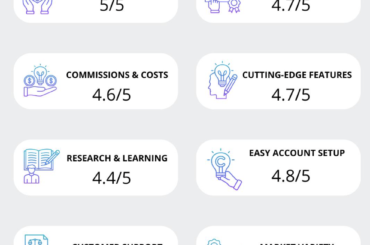

Quick comparison: Both platforms serve active and casual traders with broad investment products and tools. Fees: Webull offers commission-free stocks and options; E*TRADE provides competitive rates plus perks for mutual fund investors. Tools: E*TRADE features advanced trading tools; Webull’s app is straightforward and beginner-friendly. Education and support: E*TRADE provides extensive learning resources; Webull offers

Elara Las Vegas stands out as a unique gem on the Strip, offering well-appointed rooms equipped with full kitchens. This feature makes it perfect for travelers who prefer the comfort of home-cooked meals amidst the vibrant energy of Vegas.

CheapOair and Google Flights use smart tools to help people get the lowest ticket prices. CheapOair often gives special deals that help you save money, and Google Flights shows more flight options and has easy tools to help you plan your trip. Both apps have different ways to set prices. There can be extra

Both Spotify and Apple Music offer access to over 100 million songs. Spotify shines with easy-to-use features like Spotify Wrapped, Discover Weekly, and Daily Mix, which help you discover new music. Apple Music impresses with Spatial Audio and Lossless streaming for top-tier sound quality. Both services offer family plans and student discounts. Spotify

H&M and Uniqlo both serve fast-fashion consumers but differ in pricing, product quality, and design philosophy. H&M prioritizes affordability and trendiness, while Uniqlo focuses on timeless, functional clothing. Uniqlo emphasizes sustainability through durable materials and recycling programs. Customer experience differs in ambiance and service levels at physical store locations. Return policies and loyalty rewards

Rakuten functions like a virtual shopping mall, giving sellers more control over their online stores. Amazon, by contrast, operates a closed ecosystem. Amazon Prime offers rapid shipping and access to exclusive videos. Rakuten provides cashback and Rakuten Super Points as part of its loyalty rewards system. Rakuten emphasizes brand image and customer experience through

Canva makes graphic design simple and accessible for everyone. It’s ideal for social media posts, marketing materials, and quick projects even if you have little to no design experience. With a large library of templates and an intuitive drag-and-drop interface, you can produce great results quickly and without hassle. Figma is tailored for professional

BBB Upstart is a website for loans that the Better Business Bureau (BBB) has rated A+ since 2015. People can get personal loans, including options for debt consolidation. The interest rates depend on your credit score and other details. BBB Business Profiles show how the company meets BBB standards and helps build trust. Upstart

AbeBooks is a treasure trove for students seeking used textbooks at unbeatable prices. I've discovered everything from classic literature to niche subjects, often at a fraction of retail costs. Plus, the user-friendly interface makes finding what you need a breeze!

If you’re in the market for a robust portable speaker, the JBL Charge 5 is a fantastic choice—especially at just $90! With its impressive sound quality and rugged design, it’s perfect for outdoor adventures or home use. Don’t miss this deal!

Looking to diversify your portfolio without breaking the bank? In this listicle, we’ll uncover the best small-cap mutual funds that can offer growth potential. Expect detailed insights and expert recommendations tailored just for you!

In a surprising turn of events, Costco has lost its crown as the top warehouse club for customer service. While the retail giant long prided itself on loyal customer satisfaction, new competitors are reshaping expectations and raising the bar in service excellence.

Most people who come into trading aren’t looking to “build a portfolio” or “explore market exposure.” They’re looking for a lifeline. They’re stuck in jobs they don’t love, burdened by bills they can’t ignore, and scrolling through Instagram watching strangers flash Rolexes and fly business class to Dubai. So, yeah, when an ad pops up

Introduction When it comes to crypto exchanges, choosing the right platform is essential for maximizing your profits. Two popular non-custodial exchange aggregators, Swapzone and Changelly, offer users a simple way to swap crypto assets at competitive rates. But which one provides the better deal? In this article, we compare these platforms in terms of exchange

Looking for a good laugh? Netflix has you covered with its lineup of comedies! From quirky indie gems to laugh-out-loud blockbusters, there's something for everyone. Here’s a curated list of 26 of the funniest films currently streaming that you won't want to miss!

In this listicle, you'll discover the best Egg loan reviews to help you make informed decisions. Expect a mix of real customer experiences, standout features, and potential drawbacks that will guide you towards your perfect financial solution!

Rocket Money is an app for managing money. It has both free and paid features to help people with their finances. The app mainly earns money from paid subscriptions and from negotiating bills. Rocket Money helps users manage their money. It has tools to cancel subscriptions and save automatically. Its way of making

As investors navigate the turbulent waters of the stock market, three small-cap stocks are facing increasingly daunting challenges. From rising operational costs to competitive pressures, these companies must adapt swiftly to survive. Proceed with caution.

The 10th Gen Kindle Oasis is currently priced at just $130, making it an enticing option for avid readers. With its ergonomic design, adjustable warm light, and waterproof features, it’s perfect for cozying up with your favorite book, whether at home or by the pool.

When considering a Peloton bike, weigh your workout needs and budget. A new bike offers the latest tech, while used models save money. Refurbished options provide a balance of quality and value, and renting allows flexibility to test before committing.

Interfinex Review has become a popular choice among traders, raising questions about its credibility. The platform grants access to six financial markets: Forex, Stocks, Indices, Commodities, Cryptocurrencies, and Metals. Designed for both beginners and seasoned traders, it features a user-friendly layout. Security measures include encryption and two-factor authentication to protect assets and data. Unlike some

IMG offers many travel insurance plans for different kinds of travelers. Those who want good medical coverage can pick from IMG's travel medical insurance options. Besides single-trip plans, IMG has long-term coverage with its international health insurance. IMG is known for its large travel delay benefits, giving you up to $5,000 per person.

In 2025, the Robinhood Gold Card stands out for its unique blend of features. Offering perks like instant deposits and professional research, it's designed for both novice and seasoned investors. Overall, a solid choice for those seeking to elevate their trading experience.

If you're in the market for a top-notch speaker, now's the perfect time to invest! The highly-rated Sony speaker you've been eyeing is at its lowest price right now. With impressive sound quality and sleek design, it’s a deal you won't want to miss!

This blog post looks at Weebly and Squarespace to help you find the right website builder for you. Weebly is perfect for new users on a budget. It has a free plan and low-cost premium options. Squarespace offers stylish templates and advanced features. This makes it a good pick for businesses that want

Indeed remains a top job search platform for several reasons. Its vast database offers millions of listings, user-friendly interface simplifies searches, and personalized job alerts keep you updated on new opportunities. It's a go-to for job seekers!

In the Q4 2024 review of the Fidelity Stock Selector Mid Cap Fund, we observed a strategic pivot towards sectors with strong growth potential, significantly impacting overall performance. This fund continues to impress with its adaptability and keen market insights.

In my review of TaxRise 2025, I found an intriguing blend of promise and caution. While the service claims to offer legitimate tax relief solutions, it's essential to scrutinize their track record and client testimonials before diving in.