FedEx stock has hit a low point, prompting many investors to reevaluate their positions. With strategic changes ahead and improving economic conditions, now might be the perfect moment to consider adding FedEx to your portfolio. Don't miss this potential rebound!

Recent Investing Stories

Setting up stop-loss and take-profit orders is essential for managing risk in trading. Start by determining your risk tolerance and profit goals. Place your stop-loss just below your entry point and set your take-profit at a level that reflects a favorable reward-to-risk ratio.

Bitcoin is on the verge of a significant weekly close, potentially shaping market momentum. As it gains traction, can altcoins like HYPE, BCH, LINK, and SEI ride the wave of enthusiasm? Investors are keenly watching for potential breakouts.

Nike stock has shown resilience, indicating a potential turnaround. With innovative product launches and a renewed focus on sustainability, the brand seems poised for growth. Investors might just witness the mother of all comebacks unfold.

Goodyear's stock soared 28% in 2025, sparking conversations about its growth potential. Investors are intrigued-will this momentum continue? With innovation and market demand driving the tire industry, the future looks promising. Stay tuned!

In today's banking landscape, several regional banks are making waves with significant buyback initiatives. Institutions like First Horizon and UMB Financial are not only reflecting confidence in their financial health but also signaling strong investor returns.

Brookfield has officially acquired Barclays’ payments business, marking a significant expansion in its financial portfolio. This strategic move highlights Brookfield's commitment to tapping into the growing fintech sector and enhancing payment solutions.

In evaluating the FBY strategy for holding META, it's clear that this approach may not align with optimal investment practices. While it offers potential short-term gains, the inherent volatility and lack of long-term stability make it questionable for serious investors.

In an increasingly interconnected global economy, managing finances effectively—whether for personal needs like international travel or sending money to family abroad, or for business operations such as paying overseas suppliers and handling revenue in multiple currencies—has become more complex yet more critical than ever. For many years, traditional banking institutions were the default option for

The Senate has approved a landmark bill establishing rules for cryptocurrency and stablecoins, signaling a significant step towards regulation in the digital finance sector. This new framework aims to enhance consumer protection while fostering innovation.

While VGT tech has shown promise in improving user experience, the lack of a high-quality display remains a significant hurdle. A better screen is essential for fully realizing the potential of passive technology and enhancing visual clarity.

Analysts predict Meta could soar to $800 as it continues to innovate and expand its portfolio. drivers include advancements in AI technology and an increase in advertising revenue. Investors should watch for these developments to fuel potential growth.

In Q1 2025, the AMG GW&K Municipal Bond Fund navigated a dynamic market landscape, focusing on quality issuers and strategic allocations. With engaging performance and a keen eye on interest rates, we remain committed to delivering value to our investors.

Devon Energy stands out as a compelling capital return play. With its strong focus on shareholder returns through dividends and share buybacks, the company effectively balances growth and income, making it an attractive option for investors seeking reliable returns.

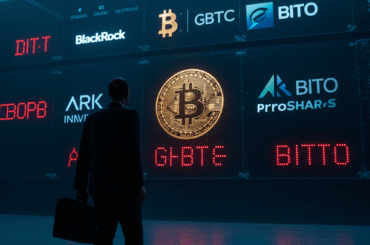

In a surprising turn, institutional Bitcoin ETF holdings have recorded their first quarterly decline, according to recent reports. This shift raises questions about market sentiment and the future of crypto investments. Investors will be watching closely.

When choosing between Dollar Tree and Dollar General, consider their growth potential and business models. Dollar Tree focuses on a single price point, enticing budget shoppers, while Dollar General offers a wider range of products and price tiers. Both have strengths!

More people are using self-directed IRAs for real estate to diversify retirement savings. These IRAs offer tax benefits, rental income, and investment control. Investors can choose between residential and commercial properties. Choosing the right IRA custodian ensures compliance with IRS rules. Beginners can access information on how these IRAs work and what to avoid.

New York's PubBitcoin bar has become a haven for crypto enthusiasts, but its mission doesn't stop there. Next, it aims to spread the Bitcoin ethos to Washington, D.C., inviting policymakers to engage with the transformative potential of cryptocurrency.

In recent years, the Port of L.A. has felt the jolts of Trump's trade war, swinging from bustling activity to sudden slowdowns. Importers grapple with tariffs while exporters face retaliation, leaving a lasting impact on this vital gateway for commerce.

The House Agriculture Committee has taken a significant step by advancing a crypto market structure bill. This move aims to establish clearer regulations for digital assets, reflecting a growing recognition of the need for oversight in this rapidly evolving market.

Stock trading involves buying and selling shares of publicly traded companies, allowing investors to participate in the financial markets. It's a way to grow wealth over time, but requires knowledge, strategy, and a clear understanding of market fluctuations.

Introduction When you are in the market, it is important to know about open interest to make your trading feel better. In options trading, open interest shows the number of contracts that people still hold at the end of the day. This is not the same as trading volume, because it stays focused on positions

The new U.K.-EU deal is unlikely to significantly alter Britain's economic landscape or public finances. While it addresses certain trade barriers, the fundamental challenges of post-Brexit adjustments remain, leaving many questions unanswered for the future.

In uncertain economic times, finding stable investments feels crucial. This little-known stock, with its strong fundamentals and consistent dividends, could offer resilience as consumers prioritize essential services. It’s worth a closer look.

Despite signs of weakening fundamentals, Apple's reputation as a blue-chip investment remains intact. Recent rating upgrades reflect confidence in its resilience. If you're considering investing, now might be the perfect time to increase your holdings.

As the possibility of SOL dropping to $120 looms, it's essential to assess the broader market context. While this decline may seem daunting, it could provide a strategic opportunity for investors to buy at a lower price point, setting the stage for future growth.

Higher tariffs on steel and aluminum are set to impact companies across industries. Increased material costs may squeeze profit margins, lead to rising consumer prices, and complicate supply chains. Businesses must adapt quickly to survive this challenge.

If you've encountered a Bitcoin scam, it's crucial to act swiftly. First, gather all relevant details about the scam. Then, visit Chainabuse to report it directly to the community, and also submit your findings to Scamwatch for wider awareness. Your report can help prevent further scams.

As ICON faces a staggering 57% drop, the implications of recent Trump-era legislation and ongoing debt reduction efforts spark intrigue. Could this be an opportune moment for investors? Let's explore whether ICON is indeed undervalued in today's market.

As an investor, finding stocks with rising dividends is crucial for building a stable income portfolio. Here are three standout companies worth your attention. Their commitment to consistent dividend growth reflects financial strength and a shareholder-friendly approach. Don't overlook these opportunities!