Lendconnects students with local credit unions and community banks for student loans and refinancing. The company offers competitive interest rates and flexible repayment terms. There are no application or origination fees, and you can borrow up to the full cost of attendance. The program offers up to 18 months of payment deferment.

Emergency dental loans provide fast cash for unexpected dental costs. These loans offer various repayment plans, allowing you to choose short-term or long-term options. Borrowers with good or bad credit can find loan rates and options that suit their needs. Simple monthly payments make costly procedures, such as braces or implants, more affordable.

Layaway programs allow customers to hold items by paying a small deposit and paying the rest in installments. This is ideal for people with low income or poor credit. These programs were widely popular in difficult times in the past. They are now experiencing a resurgence, especially before the holidays or for larger

Upstart offers loans to people with credit scores as low as 300. This is good for those with little or poor credit histories. The platform uses AI and other data points, such as your education and job status, to determine whether you qualify. You can borrow from $1,000 to $50,000. The APR ranges

Find great personal loan options and Upstart alternatives. These options work for different credit scores and financial needs. Discover why it is important to check out other lenders. This way, you can get better rates and custom loan terms. Learn about the main features of Upstart’s lending system. This includes using AI for

Get loans from $1,000 to $50,000 using an easy online form. Find your rate in just five minutes—a soft credit inquiry will not change your credit score. Fast fund transfer: 99% of loans are sent by the next business day after approval. AI-based approval system checks things like education and job status. This

Sofi Auto Loans offers straightforward and fair refinancing options. This can help borrowers save money on their monthly payments. By partnering with MotoRefi, SoFii makes it easy for borrowers to find trusted lenders. They provide personalized and quick services. Borrowers can get pre-qualified offers for refinancing. Checking eligibility does not affect their credit

Finwise Upstart makes applying for loans simple. They offer options for borrowers, such as personal loans and car refinance loans. You can choose from different account types that fit lenders, credit unions, and your needs. The platform provides clear information on interest rates, APR, and loan amounts without any hidden fees. Setting up

The Upstart app offers different loan products. This includes personal loans, refinancing for car loans, and home equity lines of credit. It uses smart technology to check if you can get a loan. This looks at many factors, not just your credit score. Borrowers can find competitive rates. There are no fees for

Wholesale funding serves as a vital alternative for banks to raise capital beyond traditional deposits. Understanding wholesale funding is essential due to its potential liquidity risks during economic downturns. Partnering with reliable institutions, such as the Federal Home Loan Banks, can secure consistent funding sources. A comprehensive funding strategy and effective risk management

A secured loan that uses your car as security may have lower interest rates compared to loans without collateral. You can access funds based on the value of your car, even if you still owe money on it. Loans based on car value often provide larger amounts and longer repayment periods. However, they

A credit builder can help establish a good credit history through timely monthly payments. These tools enable credit improvement while building savings in secured accounts. Credit builders share payment activity with major credit bureaus like TransUnion, Experian, and Equifax. Options include credit builder accounts, secured credit cards, and credit builder loans, each tailored

Bilt Rewards has exciting news for students! They've expanded into student housing, allowing users to earn points while paying rent. Now, you can also utilize those points to tackle student loans, making financial management easier and more rewarding!

When juggling student loans, it's crucial to understand deferment and forbearance. Both options allow you to temporarily pause payments, but deferment usually covers interest for certain loans, while forbearance doesn't. Knowing the difference can save you money in the long run.

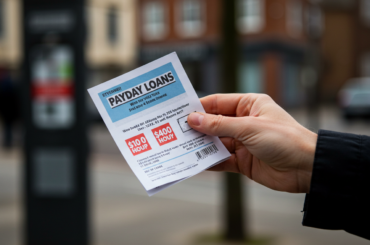

Payday loans can seem like a quick fix for financial woes, but the truth is often different. While they offer immediate cash, exorbitant interest rates can lead to a cycle of debt. It’s vital to weigh the risks and explore safer alternatives.

The debt ceiling is a cap set by Congress on the amount of money the federal government is allowed to borrow. It’s a critical tool for managing national finances, ensuring the U.S. can meet its obligations, but it can also spark intense political debates.

In this listicle, you'll discover the best Egg loan reviews to help you make informed decisions. Expect a mix of real customer experiences, standout features, and potential drawbacks that will guide you towards your perfect financial solution!

Consumer finance companies offer various financial products and services, like loans and credit cards. These companies play a key economic role by providing credit to people and businesses. Their services can be helpful, but they also have risks, such as high-interest rates and potential debt. Knowing your financial needs and looking into different

An auto equity loan allows you to borrow against the value of your vehicle, using it as collateral. If you own your car outright, this type of loan can provide quick cash for emergencies or big purchases, typically at lower interest rates than unsecured loans.

Looking to boost your credit score? In this listicle of the best credit builder loans, you’ll find options that suit your financial goals. Discover how each choice stacks up in terms of interest rates, flexibility, and potential impact on your credit history!

Unexpected car repairs can strain your finances, especially with bad credit. Auto repair loans offer a way to manage these costs, even with less-than-perfect credit history. It's crucial to understand the types of auto repair loans, interest rates, and repayment terms. This guide will explore various financing options, including secured/unsecured loans and alternatives.

Looking for the best car loans with bad credit? You're not alone! In this listicle, you'll discover top lenders who are willing to work with you despite your credit score. Expect detailed reviews and tips to help you secure that vehicle without breaking the bank.

Credit repair companies assist in identifying and disputing errors on your credit report. These companies communicate with credit bureaus and creditors on your behalf. Repairing credit requires patience and can take several months to a year. Reputable credit repair companies adhere to the Credit Repair Organizations Act (CROA). Credit counseling provides broader financial

When considering short-term loans, it’s crucial to weigh your options. Types like personal installment loans or credit union loans can be beneficial for quick financing. However, steer clear of payday loans and title loans, as they often trap borrowers in cycles of debt.

Life is uncertain, and sometimes, unaccounted-for expenses that arise suddenly require financial relief at short notice. Whether it be for an unexpected medical treatment, sudden domestic repairs at home, or short-term cash requirements, a short-term loan facility comes to the rescue. In Singapore, such short-term loan facilities are provided by lenders like Crawfort Singapore that

Facing challenges with car payments can be overwhelming, but there’s hope. Explore options like local nonprofit organizations, government assistance programs, and even credit unions that offer financial relief. Don't hesitate to seek help!

When considering a personal loan, the maximum amount you can borrow typically ranges from $1,000 to $100,000. Factors like credit score, income, and lender policies play a significant role. Always evaluate your financial needs before applying.

Credit consolidation is the process of combining multiple debts into a single loan, aiming to simplify payments and potentially reduce interest rates. Many find it a helpful strategy to regain control over their finances and ease the burden of monthly payments.

A home loan based on assets uses your investments or savings to help you get a mortgage. This type of loan can be a good choice for people with significant assets but who may have irregular income. Lenders check how much you can earn from your assets. This can help you get approved

Filing for bankruptcy can significantly lower your credit score, making it harder to get loans. Loans are still available after bankruptcy but expect higher interest rates and additional fees. Rebuilding credit is essential. Paying on time and using secured credit cards can help. Loan options include secured loans, credit builder loans, and lenders