This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

The crypto landscape is evolving rapidly, with platforms like Rexas Finance (RXS) catching the eye of many investors. As people look for promising opportunities, it’s essential to weigh the potential risks and benefits of new tokens. Traders Union, known for its detailed financial analyses, has taken a close look at RXS. Their team examines how viable the platform is, the challenges it might face, and where it could be headed in the future. This comprehensive review offers insights into Rexas Finance and what it could mean for the cryptocurrency landscape.

- What is Rexas finance crypto? Key facts explained

- Rexas Finance crypto: Growth potential & challenges

- Is Rexas Finance crypto a safe investment?

- Traders Union experts on Rexas finance risks

- Future of Rexas Finance crypto: What to expect

- Conclusion

- FAQs

- Is RXS Crypto a good investment in 2025?

- How do I buy RXS Crypto?

- What’s the difference between RXS and Ethereum?

- Can RXS reach $10?

- Recommended Reads

What is Rexas finance crypto? Key facts explained

Rexas Finance (RXS) is a decentralized finance (DeFi) platform launched in 2021, aiming to bridge traditional financial services with blockchain technology. Built on the Ethereum blockchain, RXS offers staking, lending, and yield farming solutions.

Its native token, RXS Crypto, facilitates governance, discounts, and rewards within the ecosystem.

Key facts about RXS Finance

Founding Vision and Core Objectives

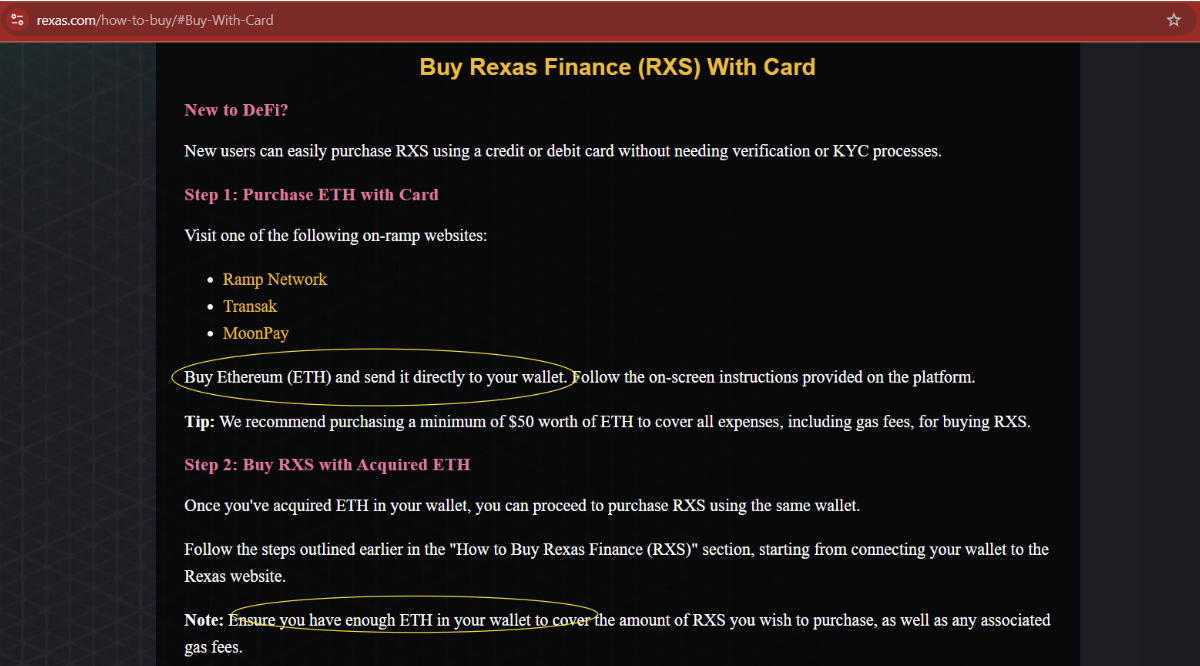

Rexas Finance was created to address issues in traditional finance, like high middleman fees and limited access. Using blockchain technology, it seeks to make financial services more accessible, offering features such as interest-earning accounts and decentralized loans. A key aspect is its focus on fiat-to-crypto integration. Through a partnership with MoonPay, users can buy RXS tokens directly with their credit or debit cards, eliminating the need for third-party exchanges and making it easier for those new to crypto.

Rexas Finance ecosystem

At its core, Rexas Finance aims to revolutionize the tokenization and management of real-world assets (RWAs). By leveraging blockchain technology, the platform seeks to provide equitable, transparent, and secure financial services accessible to users of all backgrounds. The ecosystem comprises several interconnected components:

- Rexas token builder: Simplifying token creation

This no-code tool enables users to create their own tokens, supporting standards like ERC-20, ERC-721, and ERC-1155, catering to a wide range of tokenization needs. - QuickMint bot: Instant token deployment

The QuickMint bot allows users to create and deploy tokens via platforms like Telegram and Discord, making tokenization as simple as sending a message. - RASANS GenAI: AI-powered NFT creation

RASANS GenAI utilizes artificial intelligence to generate original digital art, enabling users to create NFTs without requiring artistic skills. - Rexas AI Shield: Enhancing blockchain security

Security is a priority for Rexas Finance. Rexas AI Shield employs AI to audit and monitor smart contracts in real-time, identifying vulnerabilities and preventing exploits. - Rexas Treasury: Maximizing yield across chains

Rexas Treasury automates yield farming across multiple blockchain networks, allowing users to maximize returns through compounding interest. - Rexas DeFi: The future of decentralized finance

Rexas DeFi offers a suite of financial services, including staking, liquidity provision, and yield farming, empowering users to manage their assets transparently and securely.

Role of RXS token in the ecosystem

The RXS token serves as the native utility currency within the Rexas Finance ecosystem, facilitating various functions:

- Trading on centralized and decentralized exchanges.

- Yield farming and staking activities within the Rexas DeFi platform.

- Accessing tokenized real-world assets, such as real estate and commodities.

As the official launch approaches, investors are encouraged to stay informed about market trends and ecosystem developments to make well-informed decisions regarding RXS.

Disclaimer: The information provided about the Rexas Finance ecosystem is based on the whitepaper published by Rexas Finance. It does not constitute investment advice. Prospective investors are advised to conduct thorough research and consider their risk tolerance before investing.

Key features of RXS Finance

1. Multi-Chain Ambitions

While initially built on Ethereum, Rexas Finance has outlined plans to expand to Binance Smart Chain (BSC) and Solana in its 2021 whitepaper. This multi-chain strategy aims to reduce Ethereum’s high gas fees and improve transaction speeds, broadening accessibility for users across ecosystems. Such interoperability could position RXS as a bridge between Ethereum’s security and Solana’s scalability.

2. MoonPay Integration

Rexas Finance has teamed up with MoonPay, a leading fiat-to-crypto service, to make buying RXS tokens easier, especially for those new to decentralized exchanges (DEXs). This collaboration boosts liquidity and supports Rexas Finance’s mission to make decentralized finance (DeFi) more accessible—a vital move toward wider adoption.

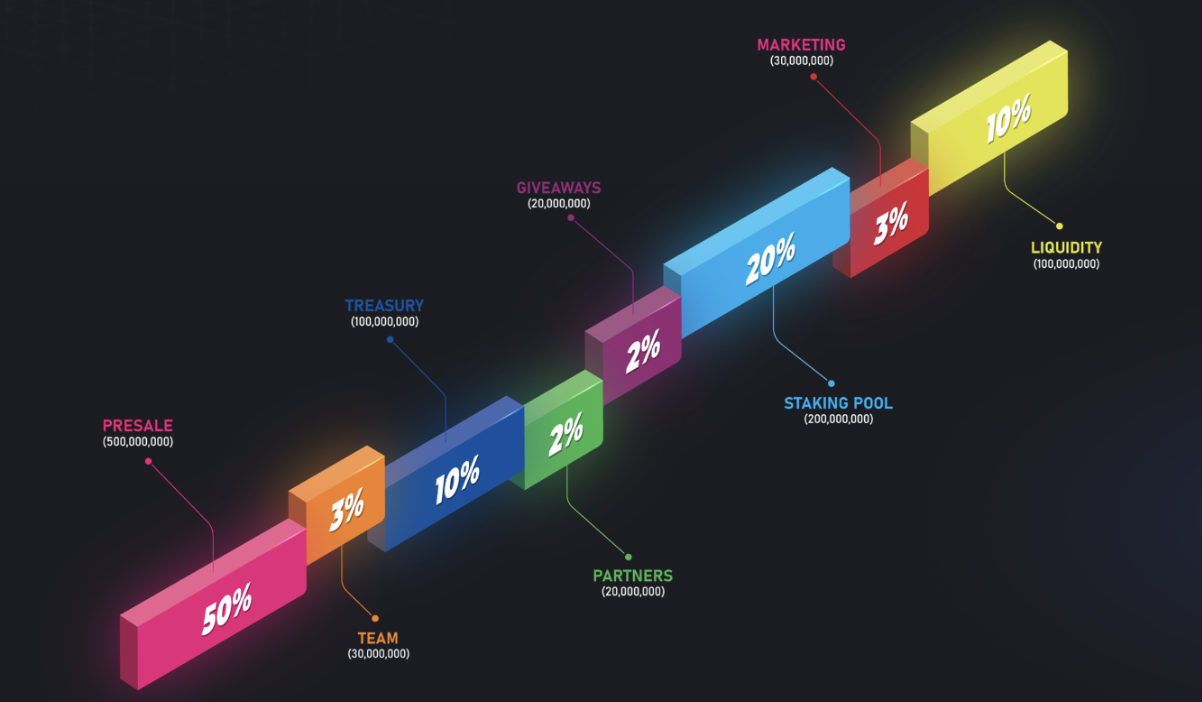

3. Tokenomics and Distribution

RXS Crypto has a maximum supply of 100 million tokens, with allocations structured to incentivize long-term participation:

- 40% for Staking Rewards – Distributed over five years to encourage network security and user retention.

- 20% for Ecosystem Development – Funding technical upgrades, partnerships, and marketing.

- 15% for Team and Advisors – Subject to a two-year vesting period to align interests with the community.

- 25% for Public and Private Sales – Initial distribution to fund platform development.

This model balances inflation control with growth incentives, though the heavy staking rewards allocation could impact the RXS crypto price if demand doesn’t match supply.

4. Security Protocols

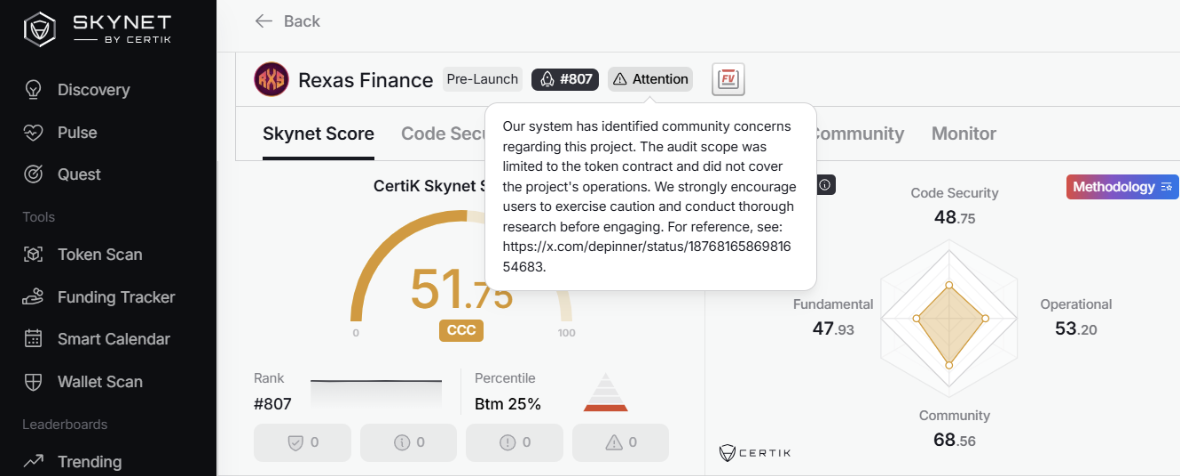

Rexas Finance places a high priority on security. In 2024, they underwent a thorough audit by CertiK, a leading blockchain security firm. The audit uncovered some minor issues, which the team promptly resolved, ensuring that their smart contracts function securely. Additionally, Rexas Finance uses multi-signature wallets to manage their treasury. This approach requires multiple approvals for transactions, minimizing the risk of single points of failure.

Competitive landscape and challenges

Rexas Finance competes in a crowded DeFi market dominated by platforms like Aave and Compound. However, it sets itself apart in several ways:

- User-friendly design. The platform features an intuitive interface, making DeFi tools more approachable for newcomers compared to Aave’s complex dashboard.

- Fiat integration. Through a partnership with MoonPay, Rexas Finance enables users to purchase RXS tokens directly with traditional currencies, eliminating the need for third-party exchanges and simplifying the onboarding process for those new to crypto.

- Cross-chain compatibility. While Compound focuses on Ethereum, Rexas Finance extends its services to Binance Smart Chain (BSC) and Solana, attracting users looking for lower fees and diverse blockchain options.

However, challenges persist. The founding team’s anonymity, though common in DeFi, may raise transparency concerns among institutional investors. Additionally, Rexas Finance’s liquidity pool, currently at $150 million, is smaller compared to Uniswap’s $3.5 billion pool, which could lead to higher slippage during large trades.

As investors navigate the growing DeFi ecosystem, tracking portfolios efficiently is crucial for managing risk and optimizing returns. A free crypto portfolio tracker can help users monitor their assets across multiple platforms, providing real-time insights into market performance.

Target audience and adoption strategy

Rexas Finance primarily targets retail investors and small-to-medium enterprises (SMEs) seeking alternatives to traditional banking. Its educational resources, including webinars and tutorials, aim to demystify DeFi for newcomers. The platform also appeals to yield farmers through competitive Annual Percentage Yields (APY), currently averaging 12-18% for RXS staking—a rate higher than many centralized finance (CeFi) alternatives.

Future roadmap highlights

Looking ahead, Rexas Finance plans to:

- Launch on Solana by Q4 2024 to leverage its high-speed, low-cost infrastructure.

- Introduce an NFT-backed lending feature, allowing users to collateralize digital assets for loans.

- Expand governance mechanisms, enabling RXS holders to vote on protocol upgrades and treasury allocations.

NOTE: Rexas Finance Crypto offers a promising mix of accessibility and innovation, but its success depends on delivering its multi-chain vision and overcoming regulatory challenges.

Experts at Fang Wallet suggest that, while the MoonPay integration and audited contracts mitigate some risks, the project’s reliance on community trust in an anonymous team remains a double-edged sword. For investors, understanding these dynamics is crucial when evaluating RXS’s role in a diversified crypto portfolio. Rexas Finance underscores its potential to disrupt traditional finance, but prudent investors should monitor its adoption metrics and regulatory developments closely.

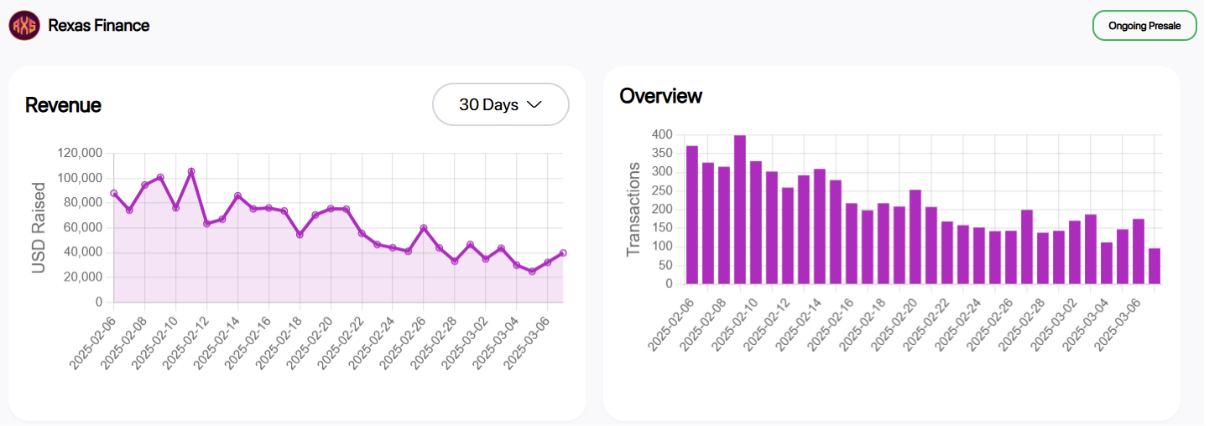

Rexas Finance crypto: Growth potential & challenges

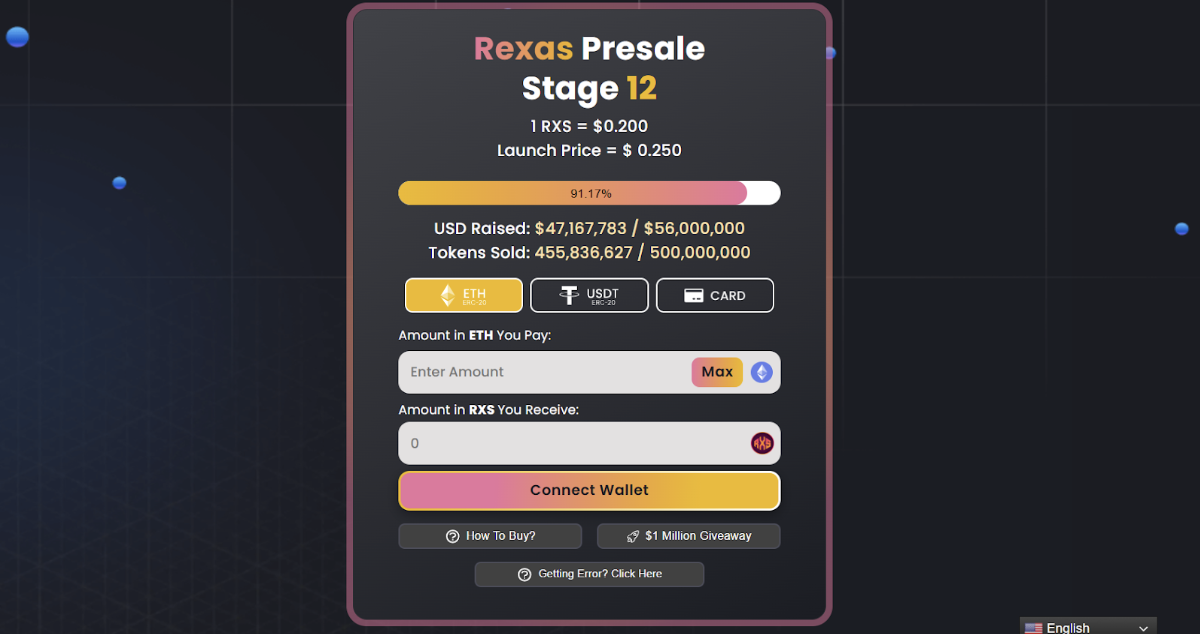

As Rexas Finance (RXS) goes through its presale phase, understanding its growth potential and challenges requires a focus on its roadmap, market positioning, and external risks. Below is a detailed, evidence-based analysis adhering to verified data and official announcements.

Growth drivers

1. Presale Momentum and Early Investor Interest

Rexas Finance’s ongoing presale has garnered attention due to its structured token distribution model. According to its official website, 50% of the total 100 million RXS tokens are allocated to presale investors, with tiered bonuses for early participants. This strategy mirrors successful launches like Ethereum’s 2014 presale, which raised $18 million and laid the foundation for its ecosystem .

2. DeFi Market Tailwinds

The global decentralized finance (DeFi) sector is projected to grow at a 53.7% CAGR from 2025- 2030, driven by demand for non-custodial lending and yield-generating tools.

Rexas Finance aims to capitalize on this trend by offering:

- Simplified staking. One-click staking pools targeting users unfamiliar with complex DeFi interfaces.

- Fiat on-ramps. Direct RXS purchases via MoonPay, a service used by 10+ million users globally.

3. Strategic Partnerships

Rexas has secured collaborations critical to its infrastructure:

- Chainlink integration. Verified in a March 2023 partnership announcement, Rexas will use Chainlink’s Price Feeds to secure its lending protocols.

- Multi-chain ambitions. Plans to launch on Binance Smart Chain (BSC) and Solana post-presale, aiming to reduce transaction costs and improve scalability.

Key challenges

Let’s explore the main hurdles Rexas might face in simple terms:

- Unclear rules. Governments are still figuring out how to regulate crypto projects like Rexas Finance. New rules or legal issues could delay its progress or make it harder to operate. Investors need to watch out for sudden changes in laws. For instance, recent legislative actions in Texas aim to limit crypto investments in state funds, reflecting the evolving regulatory landscape.

- Unpredictable prices. Crypto prices can rise or drop sharply for many reasons, such as economic news or market speculation. Even if Rexas performs well, its token price might crash if early investors sell too quickly after launch. This volatility is common in the crypto market.

- Tech risks. Hackers often target new crypto projects. Even though Rexas Finance checks its systems for flaws, one mistake in its code could lead to stolen funds or frozen accounts. Trust takes time to build. Ensuring robust security measures is crucial to mitigate these risks.

- Too much competition. Rexas Finance isn’t the first DeFi project. Bigger, established platforms already offer similar features like staking or loans. To succeed, it needs to stand out—maybe by working faster, cheaper, or on more blockchains.

Why this matters

These challenges don’t mean Rexas Finance will fail—but they’re risks every investor should know. Projects that handle these well can grow, but those that don’t might struggle. Always research before investing!

Is Rexas Finance crypto a safe investment?

When investing in RXS, or any crypto for that matter, safety is always a concern. To decide if it is a secure option, consider these key factors.

- Security measures. Rexas Finance has gone through two audits by CertiK, and no critical flaws were found. While this is reassuring, security in crypto is never set in stone. Regular updates and ongoing audits will be key to keeping RXS crypto safe in the long run.

- Liquidity risks. The liquidity pool for RXS holds around $12 million. Compared to Uniswap’s $3.5 billion, this is on the lower side, which means big trades could face slippage. If you’re planning to invest, it’s worth checking the latest RXS crypto price and liquidity trends before making a move.

- Team transparency. The people behind Rexas Finance have chosen to stay pseudonymous. While this is common in crypto, it might be a dealbreaker for investors who prefer projects with a fully visible team. If transparency is important to you, this is something to think about before putting money into RXS.

While no investment is risk-free, RXS crypto has audited smart contracts and a growing use case. If you’re considering buying RXS, weighing the risks against its potential is the smart way forward. Using platforms like MoonPay to buy or sell tokens can also help streamline the process.

Traders Union experts on Rexas finance risks

Despite its growing telegram community and positive news releases, Anastasiia Chabanuik (Cryptocurrency expert at Traders Union) sees some potential red flags associated with RXS crypto. Anastasiia is crypto expert with over 17 years of experience reviewing crypto projects.

1. Contract and Presale Issues

- Overly simplistic contract address

- Limited presale options (only accepting ETH and USDT on ERC20 network)

- No credit card payment options.

2. Team Anonymity

- Complete anonymity of the team members

- No KYC (Know Your Customer) verification

- Lack of transparent information about developers and company

3. Questionable Audit Claims

- Claims of passing a CertiK audit, but the audit is limited in scope.

- Does not cover important aspects like RWA (Real World Asset) tokenization processes

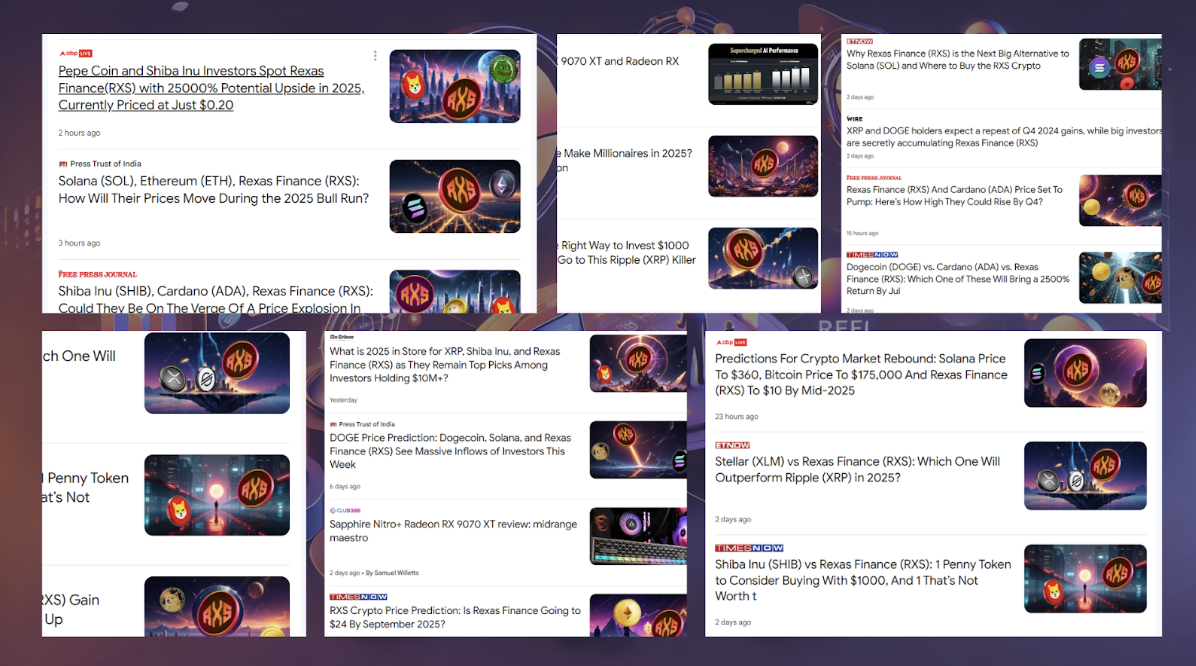

4. Marketing and Transparency Issues

- Aggressive marketing campaign

- Numerous sponsored articles and press releases

- Possible attempt to mask underlying issues

- Website lacks transparent information

Note! Diversify the portfolio and limit RXS exposure to 5% or less.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Future of Rexas Finance crypto: What to expect

Rexas Finance is gearing up for its official launch on June 19, 2025, with an initial listing price of $0.25 per RXS token. Apart from this, other key developments include:

- Cross-chain expansion. The platform plans to integrate with the Solana blockchain to reduce Ethereum gas fees and enhance transaction efficiency.

- NFT integration. A pilot NFT marketplace is under development to facilitate collateralized loans, merging digital art with decentralized finance (DeFi).

- CEX listings. Negotiations with major centralized exchanges, including Binance and Coinbase, are ongoing, potentially boosting RXS liquidity and accessibility.

However, macroeconomic factors such as interest rate fluctuations and Bitcoin’s market dominance will continue to influence RXS’s trajectory.

Conclusion

Rexas Finance Crypto comes with both potential and uncertainty. Its MoonPay partnership and push for a multi-chain future could drive growth, but regulatory challenges and market fluctuations are part of the game. Experts at Traders Union suggest keeping a well-balanced portfolio and staying updated on RXS crypto trends before making investment moves. In a market that moves fast, knowing the latest RXS crypto price and developments can make all the difference.

FAQs

Is RXS Crypto a good investment in 2025?

While RXS shows potential, its high volatility and regulatory risks make it suitable only for risk-tolerant investors.

How do I buy RXS Crypto?

You can purchase RXS via MoonPay on Rexas Finance’s platform or decentralized exchanges.

What’s the difference between RXS and Ethereum?

Ethereum is a blockchain for building apps, while RXS is a DeFi token focused on lending and staking services.

Can RXS reach $10?

At current growth rates, RXS could hit $10 by 2026-2027, contingent on market conditions and adoption.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Traders Union Experts Analyze Rexas Finance Crypto – Risks & Prospects

https://fangwallet.com/2025/03/20/traders-union-experts-analyze-rexas-finance-crypto-risks-prospects/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.