This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

- Key Takeaways

- Introduction

- Why Should I Not Accept the Initial Settlement Offer?

- Why Do Insurers Offer Fast Insurance Checks?

- What Happens if I Accept a Car Accident Settlement and Sign a Release?

- Can I Reopen My Case If a New Injury Shows Up Later?

- When Can I Reopen a Personal Injury Case?

- What Should My Insurance Check Cover?

- How to Avoid Receiving a Lowball Offer

- Conclusion

- Frequently Asked Questions

- Recommended Reads

Key Takeaways

- That first insurance offer may feel like a relief, but it often doesn’t come close to covering your full losses. Once you accept and sign, you can no longer claim further compensation.

- Pain and symptoms don’t always show up right away. Settling too soon could leave you paying for long-term medical care out of pocket.

- A liability release waives your right to seek more compensation, even if new injuries or expenses arise. Always review documents with an experienced attorney first.

- Lost income, emotional trauma, and future medical bills aren’t always part of that first offer. You deserve a settlement that reflects your overall losses.

- A trusted personal injury attorney protects your rights, uncovers your claim’s actual value, and ensures no one takes advantage of your pain.

Introduction

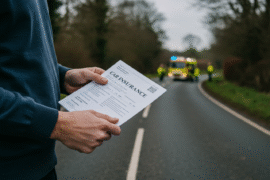

After a car accident, the aftermath can be devastating. You’re in pain, your car is totaled, medical bills are stacking up, and you’re missing work. During this challenging time, accepting the first settlement offer can be enticing. It’s fast, feels like a relief, and you’re tempted to cash it and move on.

However, accepting an insurance payout too soon, especially before knowing the full extent of your injuries or damages, can cost you thousands. Once you cash that check, you will release the other party of responsibility in the future.

If you are filing a car accident claim, this guide will help you understand why accepting the insurance check too soon can be costly and how to protect your rights in such cases.

Why Should I Not Accept the Initial Settlement Offer?

The initial settlement offer will always fall short of covering ALL of your damage expenses.

In California, cash offers are sometimes exchanged in accidents with minimal property damage, typically under $500. When you involve the insurance company, adjusters usually offer you a settlement immediately, and you may think they must have taken your situation seriously. This quick compensation may seem helpful, especially if you must cover your growing medical bills and other expenses.

But that “easy fix” could cost you far more than you realize.

What happens if that scratch on your bumper hides deeper structural damage? Or what if the soreness in your neck isn’t just a bruise but the start of a severe whiplash injury that takes weeks to surface?

Once you accept an offer, whether at the scene or through an initial lowball insurance offer, you waive your right to pursue further compensation. That means:

- If repairs cost more than expected, you pay the difference.

- If medical issues develop later, they’re on you.

- If you miss work or need therapy, no one’s reimbursing you.

This is why you should never feel pressured to accept money at the scene or from an insurance adjuster without fully understanding the extent of your injuries, the damage to your vehicle, and the rights you may be signing away.

Why Do Insurers Offer Fast Insurance Checks?

Insurance companies offer quick settlements because the faster you settle, the less they have to pay.

Insurance companies don’t rush to send you a check out of kindness. Instead, they do it to protect their profits. When they offer you money right away, it’s a calculated move. Their goal is to close your case quickly before the full impact of your injuries and losses is known.

When insurers offer you an immediate insurance check, they hope that you won’t realize that:

- You might not know the full extent of your injuries yet. Some symptoms, like chronic pain, soft tissue damage, or emotional trauma, take time to appear.

- You probably haven’t talked to a lawyer. You might not know you could be entitled to much more, such as future medical care, lost income, reduced earning potential, and pain and suffering.

- Once you cash that check, your case is likely closed. There’s no do-over if your condition worsens or new costs arise.

The truth is that fast check may only cover today’s emergency room bill, but what about tomorrow’s surgery, months of therapy, or the paycheck you miss while you heal?

Insurance companies are banking on your vulnerability. Don’t give up thousands or your peace of mind for a quick fix. Talk to someone who has your best interests at heart. And make sure any settlement truly reflects the full cost of what you’ve lost.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

What Happens if I Accept a Car Accident Settlement and Sign a Release?

When you sign a release after a car accident, you agree to take the offered compensation and, in return, give up your right to hold the other party financially responsible.

This means that even further complications arise, such as new medical issues or the realization that the offer wasn’t enough, and you can’t claim more compensation.

The at-fault party’s insurance company will typically ask you to sign a liability waiver once a settlement is reached. This form is designed to protect them legally. It confirms that you:

- Accept the agreed amount as full compensation

- Won’t pursue any further claims

- Understand the state laws that apply

- Are signing voluntarily, without pressure or coercion

When accepting an insurance check and signing a waiver, it might feel like you’re just finishing up paperwork, but remember that this is a binding contract. And once it’s signed, your legal options are likely gone.

That’s why it’s so important not to rush. Before you sign anything, especially a release form, take the time to understand precisely what you’re agreeing to and whether it truly covers the full extent of your injuries and losses. A personal injury lawyer can help you review the offer, weigh your options, and ensure you’re not giving up far more than you’re getting.

Can I Reopen My Case If a New Injury Shows Up Later?

Sadly, once you accept a settlement and sign a release, your case is usually closed, even if new injuries show up later.

Many injuries from severe accidents, like whiplash, back trauma, or even spinal cord damage, don’t always appear right away. You might feel “okay” at first, only to wake up days or weeks later with pain, numbness, or limited mobility. But if you’ve already signed a liability waiver, you’ve also signed away your right to seek more compensation, no matter how serious the injury is.

This is why it is crucial to listen to your body after an accident and not rush into a settlement. Watch for symptoms like headaches, abdominal pain, mood changes, or stiffness. These could signal something deeper and more costly injury.

When Can I Reopen a Personal Injury Case?

In rare cases, reopening is possible. For example:

- Fraud: If the insurance company acted in bad faith, such as withholding payment or using false evidence.

- Nonpayment: Your case could be revived if the insurer fails to deliver the full settlement as promised.

- Multiple At-Fault Parties: If others contributed to the accident, you might still be able to pursue a claim against them, even after settling with one party.

Remember that these are exceptions, not the rule. The best protection is being thorough and patient from the start. Don’t accept a fast payout if you’re still unsure about the full impact of your injuries.

What Should My Insurance Check Cover?

No two accident claims are alike because no two lives are impacted in exactly the same way. The value of your settlement depends on how deeply the crash has affected you, both financially and emotionally.

In a personal injury claim, you can claim the following damages when accepting compensation:

Economic Damages

These are tangible losses and can be backed by bills, receipts, and lost income. They often include:

- Medical expenses (past and future)

- Vehicle and property damage

- Lost wages from time off work

- Reduced earning capacity

- Out-of-pocket costs like transportation or caregiving

Non-Economic Damages

Some accidents can emotionally or psychologically impact you. These damages may include:

- Pain and suffering

- Emotional distress or trauma

- Loss of companionship or support

- A decline in your quality of life

- Post-traumatic Stress Disorder and long-term psychological impact

Punitive Damages

The court may award punitive damages in extreme negligence, intentional harm, or outrageous misconduct cases. These are meant to punish the at-fault party and to convey that this behavior has consequences.

It’s easy to count receipts, but much harder to quantify what this accident has truly taken from you. A legal expert can help uncover the full scope of your losses, seen and unseen, and fight for the compensation you actually deserve.

How to Avoid Receiving a Lowball Offer

Even if the other driver is clearly at fault, insurance companies are trained to pay you as little as possible, often offering quick, lowball settlements that don’t begin to cover your real losses.

Here’s how to protect yourself and get the full compensation you deserve:

- Know What Your Policy Really Covers: Know your coverages, limits, and deadlines, such as California’s statute of limitations, which is 2 years. You risk leaving money on the table if you don’t know what benefits you’re entitled to.

- Get the Right Medical Care and Document Everything: Even if you feel “okay” after the crash, some injuries take days or weeks to show up. Always get checked by a doctor and follow through on treatment. Gaps in care give insurers an excuse to say your injuries aren’t serious or weren’t caused by the crash. Detailed records of every doctor visit, diagnosis, and treatment plan help strengthen your claim.

- Watch Out for Insurance Loopholes: Insurance companies use small details to justify smaller payouts. Stay alert to out-of-network charges, hidden facility restrictions, location-based pricing differences, balance billing traps, coverage gaps between preventive and diagnostic care, and discount plans offering little protection. Unless you know how to avoid these technicalities, they can quietly drain thousands from your payout.

- Hire a Personal Injury Lawyer: The best personal injury lawyer California offers can negotiate, gather crucial evidence, and counter insurance tactics. Without legal help, a simple apology or quick “I’m fine” could be twisted against you, costing you the compensation you actually deserve.

Conclusion

Insurance companies may move quickly, but that doesn’t mean you should. Before you sign a release or accept a check, understand what you’re giving up and what you could still be entitled to.

A dedicated lawyer can help you see the full picture, protect your rights, and fight for every dollar you truly deserve, and not just the ones they want to give you.

Your recovery is too important to rush. Talk to someone who’s on your side before you sign anything. It could be the difference between a quick check and the full justice you’re owed.

Frequently Asked Questions

Should I talk to the insurance adjuster right after the crash?

Not before speaking with a lawyer. Saying the wrong thing early on could be used to deny or reduce your rightful compensation.

How long should a case take to settle?

It depends on the complexity of your case, but rushing it can cost you. Most cases take months to a year, and it’s worth the wait to ensure you get what you truly deserve.

What is the statute of limitations in California for personal injury claims?

In most cases, you have two years from the date of the accident to file a personal injury claim in California. If you miss that window, you may lose your right to compensation.

Are personal injury claims taxable?

Most personal injury settlements are not taxable under federal or California law, especially if they compensate for physical injuries or medical expenses. However, portions related to lost wages or punitive damages may be taxed.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Why Accepting the Insurance Check Too Soon Could Be a ,000 Mistake

https://fangwallet.com/2025/05/13/why-accepting-the-insurance-check-too-soon-could-be-a-10000-mistake/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.