This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

- True Costs of a Fixer-Upper Home

- Identifying Potential Red Flags Before Purchase

- Creating a Realistic Renovation Budget

- Finding Reliable Contractors and DIY Resources

- Navigating Financing Options for a Fixer-Upper

- Knowing When to Hire a Professional vs. Doing It Yourself

- Conclusion

- Frequently Asked Questions

- Recommended Reads

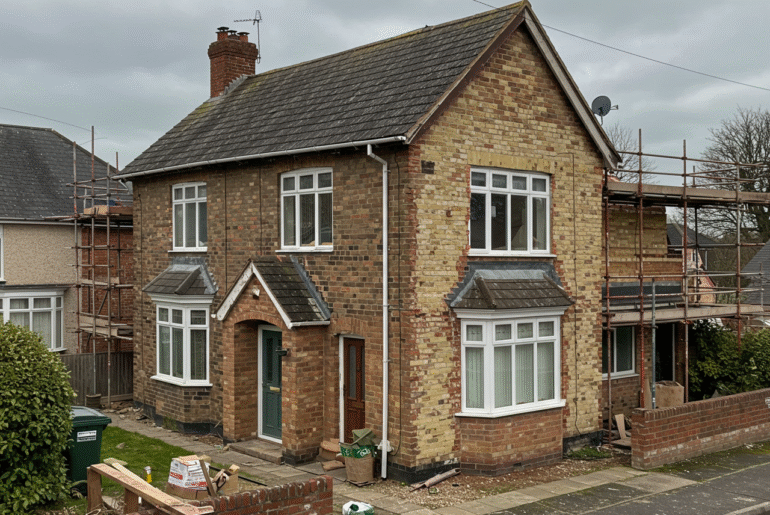

True Costs of a Fixer-Upper Home

Renovation Expenses

Renovation costs vary widely depending on the scope of work. Projects can range from minor updates to extensive repairs. Obtaining a detailed estimate before starting helps prevent overspending.

Inspection Fees

A thorough inspection uncovers hidden problems such as mold or failing pipes. These issues may not be visible but can require significant repairs.

Permits and Licensing

Certain renovations require permits. Researching local regulations helps avoid unexpected fees or project delays.

Unexpected Discoveries

Extra issues often emerge during renovation. Setting aside 10–20% of the budget for unforeseen expenses is advisable.

Time Investment

Fixer-upper projects demand considerable time and effort in addition to money.

Typical Project Cost Estimates

Project Cost Table

| Project | Estimated Cost |

|---|---|

| Kitchen Remodel | $15,000–$30,000 |

| Bathroom Update | $5,000–$20,000 |

| Roof Repair | $5,000–$15,000 |

| Electrical Work | $2,000–$10,000 |

| Painting Interior | $1,500–$5,000 |

Knowing these costs helps make informed decisions and avoid financial strain.

Identifying Potential Red Flags Before Purchase

Roof Inspection

Look for missing shingles, sagging areas, or water stains in the attic, as these indicate the need for roof repairs.

Foundation Issues

Visible cracks, uneven floors, or doors that do not operate properly may signal structural problems.

Plumbing and Electrical Systems

Old wiring and outdated pipes often require costly replacements or repairs.

Neighborhood Condition

Assess local trends such as vacant homes or declining property values, which can affect future resale potential.

Red Flag Signs Table

| Area to Inspect | Red Flag Signs |

|---|---|

| Roof | Missing shingles, leaks |

| Foundation | Cracks, sloping floors |

| Plumbing | Leaky pipes, low water pressure |

| Electrical | Old wiring, insufficient power |

| Neighborhood | Vacant homes, declining values |

Monitoring these factors supports renovation plans aligned with budget and goals.

Creating a Realistic Renovation Budget

Budget Categories

Breaking down costs into materials, labor, permits, and contingency funds clarifies spending limits and reduces overspending risks.

Typical Cost Ranges

Renovation Cost Table

| Category | Estimated Cost Range |

|---|---|

| Bathroom Remodel | $5,000–$15,000 |

| Kitchen Update | $10,000–$30,000 |

| Roof Replacement | $5,000–$12,000 |

| Paint & Flooring | $2,000–$8,000 |

Contingency Planning

Allocating 10–20% of the budget for unexpected issues like water damage or electrical repairs provides financial flexibility.

Prioritizing Preferences

Decide which features warrant higher spending to balance desires with budget constraints.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Finding Reliable Contractors and DIY Resources

Contractor Selection Tips

- Clear communication is important.

- Transparent pricing avoids surprises.

- Experienced contractors bring expertise for quality results.

DIY Resource Options

Resource Table

| Resource Type | Examples |

|---|---|

| Online Tutorials | YouTube, Skillshare |

| Blogs & Websites | The Family Handyman, DIY Network |

| Local Workshops | Home Depot Clinics, Community Colleges |

Engaging with local events or online groups can build knowledge and support for DIY efforts.

Loan Types and Features

| Financing Option | Best For | Pros | Cons |

|---|---|---|---|

| Conventional Loans | Standard Purchases | Competitive rates | Higher down payment |

| FHA 203(k) Loans | Major Renovations | Low down payment | Increased costs |

| HELOC | Homeowners with Equity | Flexible borrowing | Variable interest rates |

| Personal Loans | Small Projects | Quick access | Higher interest rates |

Selecting financing aligned with renovation scope and budget supports project success.

Knowing When to Hire a Professional vs. Doing It Yourself

Decision Factors

- Task Difficulty: Complex jobs usually require pros.

- Time Constraints: Professionals complete work faster.

- Safety Risks: Hazardous work calls for experts.

- Cost Considerations: Professional work can reduce costly errors.

Hiring vs. DIY Comparison

| Consideration | Hiring a Pro | Doing It Yourself |

|---|---|---|

| Cost | Higher initial cost | Potential savings |

| Time | Faster completion | Time-consuming |

| Quality | Guaranteed expertise | Variable quality |

| Risk | Fewer mistakes | Higher chance of errors |

Evaluating these aspects helps determine the best approach for each renovation task.

Conclusion

Buying a fixer-upper involves more than just a low purchase price. Knowing all associated costs, potential challenges, and financing options equips buyers to make sound decisions. Evaluating the property thoroughly, budgeting realistically, and choosing the right mix of professional help and DIY effort improve chances for a successful renovation and a home tailored to individual needs.

Frequently Asked Questions

What is a fixer-upper home?

A fixer-upper requires repairs or updates before becoming fully livable or appealing. The work can range from minor to extensive.

Why buy a fixer-upper?

Lower purchase prices and the chance to customize the home often motivate buyers. Renovations can increase property value over time.

What should I consider before buying?

Evaluate budget, repair costs, personal skills, time availability, and neighborhood conditions.

How do I find the right fixer-upper?

Research neighborhoods, consult real estate agents familiar with fixer-uppers, attend open houses, and look for listings marked “as-is.”

What are common pitfalls?

Underestimating renovation costs, overlooking major issues, and emotional attachment that clouds judgment.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Fixer-Upper Homes: Costs and Buying Tips

https://fangwallet.com/2025/05/24/fixer-upper-homes/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.