This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

Highlights

- Quick comparison: Both platforms serve active and casual traders with broad investment products and tools.

- Fees: Webull offers commission-free stocks and options; E*TRADE provides competitive rates plus perks for mutual fund investors.

- Tools: E*TRADE features advanced trading tools; Webull’s app is straightforward and beginner-friendly.

- Education and support: E*TRADE provides extensive learning resources; Webull offers interactive quizzes and tracking tools.

- Accounts: Both offer IRAs, margin accounts, and fractional shares (Webull only).

Introduction

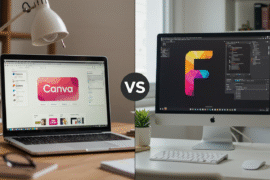

Choosing the right online trading platform influences investment success. Webull and ETRADE are prominent choices for active traders and beginners alike. Webull appeals to frequent traders with easy-to-use tools, while ETRADE delivers trusted services with robust investment options. This comparison outlines the strengths and limitations of each to guide investors in selecting the best fit.

Webull and E*TRADE Platforms

What Is Webull

Webull provides commission-free stock trading with no minimum deposit. It offers paper trading and robust technical analysis tools on mobile and desktop. Fractional shares and limited cryptocurrency trading are available. However, it does not support mutual funds or bonds.

What Is E*TRADE

E*TRADE combines powerful trading tools with resources for beginners. Investors can access stocks, mutual funds, options, futures, and robo-advisory services. The platform includes over 120 tools and indicators, advisor services, and Bitcoin futures but does not offer crypto wallets.

Webull and E*TRADE Comparison

| Feature | Webull | E*TRADE |

|---|---|---|

| Target User | Active traders, frequent traders, mobile-first investors, beginners | Active traders, casual traders, long-term investors, beginners |

| Fees | Commission-free stocks, ETFs, and options | Competitive rates, commission-free stocks & ETFs, perks for mutual funds |

| Tools & Platforms | Straightforward, beginner-friendly app; paper trading; robust technical analysis tools; clean interface; real-time data | Advanced trading tools, customizable workspaces, integrated research tools, 120+ tools and indicators, simulation tools |

| Investment Products | Stocks, ETFs, Options, Fractional Shares, Limited Cryptocurrency | Stocks, ETFs, Options, Futures, Mutual Funds, Corporate & Municipal Bonds, Robo-advisory services, Bitcoin futures (no crypto wallets) |

| Minimum Deposit | No minimum deposit for standard accounts | No minimum deposit for standard accounts |

| Account Types | Individual, Joint, Margin, Traditional IRA, Roth IRA, Rollover IRA | Individual, Joint, Margin, Traditional IRA, Roth IRA, Rollover IRA |

| Education & Support | Interactive quizzes, tracking tools, simple tutorials, forums, online support, practice accounts | Extensive learning resources, webinars, expert advice, phone support, access to professional financial advisors |

| Mobile Experience | User-friendly, emphasizes real-time data and simplicity | User-friendly, includes extensive research and educational content |

| Unique Features | Fractional shares, limited crypto trading | Broad selection of mutual funds & bonds, robo-advisory, comprehensive account management tools, Bitcoin futures |

| Cons | Does not support mutual funds or bonds | Does not offer crypto wallets |

Final Thoughts

The choice between Webull and ETRADE depends on investing style. Webull suits frequent traders seeking a mobile-first, low-cost experience. E*TRADE serves long-term investors with diverse products and advanced tools. Evaluating individual goals and platform features helps ensure the best match.

Frequently Asked Questions

Which is better for beginners, Webull or E*TRADE?

Webull offers an intuitive design, while E*TRADE provides structured learning tools. Preference depends on individual learning style.

Does Webull support cryptocurrency trading?

Yes, Webull offers select cryptocurrencies. E*TRADE supports Bitcoin futures but does not provide crypto wallets.

Are both platforms safe?

Yes, both use two-factor authentication, encryption, and regulatory protections.

What are the major differences in mobile features?

Webull emphasizes real-time data and a clean interface. E*TRADE adds research and educational tools for deeper insights.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the comment form below for feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Webull vs. Etrade: Which Brokerage is Right for You?

https://fangwallet.com/2025/06/17/webull-vs-etrade/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.