This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

In an increasingly interconnected global economy, managing finances effectively—whether for personal needs like international travel or sending money to family abroad, or for business operations such as paying overseas suppliers and handling revenue in multiple currencies—has become more complex yet more critical than ever. For many years, traditional banking institutions were the default option for these financial activities. However, a new wave of specialized financial service providers is demonstrating that focused expertise can lead to more efficient, cost-effective, and user-centric solutions, particularly for distinct needs like currency exchange and investments in precious metals.

The limitations of relying solely on conventional banking routes often manifest as common pain points for consumers and businesses alike. These can include opaque fee structures, less competitive exchange rates that erode value, slower processing times for transactions, and a general lack of deep, specialized knowledge when it comes to niche investment areas such as bullion. These challenges underscore the growing demand for alternatives that prioritize customer needs and leverage modern efficiencies. Indeed, specialized foreign exchange providers often present compelling advantages, such as more favorable exchange rates, reduced fees, and expedited transaction times, which can translate into “significant cost savings and greater efficiency” for users.

This evolution in financial services is not an isolated occurrence but mirrors a broader consumer movement towards tailored solutions and enhanced value. This movement is largely propelled by technological advancements that increase transparency and by a market that is becoming more aware of available options. Just as specialized, often tech-enabled companies have reshaped industries from retail to entertainment by focusing on specific niches and delivering superior service, dedicated financial service providers are doing the same in the financial sector. The rise and success of such providers indicate that individuals and businesses are increasingly less willing to accept the often less optimal, one-size-fits-all offerings of generalist institutions. Instead, they are actively seeking out experts who can deliver better outcomes for their specific financial tasks.

Furthermore, underlying this shift is a theme of empowerment for the individual and the small to medium-sized enterprise (SME). Specialized services frequently equip users with tools, information, and control that were previously less accessible. Features like real-time rate alerts or detailed market insights, often provided by these specialists, contrast sharply with the more opaque processes sometimes encountered with traditional institutions. This suggests that the appeal of specialized services extends beyond just better pricing; it’s also about fostering a more informed and proactive approach to financial management, transforming the user from a passive recipient to an active participant in their financial dealings.

Seamless Cross-Border Transactions: The CanAm Currency Exchange Advantage

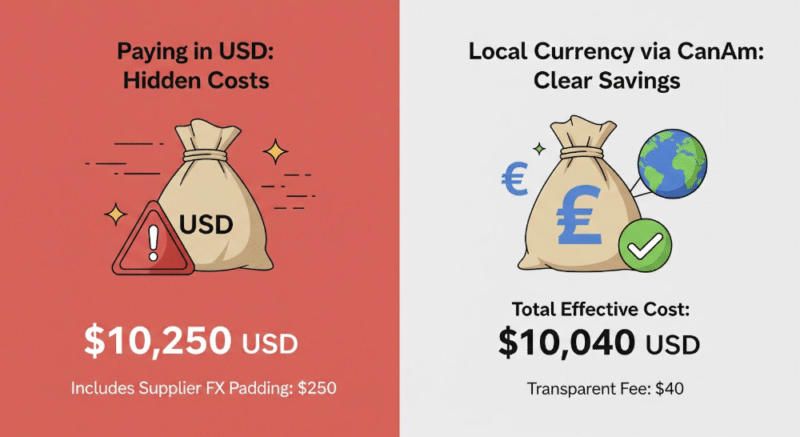

The process of exchanging currency through traditional channels can often be fraught with frustration. Common issues include high, often undisclosed, fees embedded within exchange rates, cumbersome and inconvenient procedures, and significant delays in the transfer of funds. For businesses, particularly those paying international suppliers, the practice of invoicing in U.S. dollars can mean inadvertently shouldering the cost of the supplier’s foreign exchange (FX) risk and their currency conversion fees. As noted in financial analyses, “foreign suppliers build a premium into the USD price of goods to protect against possible exchange rate fluctuations… they may also add to the price to offset bank fees for converting USD to their local currency”. This “padding” can amount to 2% or more on the price of goods, an unnecessary cost that specialized services can help mitigate.

CanAm Currency Exchange emerges as a compelling solution to these challenges, offering a service designed for clarity, efficiency, and value. A cornerstone of their offering is Competitive Rates & Transparency. They provide “Preferred Exchange Rates” based on real-time market values, with these rates displayed to four decimal points for enhanced accuracy. This level of detail directly addresses the lack of transparency often associated with bank-provided exchange rates. Initially focusing on USD and CAD, CanAm has expanded its currency offerings to include EUR, GBP, and MXN, catering to a broader range of international transaction needs. This transparency is further enhanced by features allowing users to check trading market values even before logging into the app, empowering them with information upfront.

The service is accessible through a User-Friendly Technology platform, the CanAm Currency Exchange app. This application facilitates “Quick & Secure Transfers” and boasts a “User-Friendly Interface” with step-by-step guidance. Key features such as “Rate Alerts” (notifying users when their target trading rate is reached), “Seamless Tracking” (allowing users to monitor transfers and view trade history), and “Market Insights” (providing real-time market data and historical pricing) place significant control and information directly into the user’s hands. This technological approach is not merely about convenience; it serves to demystify foreign exchange rates and processes, enabling users to make more informed decisions and potentially avoid the inflated costs that can be embedded by suppliers or unfavorable bank markups. Businesses using such a service to pay suppliers in their local currency may find themselves in a stronger position to negotiate better pricing, as the supplier’s FX risk is removed.

Security and Trust are paramount in financial transactions, and CanAm Currency Exchange addresses this through robust measures. The service is “Regulated by FINTRAC, under the MSB registration number M15487609,” ensuring that funds are handled by a trustworthy and reliable entity. This regulatory oversight is a critical factor in building user confidence, especially when moving away from large, established banks. Complementing this, CanAm emphasizes data privacy, stating “No data shared with third parties” and “No data collected” where applicable, addressing modern concerns about the security of personal and financial information. This dual commitment to regulatory compliance and data protection significantly lowers the perceived risk for potential users, making them more comfortable engaging with the service.

Finally, while technology drives efficiency, CanAm also provides access to Customer Service through “experienced foreign exchange traders”. This blend of technological convenience and human expertise ensures that users can receive support and guidance when needed. For businesses and individuals seeking competitive CAD to USD exchange rates, or other currency pairs, services like CanAm Currency Exchange offer a modern, transparent, and secure alternative to traditional banking methods.

Building a Resilient Portfolio: Investing Wisely with CanAm Bullion

Precious metals like gold, silver, and platinum have held an enduring appeal as investment assets for centuries. Their value is often seen as a hedge against inflation, a reliable store of value during economic volatility, and a means of diversifying an investment portfolio, particularly in “uncertain economic times”. While the allure of bullion is clear, the choice of where to acquire these assets is crucial.

Opting for a Specialized Bullion Dealer over non-specialist sources can offer significant advantages. Traditional banks, if they offer bullion at all, often come with “limited selection” and “high premiums”. While banks may offer a sense of security and transparent pricing on their limited offerings, specialized dealers can often provide more negotiable pricing and a significantly “wide range of rare and unique coins”. Furthermore, purchasing from unverified online sellers carries the risk of acquiring counterfeit products, a danger that reputable dealers mitigate through stringent authenticity checks. Professional dealers are typically held to higher standards, ensuring secure transactions and authentic products, backed by industry knowledge and robust customer service.

CanAm Bullion positions itself as a leading specialized dealer, emphasizing several key advantages:

- Authenticity and Quality: CanAm Bullion assures customers of “Diverse, Authentic Bullion from Around the Globe”. Their commitment to “Certified and Accredited Excellence” is underscored by their recognition as a trusted dealer by the Royal Canadian Mint (RCM) and an A+ rating from the Better Business Bureau (BBB). These credentials are vital for building investor trust.

- Wide Selection: They offer “gold, silver, and platinum products in different sizes, shapes, weights, and design variations,” catering to both collectors and investors. Their inventory includes popular items like Canadian Maple Leaf coins, RCM bars, and Valcambi bars, as well as more unique offerings such as “Goldbacks”—a novel form of spendable gold.

- Competitive and Transparent Pricing: CanAm Bullion strives to provide “Unmatched Prices” and maintains a “Commitment to Transparency” by offering the latest spot prices and market values to inform customer decisions.

- Expert Guidance & Customer Service: The company states that “precious metal experts are always available to assist and guide you on investment decisions”. This is corroborated by positive customer testimonials praising the knowledge and helpfulness of staff members. This educational component is critical, as investing in bullion can be complex, with factors like purity, mint origin, and market timing influencing value. By providing guidance, CanAm Bullion positions itself as an advisory partner, not just a vendor, which can attract and retain customers who are cautious or new to bullion.

- Secure Storage Solutions: For investors concerned about the safekeeping of their assets, CanAm Bullion offers “insured storage solutions” that provide a “safe haven for your investments, eliminating any counter-party risk”. This is a crucial service for those making substantial investments.

- Accessibility: In addition to robust online purchasing capabilities , CanAm Bullion has a physical presence with multiple locations, including Windsor, Toronto, and Regina, making their services accessible through various channels.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Streamlining Currency Exchange and Bullion Investment

https://fangwallet.com/2025/07/01/streamlining-currency-exchange-and-bullion-investment/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.