This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

- 529 Plan Contribution Limits for 2025

- 529 Plan Limits and IRS Gift Exclusion Rules

- Annual and Lifetime 529 Contribution

- State-Specific 529 Plan Contribution Limits

- Tax Considerations for 529 Contributions

- How 529 Plans Impact Financial Aid

- Qualified Withdrawals and Tax-Free Growth

- Tips to Maximize 529 Contributions

- Summary of 529 Contribution Limits and Strategy

- Frequently Asked Questions

- Recommended Reads

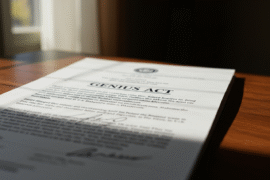

529 Plan Contribution Limits for 2025

As college tuition continues to rise, planning for education expenses early can offer major financial advantages. One of the most effective tools to save for these costs is a 529 college savings plan. Whether you’re a parent, guardian, or relative contributing to a child’s future, understanding how much you can invest and the tax rules that apply is essential for building a smart, tax-advantaged savings strategy.

This guide explains the 529 plan contribution limits for 2025, including annual and lifetime limits, gift tax exclusions, and state-specific caps, so you can contribute with confidence.

529 Plan Limits and IRS Gift Exclusion Rules

Annual contribution limit

$17,000 per individual per beneficiary

$34,000 for married couples filing jointly

Contributions within these limits fall under the annual federal gift tax exclusion, meaning they do not require IRS reporting or trigger gift taxes.

5-Year Gift Tax Election

A unique feature of 529 plans is the ability to front-load contributions through the 5-Year Election rule. This strategy allows individuals to contribute up to five years’ worth of gift tax exclusions at once.

| Contributor Type | Maximum 5-Year Election (2025) |

|---|---|

| Individual | $85,000 |

| Married Couple | $170,000 |

These contributions are treated as if they were spread evenly over five years and help maximize compound growth potential without exceeding tax limits.

Annual and Lifetime 529 Contribution

| Contribution Type | 2025 Limit |

|---|---|

| Annual (Individual) | $17,000 per beneficiary |

| Annual (Married Couple) | $34,000 per beneficiary |

| 5-Year Election (Individual) | $85,000 |

| 5-Year Election (Married) | $170,000 |

| Lifetime Limit (By State) | $300,000–$529,000 |

Each state’s 529 plan enforces its own lifetime contribution cap per beneficiary, designed to reflect the expected cost of future education. Once this threshold is reached, no additional contributions can be made.

State-Specific 529 Plan Contribution Limits

| State | Aggregate Limit |

|---|---|

| California | $529,000 |

| New York | $520,000 |

| Texas | $500,000 |

| Ohio | $452,000 |

These amounts may be adjusted annually to keep up with inflation or tuition trends.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Tax Considerations for 529 Contributions

Gift tax treatment

529 contributions are treated as gifts under federal law. In 2025:

- You can contribute up to $17,000 per year per beneficiary without filing a gift tax return.

- Married couples can contribute $34,000 per year per beneficiary without gift tax implications.

- Use the 5-Year Election to contribute up to $85,000 (or $170,000 jointly) in a single year without triggering immediate tax obligations.

Note: Contributions above these limits may require filing IRS Form 709 but typically do not result in taxes owed unless your total lifetime gifts exceed the IRS exemption threshold.

State tax benefits

Many states offer tax deductions or credits when you contribute to in-state 529 plans. These benefits vary but can help you save significantly on your state income tax.

Example:

New York residents can deduct up to $5,000 per year (or $10,000 for joint filers).

How 529 Plans Impact Financial Aid

529 plans are considered parental assets when applying for federal financial aid. This means:

- Only up to 5.64% of the account’s value is counted toward the Expected Family Contribution (EFC).

- This makes 529 plans more favorable than student-owned assets, which are assessed at a higher rate (20%).

Qualified Withdrawals and Tax-Free Growth

As long as withdrawals are used for qualified education expenses, including tuition, books, room and board, and some K-12 or apprenticeship costs, your earnings are:

- Free from federal income tax

- Exempt from capital gains tax

Using the funds for non-qualified expenses may result in taxes and a 10% penalty on the earnings portion.

Tips to Maximize 529 Contributions

- Start early to take advantage of compounding interest

- Use the 5-Year Election strategically for large gifts from grandparents

- Stick to your state’s 529 plan if tax incentives apply

- Avoid overfunding past your state’s lifetime contribution cap

- Rebalance your plan’s investments as your child approaches college

Summary of 529 Contribution Limits and Strategy

A 529 plan is a powerful, tax-advantaged vehicle to prepare for your child’s education expenses. By understanding the annual and lifetime contribution limits for 2025, taking advantage of the 5-Year Gift Tax Election, and exploring state tax perks, you can optimize your college savings strategy while staying compliant with IRS rules.

Before making large contributions or using advanced strategies, it’s wise to consult a financial planner or tax advisor to ensure your approach aligns with your goals.

Frequently Asked Questions

What is the annual 529 contribution limit for 2025?

You can contribute $17,000 per beneficiary if single, or $34,000 if married filing jointly, without triggering gift taxes. This aligns with the annual federal gift tax exclusion and helps maximize tax-advantaged savings without extra IRS paperwork.

How does the 5-Year Gift Tax Election work?

It allows you to contribute up to $85,000 as an individual or $170,000 as a couple in a single year while treating it as if you made equal contributions over five years. This strategy helps accelerate savings without incurring immediate gift tax liabilities.

What are the lifetime contribution limits?

Each state sets its own aggregate cap on how much can be contributed per beneficiary. These limits range from $300,000 to $529,000 and are designed to reflect the expected cost of higher education over time.

Are 529 plan contributions tax-deductible?

They are not deductible at the federal level. However, many states offer deductions or credits if you contribute to your own state’s plan. These state-level incentives can significantly reduce your overall tax burden.

Are qualified withdrawals from a 529 plan taxable?

No. Withdrawals used for qualified education expenses such as tuition, books, room and board, or apprenticeship programs are exempt from federal income tax and most state taxes. Non-qualified withdrawals, however, may incur taxes and penalties.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: 529 Plan Contribution Limits 2025: Annual, Lifetime, and State Caps Explained

https://fangwallet.com/2025/07/30/529-plan-contribution-limits-2025-annual-lifetime-and-state-caps-explained/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.