This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

Recent trade policies, particularly those implemented during the Trump administration, have shaped major economic conditions. While much attention has focused on tax reform, tariffs, which are taxes on imported goods, often have a more direct effect on consumer spending. These trade measures influence prices, disrupt markets, and change how businesses and households operate. Their reach extends into daily life and personal finances.

Rising Tariffs and Daily Expenses

Increases in tariffs often lead to widespread price changes. Companies usually pass these added costs on to buyers, resulting in higher prices for electronics, clothing, and everyday household items.

Common Effects of Tariffs

More Expensive Goods

Imported products tend to cost more, especially necessities used daily.

Changes in Consumer Behavior

People may switch to locally made products or alternative brands to avoid higher prices.

Broader Price Increases

As imported goods become more costly, domestic producers may also raise their prices, reducing overall purchasing power.

Estimated Cost Increases by Product Type

| Product Category | Estimated Price Increase |

|---|---|

| Electronics | 10 to 25 percent |

| Clothing | 5 to 15 percent |

| Household Items | 3 to 10 percent |

Budget adjustments in response to these increases can help individuals manage spending during uncertain periods.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Price Shifts Across the Consumer Market

Whether shopping in stores or online, the effects of tariffs often show up in rising prices and limited product selection. When production costs rise, companies may reduce variety or shift to lower-quality materials.

How Tariffs Change Spending Patterns

Noticeable Price Increases

Goods affected by trade measures tend to cost more.

Substitutes Become Common

Lower-cost alternatives may replace premium products as companies look to reduce expenses.

Shift Toward Domestic Sources

As international sourcing becomes more expensive, businesses may turn to local suppliers, which can affect long-term pricing trends.

| Product Category | Estimated Price Increase |

|---|---|

| Electronics | 10 to 20 percent |

| Apparel | 5 to 15 percent |

| Grocery Items | 3 to 10 percent |

Planning purchases and seeking alternative options can support financial stability.

Tips for Managing Rising Costs

Trade policy changes influence more than product pricing. They also affect personal financial habits. These strategies can help maintain control:

Stay Updated

Follow economic developments that may impact product availability or pricing.

Review Monthly Spending

Prioritize essentials and look for cost-saving substitutions.

Explore Different Products

Local goods or tariff-free imports can offer similar quality at a lower price.

Compare Prices

Check multiple retailers before purchasing to get the best value.

| Category | Likely Impact |

|---|---|

| Consumer Goods | Higher retail prices |

| Retail Sector | Greater demand for local goods |

| Stock Market | Instability in trade-sensitive stocks |

Acting early can reduce financial pressure and help avoid overspending.

Job and Business Concerns in a Tariff-Driven Economy

Trade-related changes can affect jobs and operations across many sectors. Individuals working in logistics, manufacturing, or import-reliant industries may experience more direct impacts. The following actions can help prepare for disruption:

Evaluate Income Sources

Identify how much your income depends on sectors affected by trade shifts.

Build New Skills

Adapt to changing job markets by developing new capabilities.

Increase Savings

Establish a financial cushion in case of job loss or reduced income.

Track Economic Developments

Monitor updates that may signal changes in your industry.

For Business Owners

| Focus Area | Suggested Action |

|---|---|

| Supply Chain | Reduce dependence on vulnerable sources |

| Pricing Strategy | Adjust margins to reflect new costs |

| Market Focus | Target regions unaffected by tariffs |

Planning ahead can protect growth and reduce financial exposure.

Investment Planning in a Changing Trade Environment

Trade measures affect industries in different ways. While some sectors struggle, others may benefit. Flexible investment strategies can help protect long-term gains.

Smart Investment Practices

Diversify Investments

Invest in a broad mix of industries to reduce risk.

Look Beyond Domestic Markets

Global options can provide better protection from local policy shifts.

Support Local Producers

Firms that rely on U.S.-based production may hold competitive advantages.

Stay Informed

Monitoring industry developments helps adjust investment strategies as needed.

| Industry | Common Effects | Suggested Action |

|---|---|---|

| Manufacturing | Rising material costs | Favor companies with local sourcing |

| Agriculture | Export delays and supply issues | Explore agribusiness opportunities |

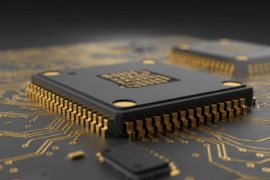

| Technology | Limited international growth | Focus on established domestic firms |

These actions can help investors avoid losses and remain financially secure.

Building Long-Term Financial Stability

As trade dynamics evolve, individuals and households can prepare by strengthening their financial position. Forward-looking steps support resilience and adaptability.

Practical Steps for Financial Health

Emergency Fund

Save enough to cover three to six months of essential expenses.

Budget Reviews

Adjust spending habits based on price shifts and income levels.

Ongoing Skill Development

Improve job security and potential earnings by learning in-demand skills.

| Investment Type | Risk Level | Potential Outcome |

|---|---|---|

| Stocks | High | Strong returns or possible losses |

| Bonds | Moderate | Predictable interest income |

| Real Estate | Moderate | Property appreciation and rent |

| Mutual Funds | Moderate | Balanced, diversified growth |

Smart planning now improves financial protection in the future.

Final Thoughts

Tariffs can affect far more than global trade. They influence everyday expenses, business strategies, job markets, and investments. From grocery stores to factories, the impact is visible and wide-reaching.

Being proactive helps maintain financial confidence. Adjusting spending habits, watching policy developments, and preparing for changes all contribute to lasting stability. The right steps today can provide a stronger foundation for tomorrow.

Frequently Asked Questions

What are tariffs?

Tariffs are taxes placed on goods brought into a country from abroad. They increase the price of foreign products and encourage local purchasing.

Why were tariffs introduced under the Trump administration?

They were used to reduce trade imbalances and protect U.S. jobs by limiting reliance on foreign competitors.

How have tariffs affected the economy?

Some domestic businesses benefited from reduced competition, while consumers and import-reliant sectors faced higher prices.

Which sectors have been most affected?

Agriculture, manufacturing, electronics, and automotive industries have experienced the greatest impact from supply and cost disruptions.

Can tariffs lead to other tax increases?

If tariffs slow economic growth or reduce revenue, governments may increase other taxes to offset budget shortfalls.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: How Tariffs Could Inflate Your Daily Costs by 25%

https://fangwallet.com/2025/07/31/how-tariffs-could-inflate-your-daily-costs-by-25/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.