This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

As a self-employed individual, understanding your tax obligations is essential to maintaining your financial health and avoiding unnecessary penalties. Educate yourself on key requirements, such as filing deadlines, estimated tax payments, and what can be considered deductible expenses. Remember, your income includes more than just what you earn directly—it also encompasses various forms of revenue you might collect, like freelance payments, commissions, or side hustles.

Here’s a quick checklist to keep in mind:

-

Track All Income: Keep detailed records of every source of income you earn.

-

Estimated Taxes: Set aside a portion of your income to cover quarterly estimated tax payments.

-

Deductions: Familiarize yourself with common deductions, such as home office expenses, equipment, and travel costs.

-

Tax Filing Status: Choose the correct filing status to maximize your tax benefits.

To give you an overview, here’s how different types of income are generally taxed:

| Type of Income | Tax Implications |

|---|---|

| Freelance Work | Subject to self-employment tax and income tax |

| Online Sales | May be subject to sales tax, depending on your location |

| Rental Income | Taxed but may qualify for property-related deductions |

By staying organized and informed, you can manage your tax obligations with confidence. Consulting a tax professional for personalized guidance is a smart move, especially if your situation is complex.

- Key Highlights

- Common Deductions You Might Be Missing Out On

- The Importance of Keeping Accurate Financial Records

- Navigating Estimated Tax Payments and Avoiding Penalties

- How to Stay Organized with Your Business Expenses

- Preparing for Tax Season: Tips for a Smooth Filing Process

-

Frequently Asked Questions

- What are some common mistakes self-employed individuals make when filing taxes?

- How can I ensure I’m keeping good records for my business expenses?

- Is it necessary to separate personal and business finances?

- What types of deductions can self-employed people claim?

- How can paying estimated taxes help me as a self-employed individual?

- Why is it critically important to understand self-employment tax?

- What should I do if I have underreported my income in previous years?

- How can I avoid making errors on my tax return?

- What resources are available for self-employed individuals to better understand taxes?

- How can I stay updated on changes in tax laws that affect self-employed individuals?

- Recommended Reads

Key Highlights

-

Understand your tax obligations as a self-employed individual

-

Maximize often-overlooked deductions

-

Keep accurate financial records for smoother tax filing

-

Plan and manage estimated tax payments effectively

-

Stay organized with business expenses

-

Learn proactive tips to streamline tax season

Common Deductions You Might Be Missing Out On

As a self-employed individual, you might be overlooking several valuable deductions that can significantly impact your tax return. Here are some commonly forgotten ones that could offer substantial savings:

-

Home Office Deduction: If you use part of your home exclusively for business, you can deduct a portion of your rent or mortgage interest, utilities, and other related expenses.

-

Health Insurance Premiums: If you’re paying for your own health insurance, this expense may be deductible from your taxable income—especially helpful for those without employer-sponsored coverage.

-

Business Use of Vehicle: Whether using your car for client meetings or running business errands, you can deduct actual expenses or take the standard mileage deduction.

-

Education and Training: Courses and workshops that enhance your skills related to your business can also be claimed. If you’re investing in yourself, don’t forget to record these expenses.

Here’s a breakdown of typical deductions:

| Deductions | What to Include |

|---|---|

| Home Office | Square footage, utility bills, internet costs |

| Health Insurance | Premiums for you and your family |

| Vehicle Expenses | Mileage or actual costs (gas, maintenance) |

| Education | Books, classes, workshops related to your field |

Consult a tax professional to fully understand how to maximize these deductions and tailor them to your business. You might be squandering money unknowingly.

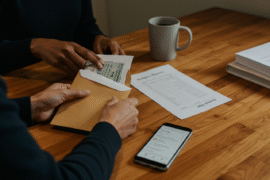

The Importance of Keeping Accurate Financial Records

Maintaining accurate financial records is a foundational part of self-employment. When you document your income and expenses carefully, you gain a clearer picture of your financial situation. This not only helps you make informed decisions, but it also streamlines the tax preparation process. You’ll find it easier to identify deductions and credits that can lower your tax bill.

Key aspects of financial recordkeeping include:

-

Organization: Use tools like spreadsheets or accounting software to categorize transactions.

-

Consistency: Regularly update records to avoid last-minute stress.

-

Documentation: Retain receipts and invoices to verify your income and expenses.

-

Review: Schedule periodic check-ins to adjust your strategies and keep things accurate.

| Record Type | Importance |

|---|---|

| Income Records | Tracks your earnings; essential for reporting |

| Expense Receipts | Proof of deductions helps reduce taxable income |

| Bank Statements | Shows cash flow; assists with budgeting |

| Invoices | Details of work provided; useful for tracking clients |

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Tax season can feel overwhelming, especially for the self-employed. One of the most important things to manage is your estimated tax payments. Failing to pay enough can result in penalties, while overpaying means you’re unnecessarily tying up your cash flow.

To avoid common pitfalls, follow these steps:

-

Understand Your Estimated Tax Obligations: Generally, if you expect to owe more than $1,000 in tax for the year, you’ll need to make estimated payments.

-

Use the Previous Year as a Guide: If your income is stable, last year’s tax liability can help you estimate this year’s obligations.

-

Stay Updated on Tax Changes: Tax laws change frequently. Be aware of any adjustments that may affect your deductions or credits.

-

Keep Detailed Records: Good recordkeeping makes it easier to estimate your taxes accurately and justify your numbers if needed.

Estimated tax schedule:

| Quarter | Due Date | Payment Percentage |

|---|---|---|

| Q1 | April 15 | 25% |

| Q2 | June 15 | 25% |

| Q3 | September 15 | 25% |

| Q4 | January 15 | 25% |

Plan ahead, and you can avoid penalties while keeping your finances in balance.

How to Stay Organized with Your Business Expenses

Staying organized with your business expenses is essential for simplifying tax time and maintaining financial clarity. Start by using accounting software or apps tailored to self-employed individuals. These tools can help you track and categorize your expenses automatically and even generate tax reports.

Update your records weekly to avoid missing any transactions. Having a clear view of your spending habits also supports better business decisions.

Here are some expense categories to monitor:

-

Office Supplies: Pens, paper, printer ink, etc.

-

Travel Expenses: Gas, lodging, and meals related to work travel

-

Marketing Costs: Advertising, website upkeep, promotional materials

-

Software Subscriptions: Tools that support business operations

-

Professional Services: Accountant fees, legal help, consultants

A table can help you visualize and manage your expenses:

| Expense Category | Monthly Estimate | Annual Estimate |

|---|---|---|

| Office Supplies | $50 | $600 |

| Travel Expenses | $200 | $2,400 |

| Marketing Costs | $100 | $1,200 |

| Software Subscriptions | $75 | $900 |

| Professional Services | $150 | $1,800 |

Getting organized now will save you time, money, and stress later.

Preparing for Tax Season: Tips for a Smooth Filing Process

Navigating tax season as a self-employed individual can be daunting, but with some preparation, you can streamline the process.

Start by organizing your financial records early. Use accounting tools or spreadsheets to track invoices, receipts, and payments. This will make filing your return much easier and more accurate.

Don’t forget to monitor deductible expenses, such as:

-

Home office costs

-

Business travel and meals

-

Health insurance premiums

-

Continuing education

-

Retirement contributions

It’s also wise to set aside money for taxes throughout the year. Here’s a basic tracking table:

| Quarter | Due Date | Estimated Payment |

|---|---|---|

| Q1 | April 15 | $[Your Amount] |

| Q2 | June 15 | $[Your Amount] |

| Q3 | September 15 | $[Your Amount] |

| Q4 | January 15 | $[Your Amount] |

By taking these steps early, you’ll avoid the last-minute scramble and reduce your chances of filing errors.

Frequently Asked Questions

What are some common mistakes self-employed individuals make when filing taxes?

Not keeping accurate records throughout the year is a major issue. This leads to missed deductions and overpaying. People also forget to track home office expenses, business supplies, and mileage.

How can I ensure I’m keeping good records for my business expenses?

Use a system that works for you—whether that’s digital tools or a simple notebook. Keep receipts, track each expense, and categorize them regularly to stay organized.

Is it necessary to separate personal and business finances?

Yes. Separating finances makes tracking easier and protects your personal assets if legal issues arise. Open a business bank account and consider a business credit card.

What types of deductions can self-employed people claim?

You can deduct home office expenses, travel costs, health insurance premiums, equipment purchases, and even qualifying education costs.

How can paying estimated taxes help me as a self-employed individual?

It spreads out your tax burden and prevents a large surprise bill at tax time. It also helps you avoid IRS penalties for underpayment.

Why is it critically important to understand self-employment tax?

Self-employment tax covers both Social Security and Medicare, which employers typically withhold. As a self-employed person, you must pay both portions, which can add up quickly.

What should I do if I have underreported my income in previous years?

File an amended return to correct the issue. It’s better to address it proactively than wait for IRS action. A tax professional can help you navigate this process.

How can I avoid making errors on my tax return?

Double-check everything before submitting. Use reliable tax software or hire a professional. Ensure all income is reported and deductions are valid.

What resources are available for self-employed individuals to better understand taxes?

The IRS and Small Business Administration offer helpful resources. Look into online courses, books, and professional advice for specific guidance.

How can I stay updated on changes in tax laws that affect self-employed individuals?

Subscribe to IRS updates and follow tax-related newsletters. Joining industry forums or professional groups can also keep you informed.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Self-Employed Tax Tips: 10 Errors You Can’t Afford

https://fangwallet.com/2025/08/02/self-employed-tax-tips-10-errors-you-cant-afford/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.