This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

- Introduction

- Who these Cards are Best for

- The 2025 Credit Card Landscape in the U.S.

- How to Choose Between Amex Platinum and Bank of America Premium Rewards

- Bank of America vs. American Express Comparison

- Know Your Spending Habits and Travel Goals

- Choosing the Right Card

- Wrapping Up the Amex vs Bank of America Card Choice

- Frequently Asked Questions

- Recommended Reads

Introduction

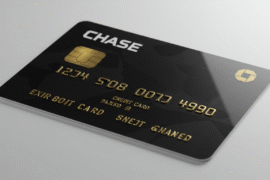

Choosing between the Amex Platinum and the Bank of America Premium Rewards Card comes down to your travel goals, spending habits, and how you value perks. While both are premium credit cards offering generous travel rewards, they cater to different types of users. The Amex Platinum stands out with luxury benefits and broad transfer options through Membership Rewards. On the other hand, the Bank of America Premium Rewards Card delivers straightforward value, especially for existing Preferred Rewards members. By comparing the features, fees, and earning potential, you can decide which card better aligns with your 2025 travel and financial plans.

Who these Cards are Best for

The Amex Platinum is a strong choice for frequent travelers who want premium benefits like lounge access, hotel upgrades, and rich Membership Rewards transfer options. It’s ideal for those with excellent credit who maximize luxury travel perks.

The Bank of America Premium Rewards Card suits users who prefer easy-to-use rewards, lower annual fees, and consistent value. Preferred Rewards members get boosted point earnings, making this card especially appealing for loyal Bank of America customers.

Both cards typically require good to excellent credit. Your travel frequency, reward preferences, and whether you’re an existing Bank of America customer can help determine the better fit.

The 2025 Credit Card Landscape in the U.S.

Credit cards in 2025 continue to evolve, with card issuers enhancing value through upgraded loyalty programs and partnerships. Amex maintains its focus on experiential travel and high redemption values via its Membership Rewards network. Bank of America, meanwhile, has refined its Preferred Rewards structure, offering more tiers and bonuses to deepen customer loyalty.

With so many new offers and shifting bonus structures, maximizing rewards means knowing where your everyday and travel spending will earn the most. Both Amex and Bank of America have adapted to changing user behavior, so the right card will depend on your specific lifestyle and financial goals.

The Amex Platinum provides rich travel benefits and exclusive perks, but it comes with a higher annual fee. In contrast, the Bank of America Premium Rewards Card offers solid value with simpler redemptions and a lower entry cost.

Before selecting a card, review your spending habits, travel preferences, and comfort with managing points programs. If luxury perks matter to you, Amex may be worth the fee. If ease of use and flexibility are more important, the Bank of America card may be a better match.

Both cards are user-friendly, even for beginners. Amex offers a polished rewards platform with airline and hotel partners, while Bank of America simplifies redemptions with fixed cash values.

What You’ll Need to Apply

To qualify for the Amex Platinum, you’ll typically need a credit score between 680 and 750 or higher, along with proof of income and ID verification.

For the Bank of America Premium Rewards Card, applicants often have better approval odds if they have an existing relationship with the bank. Participation in the Preferred Rewards program boosts both rewards and chances of approval.

Being prepared with necessary documents and understanding each card’s requirements can help speed up the process.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Bank of America vs. American Express Comparison

| Category | Bank of America | American Express |

|---|---|---|

| Banking Services | Offers a variety of checking accounts (Advantage Banking, Student Banking, and Business Checking), savings accounts (Advantage Savings), and retirement accounts (IRAs). | Provides personal and business checking accounts, as well as high-yield savings accounts (HYSAs) and Certificates of Deposit (CDs). |

| Credit Cards | Provides a range of credit cards, including cash back, travel rewards, and cards designed to help build credit. | Offers a wide selection of personal, business, and corporate credit cards with options for travel, cash back, and no annual fees. Also offers gift cards. |

| Loans | Offers home loans (mortgage, refinance, home equity) and auto loans (purchase, prequalification, refinance). | Provides personal loans and business lines of credit. |

| Investment Services | Provides investment services through Merrill, including Merrill Edge® Self-Directed Investing, Merrill Guided Investing, and Merrill Lynch® Wealth Management. | Does not offer a comparable investment service. |

| Other Services | Offers educational resources through the Better Money Habits® program and a mobile banking app with features like customizable alerts and mobile check deposit. | Provides travel-related services (booking trips, hotels, and cruises), airport lounge access, travel insurance, the Membership Rewards® program, FICO® Score and Insights, and various tools and support like CreditSecure® and Amex Offers. Also supports merchants who want to accept Amex cards. |

Know Your Spending Habits and Travel Goals

Identifying your top spending categories, such as groceries, dining, or airfare, can help determine which card delivers better long-term value. For example:

- Amex Platinum excels in travel-related purchases, particularly when used with its hotel and airline partners.

- Bank of America Premium Rewards rewards everyday spending more consistently, especially when combined with Preferred Rewards status.

Understanding why and how you travel, whether for leisure, family, or business, can also influence your decision. Amex caters more to luxury experiences, while Bank of America offers simplicity and flexibility.

Choosing the Right Card

Step 1: Identify Spending Categories and Lifestyle Needs

Start by reviewing where your money goes each month. If most of it is spent on luxury travel or fine dining, the Amex Platinum offers higher returns. For those who want broad earnings across categories without thinking about bonus types, the Bank of America Premium Rewards card may be more suitable.

Step 2: Compare Welcome Offers and Signup Bonuses

| Card | Welcome Offer | Minimum Spend | Time Frame |

|---|---|---|---|

| Amex Platinum | Up to 100,000 points | $6,000 | 6 months |

| Bank of America Premium Rewards | 60,000 points | $4,000 | 90 days |

Amex offers more points with a higher spending requirement but with greater redemption potential for travel. Bank of America’s offer is simpler and faster to unlock.

Step 3: Evaluate Ongoing Earning Rates

| Earning Category | Amex Platinum | BoA Premium Rewards (Base) | Preferred Rewards (Max) |

|---|---|---|---|

| Travel Purchases | 3x points | 2x points | Up to 3.5x points |

| Dining | 4x points | 2x points | Up to 3.5x points |

| Grocery Stores | 4x points | 1.5x points | Up to 2.62x points |

Amex offers high multipliers in select categories, while Bank of America delivers consistent earnings, which can increase significantly for top-tier Preferred Rewards members.

Step 4: Understand Redemption Options

Amex Membership Rewards points are best used for travel through airline and hotel partners. Lower value applies when redeeming for statement credits or shopping.

Bank of America Premium Rewards points have a fixed value of 1 cent per point across travel, cash back, or gift cards. This simplicity is ideal for users who prefer consistent redemption without the need for optimization.

Step 5: Weigh Fees and Perks

| Feature | Amex Platinum | Bank of America Premium Rewards |

|---|---|---|

| Annual Fee | $325 | $95 |

| Airline Fee Credit | Not applicable | Up to $100/year |

| TSA PreCheck/Global Entry | Not included | Up to $120 every 4 years |

| Authorized Users | 5 free, then $35 per additional user | Free |

| Perks | Uber Cash, hotel credits, dining credits | Simple cash back, Preferred Rewards boost |

Amex’s higher fee delivers premium benefits, while Bank of America focuses on practicality and value at a lower cost.

Wrapping Up the Amex vs Bank of America Card Choice

Deciding between the Amex Platinum and Bank of America Premium Rewards Card comes down to how you spend and what you expect from your credit card. The Amex Platinum shines for frequent travelers seeking luxury experiences and flexible point redemptions. The Bank of America Premium Rewards Card offers great value for those wanting straightforward rewards, especially if enrolled in Preferred Rewards. By reviewing your spending patterns, travel habits, and card features, you can confidently choose the option that adds the most value to your 2025 lifestyle.

Frequently Asked Questions

Which card gives better rewards for travel spending?

Amex Platinum generally offers more points on travel-related purchases, especially when used with airline and hotel partners. Bank of America Premium Rewards is competitive when paired with Preferred Rewards status, offering strong multipliers on travel and dining.

Are there restrictions on transferring Amex or Bank of America points?

Yes. Amex allows transfers to multiple airline and hotel partners, but each program has its own rules. Bank of America does not offer point transfers to travel partners, as their points are fixed in value and used directly for travel or cash back.

Can beginners easily redeem rewards with either card?

Yes. Both cards offer user-friendly platforms. Amex provides more flexibility, especially for travel redemptions. Bank of America’s rewards are easier to manage, with points worth a fixed value and simpler redemption paths.

How do the annual fees compare, and are they worth it?

Amex Platinum has a significantly higher fee but includes travel credits, lounge access, and more perks. Bank of America Premium Rewards has a lower fee and still offers valuable credits and benefits. Whether the fee is worth it depends on how much you’ll use the card’s extra features.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Amex Platinum vs. Bank of America Premium Rewards Card 2025

https://fangwallet.com/2025/08/05/amex-platinum-vs-bank-of-america-premium-rewards-card-2025/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.