This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

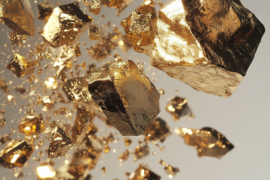

Making wise investment decisions requires knowing market trends. The dollar’s recent decline has drawn a lot of attention to gold and silver, as you may have noticed. This situation has created an interesting opportunity for people who want to make money from precious metals. Even though things aren’t always going smoothly, platinum has seen a sharp decline in value as market sentiment has changed. These tips will help you understand the current market trends and how they affect your financial strategy, whether you’re a seasoned investor or just starting to learn about commodities.

- The Impact of Dollar Weakness on Gold and Silver Prices

- How Technical Indicators Reveal Gold and Silver’s Bullish Momentum

- Identifying Safe Haven Assets in Uncertain Economic Times

- What Platinum’s Recent Decline Means for Your Investment Strategy

- Practical Tips for Diversifying Your Precious Metals Portfolio

- Making Informed Decisions: Timing Your Investments in Precious Metals

- Conclusion

-

Frequently Asked Questions

- What factors contributed to the gains in gold and silver?

- How has the dollar’s performance affected precious metals?

- What is the current outlook for gold and silver prices?

- What has been happening with platinum prices recently?

- What technical indicators should investors watch for platinum?

- What strategies can investors adopt in this market?

- Recommended Reads

The Impact of Dollar Weakness on Gold and Silver Prices

The dollar’s recent drop has caused very important changes in the precious metals market, with gold and silver gaining the most. When the dollar loses value, people usually want these metals more as other ways to store value. When the dollar’s value drops, investors often turn to gold and silver because they see them as safe places to put their money when currencies are unstable. This change can cause prices to go up, which could help your investment portfolio.

-

Investment Demand: As the dollar loses strength, many turn to gold and silver to hedge against inflation, often driving prices higher.

-

Market Sentiment: A softer dollar influences market psychology, where increased optimism around gold and silver can lead to higher trading volumes.

-

Global Economic Factors: Economic instability can further enhance the appeal of precious metals, pushing their prices upward when the dollar is weak.

To illustrate, consider the following snapshot of prevailing trends:

| Metal | Current Price (USD) | 24-Hour Change (%) |

|---|---|---|

| Gold | $1,900 | +1.5% |

| Silver | $25 | +2.0% |

| Platinum | $950 | -0.5% |

Recognizing how a weak dollar affects these markets could help you take advantage of gold and silver opportunities while being careful about platinum’s volatility. Staying up to date lets you change your plans and keep your investments balanced.

How Technical Indicators Reveal Gold and Silver’s Bullish Momentum

Technical indicators are very important for finding bullish momentum in precious metals, especially gold and silver. You can learn about how the market works and make smart choices by looking at important trends and patterns. For example, if you see the Relative Strength Index (RSI) go above 70, it usually means that the market is overbought. If it goes below 30, it usually means that the market is oversold. Keeping an eye on these changes can help you take advantage of price changes that might happen or continue.

Moving averages are also very important for spotting trends. When the short-term moving average crosses above the long-term moving average, this is called a golden cross. It usually means that bullish momentum is picking up, which is a good time to think about entering the market. On the other hand, a death cross can mean that the market is going down, so be careful.

| Indicator | Description |

|---|---|

| RSI | Measures the speed and change of price movements; identifies overbought/oversold conditions. |

| Moving Averages | Helps smooth out price action by filtering out noise; identifies potential trend reversals. |

| Bollinger Bands | Indicate volatility and potential price breakouts based on standard deviations from the moving average. |

Using these indicators not only helps you understand how the market works, but it also gives you the tools you need to take advantage of gold and silver’s gains while the dollar weakens. You can confidently navigate these markets if you stay informed and take action.

Identifying Safe Haven Assets in Uncertain Economic Times

Finding safe haven assets is important for protecting your financial health in today’s unstable economy. You might notice that gold and silver, which are precious metals, do well when things are uncertain, especially when the dollar is weak. These assets not only protect you from inflation, but they also often go up in value when the market goes down.

-

Inflation Hedge: Both gold and silver traditionally perform well during inflationary periods, maintaining their purchasing power.

-

Market Volatility: When stock markets are erratic, these metals often act as a refuge, attracting investors looking to secure their capital.

-

Diversification: Adding precious metals to your portfolio can reduce overall risk and enhance returns during turbulent times.

Assets like platinum, on the other hand, may not follow the same pattern. In recent studies, you may have noticed that platinum has been having trouble keeping its gains. It has been more volatile and less appealing to investors during times of economic uncertainty. This could be partly because it is used in industry, which can change with the economy.

| Asset | Current Trend | Investment Stability |

|---|---|---|

| Gold | Increasing | High |

| Silver | Increasing | Moderate |

| Platinum | Decreasing | Low |

When times are uncertain, you should take a more strategic approach to your investments. This means keeping up with market trends and knowing how each asset works. If you align your portfolio with stable, safe haven assets, you’ll be better able to weather economic storms.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

What Platinum’s Recent Decline Means for Your Investment Strategy

Recent changes in platinum prices are a clear example of how complicated the precious metals market can be. You may have noticed that gold and silver have done well even though the dollar has been weak. However, platinum has seen a big drop. This difference could have a big effect on how you invest. When examining your portfolio, consider the following points:

-

Diversification Importance: If platinum has been a component of your holdings, this decline underscores the necessity of diversification across various asset classes. Relying too heavily on one metal can expose you to increased risk.

-

Market Sentiment: Keep a close eye on market sentiment and industrial demand for platinum. While it may seem less favorable right now, downturns can also present buying opportunities if you believe in a reversal down the line.

-

Investment Horizon: If you’re in for the long haul, price fluctuations may be less concerning, but it’s essential to remain informed and adjust as needed.

Knowing how platinum relates to other precious metals can help you make better choices. Below is a simple comparative analysis of recent price movements:

| Metal | Recent Price Change | Investment Outlook |

|---|---|---|

| Gold | +5% | Positive due to inflation hedge |

| Silver | +3% | Steady, driven by industrial demand |

| Platinum | -4% | Monitor industrial recovery signs |

You should look at your whole investment strategy again because platinum has recently dropped. Keep up with what’s going on, be ready to change as the market changes, and don’t be afraid to ask for more financial advice that is specific to your needs.

Practical Tips for Diversifying Your Precious Metals Portfolio

When you want to expand your investments in precious metals, there are some simple things you can do to make sure your portfolio is balanced. It’s important to diversify, which means looking into more than just gold and silver. You should also look into other options like platinum and palladium.

-

Assess Market Trends: Keep an eye on market dynamics. While gold and silver have been seeing gains amid dollar weakness, platinum may behave differently. Understanding these trends can help you make informed decisions.

-

Explore Varied Forms: Think about investing in coins, bars, and ETFs. Each form has its own benefits and risks, and diversifying the types you hold can provide additional layers of security.

-

Allocate Wisely: Consider your risk tolerance. A general guideline might be to allocate a larger portion to stable metals like gold and silver, while dedicating a smaller portion to more volatile options like platinum and palladium.

To give you a clearer idea of what a diversified portfolio might look like, consider this sample allocation:

| Metal Type | Percentage of Portfolio |

|---|---|

| Gold | 40% |

| Silver | 30% |

| Platinum | 20% |

| Palladium | 10% |

Every investor’s path is different, so make these tips work for you based on your own financial situation and goals. Being proactive about diversifying your portfolio can protect you from market swings and help you take advantage of growth opportunities in the precious metals sector.

Making Informed Decisions: Timing Your Investments in Precious Metals

It’s very important to keep an eye on market trends when you invest in precious metals, especially now that the dollar is weak. When gold and silver prices are going up, it might be a good time to buy them because people are feeling good about them. You can make better choices about when to buy or sell by keeping an eye on important technical indicators.

-

Market Sentiment: Pay attention to news affecting the dollar, as its decline often correlates with increased interest in gold and silver.

-

Technical Indicators: Use charts to identify support and resistance levels for both gold and silver to find optimal entry and exit points.

-

Volume Trends: Higher trading volumes can signal buyer interest or market reversals; watch these closely for insights into price movements.

On the other hand, platinum has lost some of its gains as market conditions have changed. You should carefully think about your options and think about spreading out your metal investments based on how they are doing.

| Metal | Current Trend | Investment Outlook |

|---|---|---|

| Gold | Extending Gains | Positive |

| Silver | Rising | Positive |

| Platinum | Shedding Gains | Cautious |

By assessing these indicators and remaining flexible in your strategy, you can navigate the precious metals market with greater confidence and clarity.

Conclusion

In a market where the dollar is weak and the economy is uncertain, gold and silver continue to shine. They are very useful for both new and experienced investors because they can protect against inflation and serve as a safe haven. Platinum is more volatile and depends more on industry, but it still has potential for people who are willing to take more risks or have a longer time frame. You can build a strong and flexible portfolio of precious metals that can handle today’s changing markets with more confidence by learning about technical indicators, diversifying your investments wisely, and staying up to date.

Frequently Asked Questions

What factors contributed to the gains in gold and silver?

Gold and silver have extended their gains primarily due to the recent weakness in the dollar. As the value of the dollar declines, precious metals become more attractive to investors, leading to increased demand. Additionally, concerns about inflation and geopolitical instability have further bolstered their appeal as safe-haven assets.

How has the dollar’s performance affected precious metals?

The dollar’s weakness typically results in the appreciation of gold and silver prices. Investors looking to hedge against dollar depreciation often turn to these metals, driving up their values. When the dollar weakens, it also makes gold and silver more affordable for buyers using other currencies, enhancing global demand.

What is the current outlook for gold and silver prices?

Given the ongoing dollar weakness and macroeconomic uncertainties, the outlook for gold and silver prices remains positive in the near term. If the dollar continues to decline or if inflation fears persist, we may see further upward momentum in precious metals.

What has been happening with platinum prices recently?

Unlike gold and silver, platinum has experienced a decline in value, shedding gains amidst a lack of strong demand signals. Factors such as reduced automotive production, where platinum is commonly used in catalytic converters, have weighed on its prices.

What technical indicators should investors watch for platinum?

Investors should monitor support and resistance levels for platinum, as these can signal potential price movements. Additionally, trends in industrial demand and inventory levels can provide insights into the metal’s future performance. Technical analysis might also involve looking at moving averages and other momentum indicators to identify buy or sell signals.

What strategies can investors adopt in this market?

Investors may consider adopting a diversified approach by holding a mix of gold, silver, and platinum, depending on their risk tolerance and market outlook. Additionally, they might look for opportunities to buy on dips in gold and silver while being cautious with platinum until stronger demand signals emerge. Keeping abreast of economic data and central bank policies can also help in making informed investment decisions.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Gold and Silver Rise on Weak Dollar, Platinum Slips

https://fangwallet.com/2025/08/06/gold-and-silver-rise-on-weak-dollar-platinum-slips/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

Gold spot prices | Silver Prices | Platinum & Palladium | KITCO. (n.d.). https://www.kitco.com/price/precious-metals