This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

It can be hard to keep track of your own money. It can be hard to find the right financial advisor because there are so many choices, different qualifications, and different fee structures. But it’s still important to choose someone who has the right skills and values. The MoneySense Find a Qualified Advisor Tool was made to make that process easier by giving Canadians a reliable way to find certified professionals who share their financial goals.

The tool is meant to connect you with advisors who can help you with every step of the way, whether you’re planning for retirement, building investments, dealing with debt, or making a budget.

- What the MoneySense Advisor Tool Offers

- Define Your Financial Goals Before Searching

- Features Designed for Simplicity and Clarity

- How to Evaluate Financial Advisors Effectively

- Why Communication and Compatibility Matter

- Common Types of Financial Advisors You May Encounter

- Best Practices for Using the Tool

- Moving Forward with Confidence

-

Frequently Asked Questions

- What is the MoneySense Find a Qualified Advisor Tool?

- Who can benefit from using the tool?

- What types of advisors does the tool list?

- How does the tool match me with advisors?

- Do I need to know my goals before using the tool?

- Can I see how advisors are compensated?

- Why is fiduciary responsibility important?

- How can I tell if an advisor is a good fit personally?

- What types of financial advisors might I encounter?

- What are best practices when using the MoneySense tool?

- What questions should I ask potential advisors?

- How does this tool make the selection process easier?

- Recommended Reads

What the MoneySense Advisor Tool Offers

The MoneySense Find a Qualified Advisor Tool is a free, simple website that helps people in Canada find professional financial advisors. It is more than just a database; it is a system that matches advisors to your needs, location, and preferences.

The tool shows advisors who have well-known titles like Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). These credentials show that someone has a lot of knowledge and follows ethical standards. Profiles that are easy to read make it easy to compare qualifications and find the right advisor.

MoneySense helps Canadians find professionals who meet industry standards and their own needs by focusing on openness and ease of use.

Define Your Financial Goals Before Searching

It helps to know what your current financial needs are in order to use the tool correctly. It’s harder to find the right kind of advisor to help you on your journey if you don’t know exactly what you want to achieve.

Consider questions such as:

- Are you saving for retirement, buying a home, or building an investment portfolio?

- Are you looking for help managing debt or improving your budgeting habits?

- Do you need guidance on taxes, estate planning, or long-term strategy?

Knowing what is most important to you will help you choose the right advisors from the list the tool gives you.

Features Designed for Simplicity and Clarity

The platform was made with accessibility in mind. It doesn’t use any unnecessary jargon and guides users through a step-by-step process to find the right advisors. Some of its notable features include:

- Filter options that allow you to sort advisors by region, specialization, and compensation model

- Visible qualifications and certifications to verify professional credibility

- Easy-to-read profiles that make comparing advisors more straightforward

- Access to feedback and insights from past clients, where available

These features make it easier to choose an advisor and lower the stress that comes with making financial decisions.

How to Evaluate Financial Advisors Effectively

After the tool gives you a list of possible advisors, the next step is to carefully look over the list. You should look for someone who has the right certifications and experience, but you should also look for someone who can talk to you and shows that they really want to help you reach your goals.

Qualities to assess:

- Certifications: Look for designations like CFP, CFA, or RFP (Registered Financial Planner) that are recognized in the field and show that the person has the right technical and moral standards.

- Relevant experience: Consider whether the advisor has worked with clients in situations similar to yours.

- Compensation structure: Understand whether the advisor charges hourly, by project, or through a fee-based or commission model.

- Fiduciary responsibility: Some advisors are legally required to prioritize your best interests, which adds a layer of trust and protection.

Finding someone who knows a lot about technology and is good at communicating will help you build a better relationship with your advisor.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Why Communication and Compatibility Matter

In addition to qualifications, personal compatibility is a key factor in the success of any advisor relationship. You should be able to talk to your advisor and feel like they care about your point of view and values.

Ask yourself:

- Do they listen carefully and ask relevant questions?

- Are their explanations clear and easy to follow?

- Do they show a commitment to tailoring solutions rather than offering generic advice?

Consultations let you see if the advisor is not only smart but also easy to talk to and reliable.

Common Types of Financial Advisors You May Encounter

Different kinds of financial experts offer different kinds of help. Your advisor should be able to help you reach your goals and fit your financial situation.

| Advisor Type | Area of Specialization |

|---|---|

| Fee-only Financial Planner | Long-term financial planning and budgeting |

| Investment Advisor | Portfolio design and wealth management |

| Tax Advisor | Tax planning and optimization strategies |

Choosing an advisor with the right area of expertise makes sure you get more useful and personalized advice.

Best Practices for Using the Tool

To gain the most benefit from the MoneySense tool, approach the process methodically:

- Define your current financial needs and long-term goals

- Use the platform’s filters to narrow down advisors who meet your criteria

- Review each advisor’s qualifications, service focus, and compensation model

- Schedule consultations with a few candidates to compare their approaches

- Prepare thoughtful questions to ask during your meetings

Helpful questions may include:

- What is your overall approach to financial planning or investment management?

- How do you tailor your recommendations to fit each client’s goals?

- What is your fee structure, and are there any additional costs?

- Are you legally obligated to act in a client’s best interest?

- Can you share references or client success stories?

Taking these steps will help you feel more confident when making your final decision.

Moving Forward with Confidence

One of the most important things you can do to plan and improve your financial future is to pick a financial advisor. The benefits can last a long time if you work with someone who knows what you want, gives you clear advice, and has proven expertise.

The MoneySense Find a Qualified Advisor Tool was made to help Canadians find honest, knowledgeable professionals without making things too hard. You can make clear choices with it because it focuses on openness, user control, and high standards.

This tool will help you find the right financial advisor, whether you’re just starting to learn about financial planning or want to improve the quality of the advice you get.

Frequently Asked Questions

What is the MoneySense Find a Qualified Advisor Tool?

It’s a free website that helps Canadians find certified financial advisors who meet industry standards. The tool finds professionals who fit your needs based on your goals, location, and preferences.

Who can benefit from using the tool?

Anyone in Canada who needs help with retirement planning, building an investment portfolio, managing debt, making a budget, paying taxes, or planning their estate can use the tool.

What types of advisors does the tool list?

The platform highlights professionals with recognized designations such as:

- CFP (Certified Financial Planner)

- CFA (Chartered Financial Analyst)

- RFP (Registered Financial Planner)

How does the tool match me with advisors?

You can narrow down your list of advisors by their location, area of expertise, and pay structure. Profiles show qualifications, areas of expertise, and sometimes even feedback from clients.

Do I need to know my goals before using the tool?

Yes. Setting specific goals, like saving for retirement, managing your investments, or paying off debt, can help you find the right advisors for you.

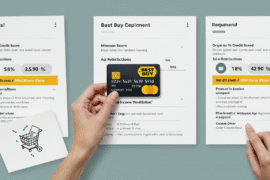

Can I see how advisors are compensated?

Yes. The tool lets you see if an advisor charges by the hour, by project, through a fee-based model, or through commissions, so you can pick the structure that works best for you.

Why is fiduciary responsibility important?

Advisors who have a fiduciary duty are legally required to put your best interests first. This adds an extra level of trust and safety to the relationship.

How can I tell if an advisor is a good fit personally?

You should look for clear communication, active listening, personalized suggestions, and an understanding of your values. The best way to see if you and someone else are a good fit is to set up a meeting.

What types of financial advisors might I encounter?

- Fee-only Financial Planner: Long-term planning and budgeting

- Investment Advisor: Portfolio design and wealth management

- Tax Advisor: Tax strategy and optimization

What are best practices when using the MoneySense tool?

- Define your needs and goals before searching

- Use filters to narrow down candidates

- Review qualifications, services, and compensation models

- Schedule consultations with multiple advisors

- Prepare relevant questions about their approach and fees

What questions should I ask potential advisors?

- What is your financial planning or investment approach?

- How do you tailor strategies to individual clients?

- What is your fee structure, and are there any hidden costs?

- Are you legally obligated to act in my best interest?

- Can you provide references or client success stories?

How does this tool make the selection process easier?

It helps you quickly compare advisors and make a confident choice by focusing on openness, accessibility, and trustworthy credentials.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: How the MoneySense Tool Helps You Choose Wisely

https://fangwallet.com/2025/08/15/how-the-moneysense-tool-helps-you-choose-wisely/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.