This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

Cryptocurrency is becoming more and more popular in mainstream finance. One of the most important changes recently is that USD Coin can now be used as collateral for U.S. futures trading. This step is a big step toward bringing digital assets and traditional financial markets closer together. The USDC from Circle is a fully reserved stablecoin that is tied to the US dollar. People are starting to trust stablecoins more as reliable, clear, and liquid tools, as shown by how often they are used in regulated financial markets like futures markets. Exchanges are making it easier for both small and large traders to use USDC as collateral for futures contracts. This also makes the connection between crypto and regular trading systems stronger. It talks about how USDC is used in U.S. futures trading, the good and bad things about using it, what it means for the market as a whole, and what people who are thinking about using it as collateral should do.

- What is USDC?

- Why USDC Matters in Futures Trading

- Market Implications

- Getting Started with USDC in Futures Trading

- Risk Factors to Consider

- Circle’s Broader Vision

- Conclusion

- Frequently Asked Questions

- What is USDC?

- Why is USDC eligible for U.S. futures trading?

- How does using USDC as collateral benefit traders?

- What are the risks of using USDC in futures trading?

- Which platforms accept USDC as collateral for futures?

- How can traders acquire USDC?

- What does this mean for the future of crypto and traditional markets?

- Recommended Reads

What is USDC?

USDC is a stablecoin that is backed by fiat money and is kept at a 1:1 ratio with the U.S. dollar. Regulated financial institutions keep an equivalent U.S. dollar (or dollar-denominated asset) in reserve for every USDC that is in circulation.

Important Features of USDC

- Price Stability: Pegged to the U.S. dollar to minimize volatility.

- Transparency: Monthly reserve attestations are published by third-party auditors.

- Regulatory Compliance: Issued under U.S. financial regulations.

- Global Accessibility: Transferable across major blockchain networks.

Why USDC Matters in Futures Trading

Futures trading involves contracts to buy or sell an asset at a predetermined price on a future date. Collateral is required to secure these positions and protect both parties from default risk. Traditionally, this collateral has been held in cash or U.S. Treasuries, but stablecoins like USDC are now entering the mix.

Benefits of Using USDC as Collateral

- Increased Liquidity: Stablecoins can be transferred globally within minutes, making them highly liquid compared to some traditional forms of collateral.

- Faster Settlement: Blockchain-based transfers enable near-instant settlement times.

- Reduced Conversion Costs: Eliminates the need to repeatedly convert between fiat and crypto.

- Enhanced Transparency: Reserves are verifiable, reducing counterparty concerns.

Collateral Options Comparison

| Collateral Type | Liquidity | Volatility | Settlement Speed | Transparency |

|---|---|---|---|---|

| Cash (USD) | High | None | High | High |

| U.S. Treasuries | Medium | None | Low | High |

| USDC | High | Very Low | High | High |

| Bitcoin | Medium | High | Medium | Medium |

Market Implications

The acceptance of USDC as collateral has broader implications for the financial ecosystem:

- Lower Barriers to Entry: More traders can access futures markets without needing large amounts of traditional cash reserves.

- Institutional Adoption: Regulated stablecoins increase institutional confidence in digital asset participation.

- Integration of Crypto and TradFi: Encourages smoother interaction between digital and traditional asset markets.

- Global Participation: Stablecoins provide an entry point for non-U.S. participants without requiring complex currency conversions.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Getting Started with USDC in Futures Trading

For traders and institutions considering using USDC in U.S. futures markets, the process involves several important steps:

Step 1: Secure a Crypto Wallet

Select a secure wallet to store USDC. Options include:

- Hot Wallets: Internet-connected, convenient for frequent transfers.

- Cold Wallets: Offline, better for long-term storage.

Step 2: Acquire USDC

Purchase from reputable exchanges such as Coinbase, Binance US, or Kraken, then transfer to the wallet.

Step 3: Choose a Futures Trading Platform

Select an exchange or brokerage that accepts USDC as collateral. Evaluate:

- User interface and tools

- Asset coverage

- Fee structures

- Security measures

Step 4: Implement a Risk Management Plan

- Start Small: Begin with limited exposure.

- Use Stop-Loss Orders: Automatically exit positions at predetermined price levels.

- Diversify: Avoid allocating all trading capital to one market or asset.

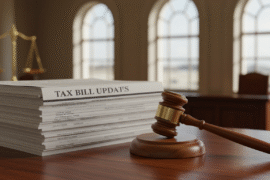

Risk Factors to Consider

While USDC offers many benefits, futures trading remains inherently risky.

Primary Risks

- Market Volatility: While USDC is stable, futures contracts often involve volatile underlying assets.

- Regulatory Shifts: Stablecoin regulations are evolving; new laws could impact their use.

- Counterparty Risk: The reliability of the exchange or broker is important.

- Technology Risks: Security vulnerabilities in wallets, exchanges, or blockchains.

Risk Assessment Table

| Risk Type | Likelihood | Impact on Traders |

|---|---|---|

| Price Volatility | High | Medium to High |

| Regulatory Change | Medium | Medium to High |

| Fraud/Scams | Medium | High |

| Technical Failure | Low | Medium |

Circle’s Broader Vision

Circle aims to position USDC as a bridge between traditional finance and the crypto economy. Its acceptance in U.S. futures markets is part of a wider strategy to:

- Increase stablecoin adoption in regulated environments.

- Encourage institutional participation in blockchain-based assets.

- Foster innovation in payment systems and financial products.

Conclusion

The fact that USDC can be used as collateral for U.S. futures trading is a big step toward making cryptocurrency more popular. This change makes it easier for traders to get to markets all over the world, settle trades faster, and pay less for transactions. It gives institutions a clear, regulated asset that works well with their current compliance systems.

But with the good things come duties. Futures trading is very risky, and USDC does help with some collateral problems, but it doesn’t make the market less volatile or the rules less unclear. Traders and investors should have good plans for managing risk, keep a mix of investments in their portfolios, and stay up to date on changes to the rules.

If a lot of people start using USDC for futures trading, it could lead to more cryptocurrencies being used in everyday finance. This would change how markets work in the future.

Frequently Asked Questions

What is USDC?

USDC, or USD Coin, is a U.S. dollar-backed stablecoin issued by regulated financial institutions, maintaining a 1:1 peg with the U.S. dollar.

Why is USDC eligible for U.S. futures trading?

It offers high liquidity, transparency, and regulatory compliance, making it suitable as secure collateral.

How does using USDC as collateral benefit traders?

It speeds up settlements, reduces conversion costs, and provides a stable asset during market volatility.

What are the risks of using USDC in futures trading?

While USDC itself is stable, risks include market volatility of underlying assets, regulatory changes, and operational risks.

Which platforms accept USDC as collateral for futures?

Some regulated U.S. futures exchanges and brokers are beginning to accept USDC; availability varies by jurisdiction.

How can traders acquire USDC?

It can be purchased on major cryptocurrency exchanges and stored in secure wallets.

What does this mean for the future of crypto and traditional markets?

The move could accelerate institutional adoption and lead to greater integration between blockchain-based assets and conventional finance.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: USDC Will Soon Be Accepted as Collateral for US Futures Trading

https://fangwallet.com/2025/08/24/usdc-will-soon-be-accepted-as-collateral-for-us-futures-trading/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.