This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

- Introduction

- Why Down Payment Assistance Matters Now

- Benefits of Down Payment Assistance

- Types of Down Payment Assistance Programs

- Local Versus National Programs

- How to Qualify for Down Payment Assistance

- Steps to Apply for Down Payment Assistance

- Common Myths About Down Payment Assistance

- Closing Costs and Their Impact

- Tools to Calculate Mortgage and Affordability

- Frequently Asked Questions

- Final Thoughts

- Recommended Reads

Introduction

- Grants: Funds you don’t have to repay.

- Forgivable loans: Loans forgiven if conditions, such as staying in the home for a set period, are met.

- Second mortgages: Supplemental loans with favorable terms.

- Employer-assisted programs: Housing benefits offered by certain employers.

For verified details and program discovery, review the U.S. Department of Housing and Urban Development resources, such as Buying a Home and the FHA help page. Authoritative guidance on assistance forms is also summarized on HUD Exchange’s HOME Homeownership page.

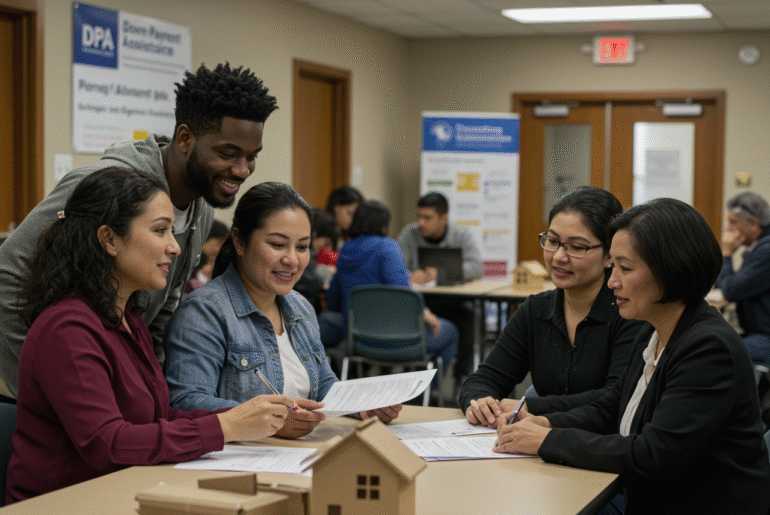

Why Down Payment Assistance Matters Now

With home prices elevated and mortgage rates higher than recently, affordability challenges remain significant. Surveys and housing research in 2024–2025 show many renters view homeownership as out of reach without help. Down payment assistance can bridge this gap by easing upfront expenses and improving purchasing power. It provides many first-time buyers with a pathway to homeownership that they might otherwise postpone for years.

For additional context on affordability trends, see Freddie Mac’s 2024 housing research note on renting versus owning (web summary/pdf).

Benefits of Down Payment Assistance

- Improved affordability: Reduce upfront costs and ease your financial burden.

- Greater confidence: Financial support builds peace of mind during the buying process.

- Expanded options: Unlock access to neighborhoods that may have felt unattainable.

- Wealth building: Begin growing equity and long-term financial stability earlier.

Types of Down Payment Assistance Programs

| Program Type | Description | Pros | Cons |

|---|---|---|---|

| Grants | These are free funds that do not require repayment. | There is no repayment necessary. | There is limited availability and competition. |

| Forgivable loans | Loans are forgiven after a period of ownership if conditions are met. | There will be no repayment if you remain in the home. | The terms and eligibility are varied. |

| Second mortgages | There are supplemental loans available with lower interest rates. | It effectively covers upfront costs. | Must be repaid alongside the primary mortgage. |

| Employer-assisted programs | The company offers down payment help as an employee benefit. | The employee adds value through employer perks. | The program is limited to select employers or industries. |

This table shows common program structures, each offering unique advantages. Buyers should weigh repayment obligations, availability, and long-term affordability when comparing options. It is also helpful to model scenarios with and without assistance to measure break-even timelines. Careful comparison supports better budgeting and long-run planning.

Local Versus National Programs

Assistance is available through both national and local channels. National frameworks and guidance from FHA and HUD provide broad support and pathways to lenders. Local housing finance agencies, nonprofits, and municipalities often target specific community needs with tailored eligibility criteria. Exploring both levels can uncover more flexible or generous options for your situation.

Start with HUD’s directory of Homebuying Programs in Your State, then check your state housing finance agency website. For loan pairings, review official program pages for FHA, VA, and USDA options.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

How to Qualify for Down Payment Assistance

Eligibility varies by program, but common requirements include income thresholds based on area median income, minimum credit scores (often around 620 or higher), and first-time homebuyer status. Some programs require the property to be your primary residence or located in a targeted area. Others may mandate homebuyer education or counseling before closing. Always review the specific guidelines, timelines, and post-closing conditions of the program before applying.

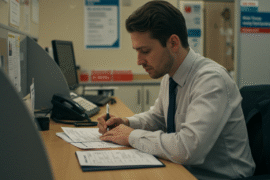

Steps to Apply for Down Payment Assistance

- Research programs; review local and national options through HUD and your state housing agency.

- Contact professionals; work with lenders, mortgage brokers, or housing counselors familiar with assistance programs.

- Prepare your documents and collect pay stubs, tax returns, asset statements, and proof of income.

- Submit applications; please ensure that you meet deadlines and adhere to program instructions carefully.

- Get pre-approved; secure mortgage pre-approval to strengthen your offer.

Common Myths About Down Payment Assistance

- Myth: “I won’t qualify.” Many programs have flexible criteria, with options for varied income levels.

- Myth: “It’s too complicated.” Housing counselors and lenders can guide you through the process.

- Myth: “It costs more in the long run.” While some fees may apply, benefits often outweigh costs.

Closing Costs and Their Impact

Closing costs, including appraisal fees, loan origination, and title insurance, often add thousands to the final purchase. While some down payment assistance programs cover these expenses, others do not. Homebuyers should plan for this additional cost when budgeting to avoid funding shortfalls near closing. Factoring in both down payment and closing costs ensures a smoother path to ownership.

Tools to Calculate Mortgage and Affordability

Mortgage calculators help estimate monthly payments based on loan amount, term, and interest rate. Budgeting tools that factor in income and debt obligations provide a clearer picture of overall affordability. By combining these tools with assistance programs, buyers can make informed financial decisions. Many lenders and housing agencies also offer affordability worksheets and educational resources to reinforce planning.

Frequently Asked Questions

What is down payment assistance?

There are programs that provide grants, loans, or subsidies to cover the upfront costs of buying a home.

Why is down payment assistance becoming more popular?

Rising home prices and higher mortgage rates make saving for a down payment harder, so many buyers turn to these programs.

Who qualifies for down payment assistance?

Requirements often include income limits, a minimum credit score, and first-time buyer status, with specifics varying by program.

How can I find down payment assistance programs?

Start with HUD’s website, your state’s housing finance agency, and local nonprofits or lenders that offer specialized programs.

Can down payment assistance cover closing costs?

Some programs include this benefit, but many do not, so plan a separate budget for these fees.

What types of mortgages can down payment assistance be used with?

Many programs can pair with conventional, FHA, VA, and USDA loans, subject to eligibility and lender overlays.

Final Thoughts

Down payment assistance programs are a powerful resource for first-time and aspiring homeowners. By reducing upfront costs, they make homeownership achievable for a wider range of buyers. With the right program, you can enter the housing market sooner and begin building equity. Be sure to research local and national options, prepare your finances, and consult professionals who specialize in these programs. For official program details, refer to FHA, VA, and USDA resources. In 2025, down payment assistance remains one of the most effective tools for overcoming affordability challenges and securing a stable future.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Down Payment Assistance Programs 2025

https://fangwallet.com/2025/09/02/down-payment-assistance-programs-2025/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.