This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

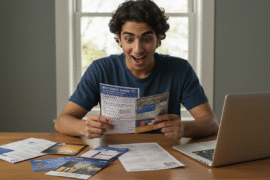

Generating an additional $6,000 in monthly income may seem ambitious, but with strategic planning and steady execution, it’s a target within reach. Rather than chasing gimmicks or high-risk ventures, the focus here is on sustainable, skill-based income streams that integrate smoothly into everyday life. Whether you’re looking to build a financial cushion, increase savings, or reduce dependence on a single source of income, a measured approach can make all the difference.

- Choosing Income Paths That Align With Your Lifestyle

- Passive Income Ideas That Don’t Require a Large Upfront Investment

- Turning Personal Skills and Hobbies into Reliable Income

- Designing a Budget to Support Growth Goals

- Maintaining Momentum and Consistency

- Frequently Asked Questions

- What are some practical ways to earn $6,000 per month in extra income?

- How can I monetize my professional or creative abilities?

- Is it realistic to reach $6,000 a month with passive income?

- Which platforms or tools can support my income goals?

- What’s the first move I should make?

- How do I stay consistent over time?

- Are there common mistakes to avoid?

- Recommended Reads

Choosing Income Paths That Align With Your Lifestyle

Success begins with identifying income opportunities that match your existing skills and availability. Rather than stretching yourself thin, aim for methods that complement your natural strengths or current schedule. Below are examples of time-flexible options that have proven viable for many.

Flexible Income Options

- Freelance Work: Offer services in areas such as writing, design, or development using platforms designed to connect freelancers with clients.

- Tutoring: Share subject knowledge through virtual tutoring platforms, covering academic topics or professional skills.

- Delivery Services: Use food delivery or courier apps that let you work according to your own schedule.

- Affiliate Marketing: Monetize an audience through social channels or content platforms by recommending relevant products or services.

Estimated Time and Earnings Breakdown

| Income Stream | Weekly Time Commitment | Monthly Potential Income |

|---|---|---|

| Freelance Work | 5-10 hours | $500-$2,000 |

| Online Tutoring | 5-15 hours | $300-$1,500 |

| Delivery Services | 10-30 hours | $200-$1,000 |

| Affiliate Marketing | 2-5 hours | $100-$2,000 |

The most sustainable strategies tend to be those that fit your interests. The more naturally the work integrates into your day-to-day life, the more consistent your efforts will be.

Passive Income Ideas That Don’t Require a Large Upfront Investment

Passive income streams are built on the premise of investing time or capital once and receiving recurring income with minimal oversight. While some require an initial learning curve, they often offer scalable potential once established.

Practical Passive Income Models

- Digital Products or Courses: Package your expertise into a course or downloadable product. Once developed, they can be sold repeatedly with limited additional effort.

- Print-on-Demand Goods: Create custom designs for apparel, home items, or stationery and sell through third-party platforms that handle production and shipping.

- Referral or Commission Programs: Earn ongoing income through referrals, especially when integrated with content creation or audience engagement.

Low-Cost Investment Opportunities

For those with modest capital available, there are accessible financial vehicles that can supplement income over time.

| Investment Type | Average Annual Return | Minimum Starting Capital |

|---|---|---|

| Index Funds | 7-10% | $100 |

| Peer-to-Peer Lending | 5-12% | $25 |

| Real Estate Crowdfunding | 6-12% | $500 |

Building multiple income channels reduces risk and creates a more dependable financial foundation.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Turning Personal Skills and Hobbies into Reliable Income

Many overlooked talents hold strong income potential. Whether practical or creative, personal skills can often be monetized with minimal adjustments.

Examples of Monetizable Skills

- Freelance Writing or Editing: Provide editorial services to blogs, media outlets, or businesses.

- Course Creation: Turn knowledge into teaching material hosted on educational platforms.

- Artisan Crafts or Handmade Goods: Sell on craft marketplaces or through local fairs.

- Cooking or Baking: Offer small-scale catering or sell homemade goods to your community.

- Private Coaching or Instruction: Offer lessons in academic subjects, sports, music, or business skills.

Potential Returns by Category

| Skill or Hobby | Approximate Monthly Income |

|---|---|

| Freelance Writing | $50–$200 per article |

| Handmade Crafts | $20–$100 per item |

| Tutoring | $15–$50 per hour |

| Baking/Catering | $100+ per event |

These ventures often grow through referrals and repeat customers, so consistency and quality play a significant role in scaling.

Designing a Budget to Support Growth Goals

A detailed, realistic budget gives structure to your financial aspirations. Instead of just tracking spending, a purpose-driven budget can reveal new opportunities for growth.

Core Budget Categories

- Fixed Living Expenses: Housing, utilities, food, transportation

- Variable Spending: Entertainment, leisure, shopping

- Savings and Investments: Retirement funds, general savings, market investments

- Debt Reduction: Loans, credit cards, other financial obligations

Budget Tracking Example

| Category | Budgeted Amount | Actual Spending | Variance |

|---|---|---|---|

| Fixed Expenses | $2,000 | $1,800 | +$200 |

| Variable Spending | $500 | $600 | –$100 |

| Savings | $1,000 | $1,200 | –$200 |

| Debt Repayment | $300 | $300 | $0 |

Monthly reviews can keep financial plans on course and offer early indicators when adjustments are needed.

Maintaining Momentum and Consistency

Reaching higher income levels is as much about mindset as it is about strategy. Measurable goals and daily routines offer structure to the process.

Techniques That Reinforce Progress

- Automated Transfers: Direct part of your income to separate accounts for savings or reinvestment.

- Performance Tracking: Monitor earnings and habits with a personal dashboard or spreadsheet.

- Community Support: Participate in forums or peer groups to maintain engagement and accountability.

Over time, even modest efforts can accumulate into meaningful gains, especially when carried out with discipline and patience.

Frequently Asked Questions

What are some practical ways to earn $6,000 per month in extra income?

Freelancing, tutoring, content creation, product sales, affiliate programs, and local service offerings are all viable options. Selecting methods that align with your skills will improve results and sustainability.

How can I monetize my professional or creative abilities?

Identify areas of expertise and match them to existing market needs. Whether offering remote services or creating products, the trick is to address a clear demand while maintaining quality and consistency.

Is it realistic to reach $6,000 a month with passive income?

Yes, though it typically requires an initial investment of either time or money. Streams such as course sales, investments, or digital products can eventually produce recurring income, though they build gradually.

Which platforms or tools can support my income goals?

Freelance marketplaces, e-commerce platforms, educational hubs, and social media channels all provide infrastructure to build and market a side venture. Select those most aligned with your niche and audience.

What’s the first move I should make?

Clarify your income goal, audit your available time and skills, and choose a path that feels manageable. Break larger targets into smaller, achievable phases.

How do I stay consistent over time?

Use systems that reward progress, like goal-setting tools, weekly reviews, or personal dashboards. Staying aware of milestones can reinforce motivation during slower periods.

Are there common mistakes to avoid?

Taking on too much too quickly, underpricing work, or neglecting time management can stall momentum. Evaluate results regularly and recalibrate when necessary.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: How to Earn ,000 Monthly with Flexible and Passive Income

https://fangwallet.com/2025/10/14/how-to-earn-6000-monthly-with-flexible-and-passive-income/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.