This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

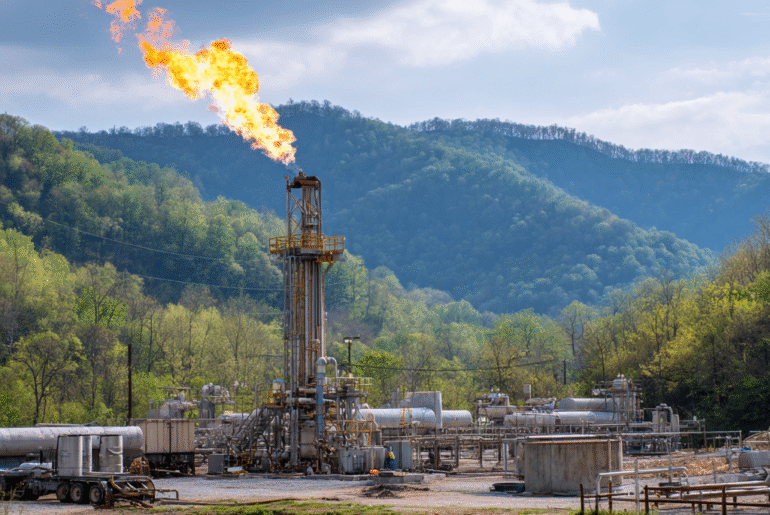

EQT Corporation is at an important point in the energy industry. The company is the biggest producer of natural gas in the Appalachian Basin, and it has to deal with both rising demand and rising expectations for environmental responsibility. EQT signed a long-term deal in 2025 to buy 2 million tonnes per year (Mtpa) of liquefied natural gas (LNG) from Port Arthur Phase 2. This strengthened its plan to enter global LNG markets.

EQT’s 2024 ESG report, “Promises Made, Promises Delivered,” showed that the company had made great progress: since 2018, its Scope 1 greenhouse gas (GHG) emissions had dropped by 67%, its Scope 1 and 2 emissions were net-zero, and its water recycling rate was 96%. These milestones show that EQT is dedicated to operational sustainability and innovation while also keeping its finances in check and being able to grow.

- EQT’s Recent Strategic Highlights

- Operational and Environmental Performance

- Integration and Capital Strategy

- Financial Performance and Demand Trends

- Broader Market Implications

- Conclusion

- Frequently Asked Questions

- What is EQT’s current daily production volume?

- What is the significance of the Equitrans Midstream reintegration?

- What are EQT’s ESG milestones as of 2024?

- How is EQT responding to future demand trends?

- What are EQT’s financial highlights for Q2 2025?

- Why are institutional investors interested in EQT?

- Recommended Reads

EQT’s Recent Strategic Highlights

Strategic Developments

| Focus Area | Description |

|---|---|

| LNG Supply Contract | Signed a 20-year agreement to purchase 2 Mtpa of LNG from Port Arthur Phase 2 |

| ESG Progress | Achieved 67% Scope 1 GHG reduction; net-zero Scope 1 & 2; 96% water recycling rate |

| Midstream Reintegration | Reacquired Equitrans Midstream to form a fully integrated gas company |

| Capital & Operations | Strong Q2 2025 cash flow, net debt reduction, Olympus acquisition, pipeline capacity boosts |

| Investor Confidence | Forecasted 112% earnings increase in 2025; institutional backing and technical leadership |

Operational and Environmental Performance

EQT has made substantial progress in reducing its environmental footprint and improving efficiency:

- GHG Emissions: Reduced Scope 1 emissions by 67% since 2018. Achieved net-zero Scope 1 and 2 emissions.

- Methane Management: Methane intensity reduced to 0.0070%, well below the company’s 2025 goal of 0.02%.

- Water Usage: Water recycling increased from 81% in 2019 to 96% in 2024.

- Nature-Based Projects: Collaborating on a 400,000-acre carbon sequestration initiative in West Virginia.

- Monitoring & Innovation: Expanded aerial methane detection through the Appalachian Methane Initiative using over 15,000 surveys.

- Infrastructure Upgrades: Electrified frac fleets and replaced pneumatic devices, significantly cutting emissions.

Integration and Capital Strategy

By bringing Equitrans Midstream back into the fold, EQT was able to control the entire gas value chain, which led to about $250 million in annual synergies. This vertical integration makes it easier to plan transportation and keep costs down.

The company also made a $3.5 billion deal with a private equity partner to make money off of midstream assets while still being in charge of operations. These steps help a balanced capital strategy without lowering equity or raising leverage too much.

EQT’s model is still based on cost leadership. The company can make free cash flow even when commodity prices are only moderately high because its breakeven cost at Henry Hub is only $2 per MMBtu.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Financial Performance and Demand Trends

EQT’s Q2 2025 results showed strong momentum:

- Operating Cash Flow: $1.24 billion

- Free Cash Flow: $240 million (despite $134 million in litigation charges)

- Net Debt: Reduced to $7.8 billion, down $1.4 billion year-to-date

- Infrastructure Expansion: Added firm demand through Shippingport Power Station (800 MMcfd), Homer City redevelopment (665 MMcfd), and new takeaway capacity via MVP Boost and Southgate

After buying Olympus, the company also raised its production forecast for the whole year. It got $2.81 per Mcfe of gas, which is 20% more than last year.

Market experts think EQT’s profits will go up by 112% in 2025 and another 45% in 2026. This is because of rising LNG demand and the growing energy needs of AI-powered data centers.

Broader Market Implications

EQT’s strategy has significant implications for both U.S. and global energy markets:

- Global LNG Role: Its long-term export contracts contribute to global energy diversification.

- AI-Driven Demand: Rising data center energy needs are boosting demand for consistent, dispatchable natural gas.

- Investor Momentum: EQT’s integrated business model, environmental track record, and capital discipline are drawing strong interest from institutional investors.

Conclusion

EQT’s change into a vertically integrated, low-emissions, and financially flexible energy provider is a big change in the U.S. natural gas industry. It is a leader in sustainable energy production because it did so well in 2025 in terms of environmental, financial, and operational metrics.

EQT is putting profit in line with the needs of the planet by reintegrating midstream assets, signing long-term LNG contracts, cutting emissions, and promoting water recycling. EQT’s playbook shows how natural gas can be responsibly produced while also providing energy security and economic growth as the world needs more clean, reliable energy.

Frequently Asked Questions

What is EQT’s current daily production volume?

About 6 billion cubic feet per day (Bcf/d) from its operations in the Appalachian region.

What is the significance of the Equitrans Midstream reintegration?

It makes a value chain from start to finish, which lowers costs, increases synergies, and makes sure that the capacity for takeout is always there.

What are EQT’s ESG milestones as of 2024?

Net-zero Scope 1 and 2 emissions, a 67% cut in emissions since 2018, 96% water recycling, and taking part in large-scale methane monitoring.

How is EQT responding to future demand trends?

Through LNG export contracts and projects that meet the growing demand for electricity from AI and data centers in the same area.

What are EQT’s financial highlights for Q2 2025?

There was $1.24 billion in operating cash flow, $240 million in free cash flow, and net debt went down by $1.4 billion. The price of gas went up by more than 20% year over year.

Why are institutional investors interested in EQT?

Long-term investors looking for both returns and stability are drawn to the company because of its strong earnings growth outlook, proven ESG delivery, and fully integrated operational structure.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: EQT’s Appalachian Gas Driving Sustainable Growth

https://fangwallet.com/2025/09/09/eqts-appalachian-gas-driving-sustainable-growth/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

EQT Corporation (EQT) is a Strong Growth Stock (NASDAQ): https://www.nasdaq.com/articles/heres-why-eqt-corporation-eqt-strong-growth-stock