A couple years back, the internet went crazy talking about something called crypto and NFTs. All people were talking about was Bitcoin, Ethereum, and these weird cartoon images that people were somehow selling for thousands, sometimes millions, of dollars. If you're like everybody else, it sort of seems cool at first. Like, wait… you can

Introduction: Why This Even Matters As teens, most of us think banking is something we’ll worry about when we get older, maybe when we start college, get our first job, or move out. But here’s the truth: the sooner you learn how to manage money, the stronger your financial future becomes. Opening a bank account

As much as I hate to admit it, saving money can be a very hard topic to crack depending on the individual. Measuring success for budgeting and saving money can look very different because living a frugal lifestyle relies heavily upon the individual to adopt an unrealistic good set of habits from cold turkey sometimes.

A question that I get sometimes is how am I calm, composed, and collected about 80% of the time at 24 years old? The other 20%, let's not talk about it. Just kidding, but what helps me keep my mojo is I try to follow certain principles or motto quotes that closely resonate with me

Believe it or not, having more than one credit card is beneficial to the financial health of your credit history. One of the common myths of owning a credit card is having one too many. But, nowadays, I've noticed that the problem most people have is sticking to only one credit card. The one credit

Budgeting and planning for retirement can be a boring, gruesome task that takes a toll on one's self worth. Before you know it, after doing some calculations, you may find that you are in an even bigger financial hole than you thought you were. One of the biggest mistake a person can make is neglect

A mortgage prepayment penalty can catch homeowners off guard, costing them if they pay off their loan early. Understanding this fee is crucial. To avoid it, look for lenders that offer no-prepayment-penalty options and read the fine print carefully.

As the economy begins to rebound, now is the time to reevaluate your portfolio. Look at companies like XYZ Corp, ABC Industries, and 123 Technologies, which show strong fundamentals and growth potential during this early cycle recovery. Invest wisely!

A two-party check is a financial instrument made out to two people or entities, requiring both signatures to cash or deposit it. This setup enhances security and trust, often used in transactions like real estate deals or shared expenses.

Bitcoin bulls are making a strong comeback as BTC hovers around the $112K mark, reigniting optimism in the crypto community. Analysts are closely watching market trends, speculating on the potential for further gains as interest surges once again.

Learn how much you can contribute to a 529 plan in 2025, including annual limits, 5-year gift tax election, and state caps. Maximize savings with tax benefits and compliance tips.

What Is a Deferred Tax Asset A deferred tax asset is something that lets a company pay less in taxes later on. It happens when there is a gap between what the company reports in its books and what it gets taxed for. A company might have already paid tax, or it could get to

Looking for the perfect place to enjoy your golden years? In this listicle, you'll discover the best retirement communities that blend comfort, activities, and camaraderie. Get ready to find vibrant environments tailored just for you!

Looking to travel from Seattle to Brussels? Scandinavian Airlines has got you covered with roundtrip fares starting at $497 for Basic Economy and $1,159 for Regular Economy. Both prices include all taxes—making your European adventure more accessible!

CIT Bank is making waves with its Platinum Savings account, offering a generous bonus of $225 for new customers and $300 for existing ones. Plus, enjoy a competitive APY of 4.30%, making it a great time to boost your savings. Don't miss out!

Soft2Bet stands out as a leading iGaming turnkey solutions provider, celebrated for its innovative gamification features and player-centric design. The platform supports over 12,500 games, 1 million live events annually, and numerous successful iGaming brands worldwide. Operators benefit from motivational engineering, advanced retention strategies, and flexible solutions for casinos and sports books. Soft2Bet

If you’re considering a flexible side hustle, becoming a DoorDash driver, also known as a Dasher, might be the perfect option for you. With an ever-growing demand for food delivery, especially in urban areas, DoorDash offers an opportunity to earn money on your schedule. However, before diving in, it’s important to understand how much you

In today’s fast-paced financial landscape, managing personal finances effectively can feel like a daunting task. With bills to pay, subscriptions to track, and the need to budget for both short- and long-term goals, staying on top of your finances is essential. That’s where personal finance apps like Rocket Money come in. Formerly known as Truebill,

When Can You Be Charged a Late Fee? A late fee is an extra charge you get when you do not pay by the set date. This helps businesses deal with problems in their cash flow. Late fees often show up when people are late on credit card payments, bills for water or electricity, and

Debt collection follows both federal and state rules, and the Fair Debt Collection Practices Act (FDCPA) is one of these. It keeps people safe from unfair and harsh ways of getting money back. The Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC) are the ones who check that these laws are

Facing financial difficulty can be overwhelming, but bankruptcy isn't your only option. Explore alternatives like debt consolidation, negotiation with creditors, or developing a strict budget. These strategies can help you regain control without damaging your credit.

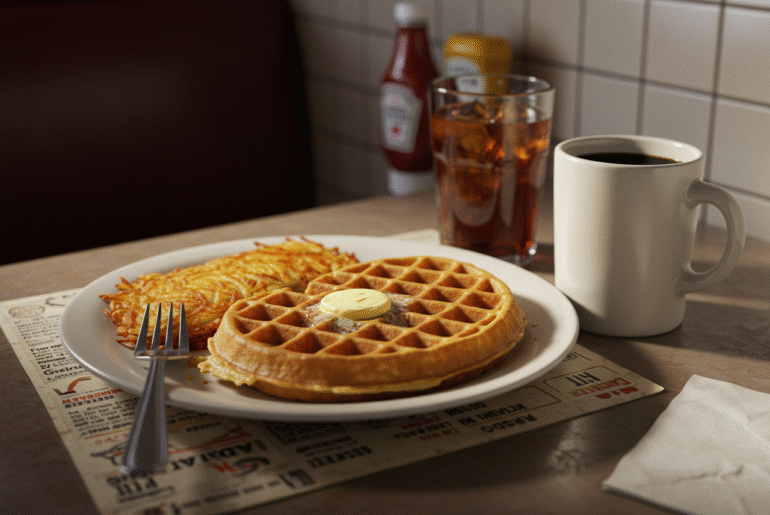

Waffle House menu prices are increasing on popular items like waffles and hash browns. Learn what's changing, why it’s happening, and how to save money on your next visit.

It's not a crime to take a loan, but it is mandatory that you repay your debt. One method of debt repayment is refinancing. Therefore, in this article, we will discuss the steps you should follow when refinancing your loan. But before we go over each step, we will first define refinancing and explain how

Improving the accuracy of payment processing hinges on the effective use of advanced treasury tools. The increasing complexity of financial operations demands reliable solutions that streamline processes and reduce costly errors. Such software plays a crucial role in enhancing the precision of payment processing while offering greater visibility and control over cash flow activities. The

Learn the latest cybersecurity tips, threat types, and security best practices to protect your data in 2025. Includes cloud, endpoint, and DLP solutions.

AI chatbots can be valuable allies in managing personal finances, but the key lies in asking the right questions. From budgeting tips to investment advice, the insight they provide can empower your financial decisions, making money management more accessible.

Credit cards are a simple way to keep track of your purchases, but they can also be hard to understand, especially when you see terms like “closing date” and “due date” that might not make sense at first. You need to know these dates to manage your money well and avoid paying extra fees. The

Learn how to apply for a Cal Grant in 2025. Discover eligibility rules, FAFSA steps, key deadlines, and tips to maximize your California financial aid.

Learn the pros and cons of LLCs, corporations, partnerships, and sole proprietorships to pick the best business structure for your goals and taxes.

Learn how split payments work, can you really use two credit cards for one purchase? Discover store policies, online checkout tips, fees to watch, and smart alternatives like PayPal or BNPL.

Explore the best states to retire on Social Security in 2025. Learn which states offer tax savings, affordable living, healthcare access, and senior-friendly communities.

Canceling your auto insurance can feel daunting, but it’s straightforward. Start by reviewing your policy for cancellation details. Contact your insurer, provide necessary info, and confirm any refunds. Keep documentation for your records—it's that simple!

Introduction Minimalist budgeting helps simplify your financial life while supporting meaningful goals. It gives you the power to focus on needs and values without getting overwhelmed by every spending detail. Instead of tracking dozens of budget categories, you prioritize what truly matters. This strategy encourages intentional decisions and helps reduce financial stress. Whether you want