In a significant move, 55,000 more borrowers are set to receive student loan forgiveness, easing the financial burden for many. This decision reflects ongoing efforts to address the challenges faced by students and graduates in repaying their loans.

Dealing with collection agencies can be daunting, but it's important to stay calm and informed. Start by verifying the debt and your rights. Keep records of all communications, and consider negotiating a payment plan that fits your budget.

Financial planning is a structured approach to managing your finances, aligning your goals with your current resources. It involves assessing your income, expenses, and investments to craft a roadmap for achieving your future financial aspirations. Expect clarity and direction!

When aiming to boost your credit score, focus on high-interest debts first, like credit cards. These can harm your score the most. Next, tackle smaller loans or those with overdue payments to improve your credit utilization and payment history.

After months of navigating turbulent skies, the struggling airline has successfully restructured its debt, setting the stage for a hopeful exit from bankruptcy. This pivotal moment promises a fresh start, aiming to rebuild trust and revitalizing air travel.

Navigating the process of securing a loan to buy a business can feel daunting. Start by assessing your finances, researching lenders, and preparing a solid business plan. A clear strategy and understanding of your goals will make the journey smoother.

Facing medical debt can feel overwhelming, but you're not alone. Start by reviewing your bills for accuracy, then consider negotiating with providers to set up a payment plan. Explore financial assistance programs, as many hospitals offer support for those in need.

Managing finances can be challenging, especially when unexpected expenses arise or you want to consolidate existing debt. Personal loans offer a way to manage such needs, and Upstart provides a unique lending platform designed to make borrowing more accessible. Upstart partners with financial institutions to offer personal loans ranging from $1,000 to $75,000. Unlike traditional

Lendconnects students with local credit unions and community banks for student loans and refinancing. The company offers competitive interest rates and flexible repayment terms. There are no application or origination fees, and you can borrow up to the full cost of attendance. The program offers up to 18 months of payment deferment.

A balanced budget means spending doesn't exceed income, whether for individuals, businesses, or government. It's about living within your means, ensuring financial stability, and avoiding debt. Achieving this balance fosters trust and sustainability in any financial landscape.

Looking for the best personal loans with a cosigner? You’re in the right place! In this listicle, you’ll discover top lending options that offer competitive rates and flexible terms. Let’s help you secure the financial support you need!

Emergency dental loans provide fast cash for unexpected dental costs. These loans offer various repayment plans, allowing you to choose short-term or long-term options. Borrowers with good or bad credit can find loan rates and options that suit their needs. Simple monthly payments make costly procedures, such as braces or implants, more affordable.

Layaway programs allow customers to hold items by paying a small deposit and paying the rest in installments. This is ideal for people with low income or poor credit. These programs were widely popular in difficult times in the past. They are now experiencing a resurgence, especially before the holidays or for larger

Find great personal loan options and Upstart alternatives. These options work for different credit scores and financial needs. Discover why it is important to check out other lenders. This way, you can get better rates and custom loan terms. Learn about the main features of Upstart’s lending system. This includes using AI for

Bar exam loans are private financial products created to support law students during the bar preparation period. These loans can be used to cover living expenses, bar exam fees, and prep course costs. Leading lenders include Sallie Mae, PNC Bank, and Citizens Bank, each offering competitive rates and flexible terms. Eligibility often requires

A secured loan that uses your car as security may have lower interest rates compared to loans without collateral. You can access funds based on the value of your car, even if you still owe money on it. Loans based on car value often provide larger amounts and longer repayment periods. However, they

If a tax lien is weighing down your credit report, removing it is crucial for your financial health. Start by verifying its accuracy, then pay the lien if possible. Once settled, request a withdrawal from your local tax authority to help clear your credit.

Bilt Rewards has exciting news for students! They've expanded into student housing, allowing users to earn points while paying rent. Now, you can also utilize those points to tackle student loans, making financial management easier and more rewarding!

Struggling with bad credit? You're not alone. In 2025, several lenders offer auto loans even for scores below 580. These options provide flexible terms and competitive rates, making it easier for you to get behind the wheel of a reliable vehicle.

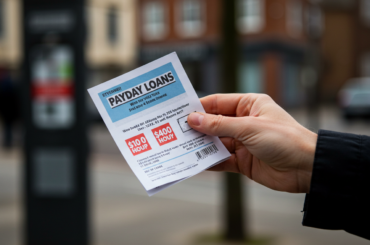

Payday loans can seem like a quick fix for financial woes, but the truth is often different. While they offer immediate cash, exorbitant interest rates can lead to a cycle of debt. It’s vital to weigh the risks and explore safer alternatives.

The debt ceiling is a cap set by Congress on the amount of money the federal government is allowed to borrow. It’s a critical tool for managing national finances, ensuring the U.S. can meet its obligations, but it can also spark intense political debates.

As we face economic uncertainties, it’s crucial to take proactive steps. Start by building an emergency fund, reducing debt, and diversifying your income streams. Small changes now can safeguard your financial future during a recession.

When you’re drowning in debt, it can feel like there’s no way out. I’ve been there myself, staring at a pile of bills, dodging phone calls, and barely making a dent with minimum payments. If you’re in that spot, you might be thinking about debt settlement. For some people, it’s a lifeline; for others, it’s

In the quest for financial wisdom, we often encounter advice that seems helpful but can lead you astray. From “keep all your savings in cash” to “buying a car is a good investment,” these misguided tips can wreak havoc on your financial health.

Borrowing from your 401(k) can seem tempting, especially during financial crunches. On the plus side, you'll pay interest to yourself, not a bank. However, risks include potential penalties and hindering future retirement savings. Weigh your options carefully.

Consumer finance companies offer various financial products and services, like loans and credit cards. These companies play a key economic role by providing credit to people and businesses. Their services can be helpful, but they also have risks, such as high-interest rates and potential debt. Knowing your financial needs and looking into different

Understanding the difference between a tax lien and a tax levy is crucial for homeowners. A tax lien is a claim against your property due to unpaid taxes, while a levy involves seizing assets to satisfy the debt. Acting quickly can help you navigate these challenges effectively.

Paying off a low-interest-rate mortgage early can seem tempting, but it’s often not the best financial move. If you’re looking for security in retirement, reducing debt stress, or freeing up cash for other investments, those are valid reasons to consider.

Unexpected car repairs can strain your finances, especially with bad credit. Auto repair loans offer a way to manage these costs, even with less-than-perfect credit history. It's crucial to understand the types of auto repair loans, interest rates, and repayment terms. This guide will explore various financing options, including secured/unsecured loans and alternatives.

As we look ahead to 2025, understanding the best business acquisition loans is crucial for aspiring entrepreneurs. From SBA loans to traditional bank financing, each option presents unique benefits tailored to different business needs. Exploring these choices can pave your path to success.