As we bid farewell to Forever 21, another trendy chain joins the ranks of retail casualties. The closure reflects the shifting landscape of fashion—consumer habits evolving and fast fashion losing its luster. It's a poignant reminder of the industry's impermanence.

As the crypto landscape evolves, several proposed bills in the U.S. Congress could reshape its future. With a focus on regulation, taxation, and consumer protection, these initiatives aim to create a clearer framework, impacting innovation and investment in the industry.

Looking for the best injury lawyer near you? In this listicle, we'll explore top local attorneys who specialize in personal injury cases. Expect insights on their experience, client reviews, and how they can help maximize your compensation!

Introduction Cyclical unemployment plays a critical role in understanding economic fluctuations. It refers to job losses caused by changes in the economy, such as periods of recession or growth. These fluctuations significantly affect the labor market, creating challenges for policymakers aiming to achieve economic stability and full employment. Understanding the concept of cyclical unemployment allows

Trademark Registration Costs and Process Explained Trademark registration is a critical step for safeguarding your brand and intellectual property in the United States. This guide outlines the costs involved in registering a trademark and offers insights to help you make informed decisions. By understanding the process and associated expenses, you can confidently navigate the trademark

Introduction Understanding the differences between sole and joint custody helps parents plan for a child-centered future after separation or divorce. This guide explains legal terms, court considerations, and how to prepare custody documentation. Child Custody Types in the United States California’s Self‑Help Guide says judges can give custody to both parents together or to just

Find out how employer payroll taxes are not the same as income taxes and why it's important for a business to know the difference. Learn about federal payroll taxes you have to pay, such as Social Security, Medicare, and FUTA, to follow the rules. Take a look at state and local payroll tax rules,

Introduction Credit card debt that stays for years brings up many questions about what the law lets you do and what this means for your money. One important thing to know is the statute of limitations. This is the time there is for people you owe to take action if you have not paid. Knowing

Impact of Quid Pro Quo in Law and Why It Still Matters Today The term “quid pro quo,” Latin for “something for something,” describes an exchange where one action is contingent upon another. While often viewed negatively, especially in politics or workplace settings, its ethical standing depends on context. Understanding this concept across law, ethics,

Introduction Planning for retirement is a crucial financial goal, and 401(k) plans play a significant role in helping individuals achieve it. These employer-sponsored plans offer tax advantages and, in many cases, employer contributions, making them an excellent tool for building a secure future. Each year, the Internal Revenue Service (IRS) determines the maximum amount individuals

Introduction Stimulus checks gave quick money help to many people in the US during the COVID-19 crisis. The federal government sent out these payments in three different rounds with different laws. The money was there to help people and families who lost jobs, had less work, or had higher bills. It is good to know

Introduction Public help programs in the United States are very important for those who have money problems. These programs give people and families a way to get the things they need, like food, healthcare, a place to live, and more. From the Supplemental Nutrition Assistance Program (SNAP) to Medicaid and Temporary Assistance for Families, there

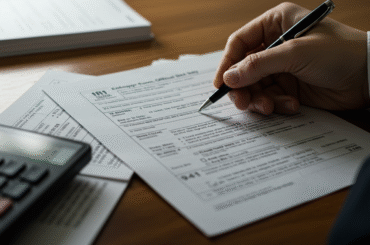

Are you aware of the penalties for filing Form 1065 late? Staying compliant with IRS regulations is crucial for partnerships, but keeping track of deadlines and requirements can be challenging. This guide simplifies the process by providing actionable steps to: Understand Form 1065 and its importance. Prepare necessary documents and use tools for accurate filing. Avoid

Phantom tax refers to taxes owed on income you haven't received in cash yet, creating potential financial strain. Common examples include unrealized investment gains, stock options, depreciation recapture in real estate, and undistributed income from S‑corporations or LLCs. Phantom tax occurs due to discrepancies between taxable income and actual cash flow. Understanding phantom income

Introduction Gift tax laws in the United States set rules for how much money or things you can give to other people before you need to pay tax. These laws stop people from moving their things to others just to avoid estate taxes. In 2025, you can give up to $19,000 to each person every

What You Should Know About Security Deposits A security deposit is money that tenants pay to landlords to protect against unpaid rent or damage beyond normal wear and tear. State laws regulate how much landlords can request and when they must return the deposit after a lease ends. Common reasons landlords keep deposits include property

What Imputed Income Means and How It Affects Your Taxes Imputed income plays a key role in tax compliance and payroll reporting. It refers to the value of non-cash benefits you receive from your employer, such as company vehicles, domestic partner health insurance, or life insurance exceeding a set threshold. Although these benefits are not paid

Understanding Wrongful Death Attorneys Wrongful death claims can be emotionally and legally challenging for families. When a loved one dies due to someone else's negligence, such as in a car accident, medical malpractice, or other avoidable incident, surviving family members may have the right to seek justice and compensation. However, misconceptions about wrongful death attorneys

What is the Child Tax Credit? The Child Tax Credit helps families lower the amount they owe on their taxes for kids who qualify. This gives a lot of money help for families at tax time. To be able to get this credit, you must meet some rules, like age, how the child is related

Legal Considerations for Side Hustles Learn how to make your side hustle follow US laws and avoid extra risks. Understand how job contracts and company rules help manage side work and lower conflicts. See why keeping the right paperwork is important to protect your small business in a legal way. Get to know the tax

In a surprising move, Trump has postponed the TikTok ban once more, igniting debate among users and lawmakers alike. This extension leaves many wondering about the future of the popular app and its role in U.S.-China relations. What’s next?

The Senate has approved a landmark bill establishing rules for cryptocurrency and stablecoins, signaling a significant step towards regulation in the digital finance sector. This new framework aims to enhance consumer protection while fostering innovation.

In the intricate dance of political finance, many Californians may wonder if they're inadvertently footing the bill for Trump's ventures. From campaign expenditures to inflation's impact on taxes, understanding where their money flows is crucial for informed citizenship.

Four states are urging the FDA to remove special restrictions on the abortion pill, mifepristone. Advocates argue that lifting these barriers would enhance access to safe and effective reproductive healthcare, reflecting growing demand for reproductive rights.

More people are using self-directed IRAs for real estate to diversify retirement savings. These IRAs offer tax benefits, rental income, and investment control. Investors can choose between residential and commercial properties. Choosing the right IRA custodian ensures compliance with IRS rules. Beginners can access information on how these IRAs work and what to avoid.

In recent years, the Port of L.A. has felt the jolts of Trump's trade war, swinging from bustling activity to sudden slowdowns. Importers grapple with tariffs while exporters face retaliation, leaving a lasting impact on this vital gateway for commerce.

The House Agriculture Committee has taken a significant step by advancing a crypto market structure bill. This move aims to establish clearer regulations for digital assets, reflecting a growing recognition of the need for oversight in this rapidly evolving market.

Income taxes are a portion of your earnings that the government collects to fund public services like education, infrastructure, and healthcare. Understanding them is essential, as they impact your finances and the services your community relies on daily.

If you've encountered a Bitcoin scam, it's crucial to act swiftly. First, gather all relevant details about the scam. Then, visit Chainabuse to report it directly to the community, and also submit your findings to Scamwatch for wider awareness. Your report can help prevent further scams.

Looking for the best personal injury lawyer near you? In this listicle, you'll discover top-rated attorneys who can help you navigate your case. From their credentials to client reviews, find trusted legal support that fits your needs!