When it comes to family living, some home features seem designed solely for parents navigating chaos. From mudrooms for messy shoes to playrooms for endless toys, these spaces often feel superfluous-until you're managing tiny tornadoes every day!

Discover the best landlord insurance providers for 2025, offering comprehensive coverage for property damage, liability, and rental income loss to protect your investment.

If you find a home you love that's marked as contingent, you can still place an offer. While it won't be prioritized, it keeps you in the running should the first buyer back out. Always consult your agent for the best strategy!

When considering a high-end home, a million dollars might seem like a solid budget. However, in many markets, it's often just a starting point. Luxury properties frequently exceed this figure, especially in sought-after locations. Understanding this can save potential buyers from disappointment.

In today's economy, many middle-class families are just one unexpected event-like a job loss, medical emergency, or major repair-away from foreclosure. Rising living costs and stagnant wages create a precarious balance, making stability feel increasingly fragile.

In California, $2.3 million can open doors to diverse dream homes, from coastal retreats to urban hideaways. These properties often blend luxury, modern amenities, and unique architectural features, offering a glimpse into the state's vibrant real estate landscape.

Refinancing your mortgage can be a smart move to lower monthly payments or tap into your home's equity. Start by assessing your current loan, researching rates, and gathering necessary documents. Don't forget to calculate the costs and potential savings to make an informed decision.

It can be a good idea to use the equity in your home to make improvements. You can get a loan or line of credit with lower interest rates by using the increased value of your home. This can help you pay for upgrades that make your home more comfortable and increase its resale value.

Rent-to-own can be a viable option for those who want to eventually own a home but may not be ready to buy outright. However, it's important to understand the potential risks, such as higher costs and damaged credit if payments are missed. Always weigh your options carefully.

Today, navigating the real estate market seems hard. Buyers may wonder if now is a bad time to invest because interest rates are going up and prices are going up and down. Yet, opportunities abound for those willing to research and strategize. Timing can be very important.

A pending home sale means a seller accepted an offer, but the deal hasn’t closed yet. Even with a pending status, the sale can fall through due to financing issues, inspection problems, or other contingencies. Making an offer on a pending home is possible, but sellers aren't obligated to consider it. Backup offers can

When I decided to transform my basement, I envisioned a cozy retreat. By selecting the right furniture and fixtures, I created functional spaces for relaxation and entertainment. Each piece was carefully chosen to enhance comfort while reflecting my style.

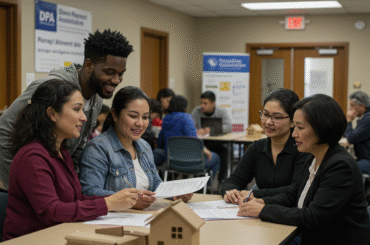

As the dream of homeownership becomes increasingly challenging, down payment assistance is stepping in as a vital resource. This growing tool helps aspiring buyers bridge the financial gap, making it easier to turn their homeownership dreams into reality.

If you're looking to save on taxes when selling your home, the tax-free home sale exclusion allows you to exclude up to $250,000 ($500,000 for married couples) of capital gains every two years. Strategically timing your sales can maximize these savings.

Want to find the best homeowners insurance in Georgia? You'll find the best coverage options, the best rates, and important tips for protecting your home while saving money.

Despite recent Federal Reserve rate cuts, mortgage rates remain stubbornly high. This is largely due to persistent inflation, supply chain issues, and rising housing demand, making home financing more costly for buyers. Understanding these factors is key.

Understanding FHA loan closing costs is crucial for homebuyers. Using a closing costs calculator can help you estimate these expenses accurately. For example, a $200,000 home might see costs ranging from $3,500 to $5,000, depending on various factors. It's an essential step in budgeting for your new home.

Looking for the best home warranty companies in Florida? You're in the right place! In this listicle, you'll discover top-rated providers that protect your home and budget. Expect insights on coverage options, pricing, and customer experiences to help you make an informed choice!

Introduction In a world dominated by large corporations, cottage industries provide an excellent opportunity for individuals to turn their unique skills into profitable businesses. These small enterprises prioritize quality and craftsmanship over mass production. This guide explores key aspects of cottage industries, focusing on legal and financial considerations to ensure success. Cottage Industries Cottage industries

Choosing a mortgage lender is a significant decision. Start by comparing interest rates and fees from multiple lenders. Read reviews to assess customer service, and consider their loan options. It’s essential to find a lender that fits your financial needs and makes you feel secure.

Exploring VA loans? They offer fantastic benefits like no down payment and competitive rates, making homeownership accessible. However, they come with certain limitations and specific eligibility requirements. Weigh the pros and cons to find your right fit.

Mortgage Protection Insurance (MPI) can help ensure your home is paid off if you pass away unexpectedly, protecting your family from the burden of mortgage payments. But like any type of insurance, it’s important to understand your options before you buy. Here are four key tips to help you choose the right MPI policy for

As headwinds in homebuilding persist, three stocks are feeling the strain. Rising interest rates and material costs have created a challenging landscape. Investors should closely monitor these companies as they navigate these turbulent times.

Adjustable Rate Mortgages (ARMs) can be a savvy choice for homeowners looking to save. Initially lower interest rates mean reduced monthly payments, freeing up cash for investments. As your income grows, you can refinance or benefit from rising property values.

Learn how to remove PMI from your mortgage fast. Follow steps like checking your LTV ratio, contacting your lender, and submitting required documents.

Navigating a hot housing market can be daunting. Start by getting pre-approved for a mortgage to strengthen your offer. Stay flexible with your must-haves, and be ready to act quickly—homes can sell in a matter of days. Being prepared is key!

When selling your home, high-quality photos are essential. Start by decluttering and staging your space to highlight its best features. Natural light is your friend-shoot during the day and open curtains. Finally, consider hiring a professional photographer for stunning results!

Rewiring your home can be an important step in keeping it safe and working well, especially in older homes with old wiring. It may seem hard, but knowing the basics can make it easier to deal with and help you make smart choices. We will explain why rewiring is necessary, how much it will cost,

Looking for the best homeowners insurance in New Jersey? You're in the right place! In this listicle, we'll break down top providers, coverages, and tips to help you protect your home while saving money. Dive in to find your ideal policy!

It can be hard to figure out mortgages. This guide makes it easier to understand how to recast a mortgage. It tells homeowners how to lower their monthly bills. They can do this by making a large one-time payment on their balance while keeping the same interest rate. We'll go over the basics and show