Stocks took a hit today while bond yields soared, driven by unexpectedly strong Consumer Price Index (CPI) data. Investors are grappling with the implications for inflation and interest rates, raising concerns about economic stability ahead.

In June, savvy investors are eyeing three tech stocks insiders are snapping up. These speculative plays could signal potential growth, making them worth watching. Keep an eye on these picks to see if insiders' confidence translates into market success.

The Federal Reserve's decision to hold interest rates steady offers a unique opportunity for financial planning. Now is the time to reassess your budget, explore investment options, and consider how to optimize savings. Make informed choices to thrive financially!

Stocks closed sharply lower today as escalating tariffs stoked fears of an economic slowdown. Investors are grappling with uncertainty, weighing the potential impact on growth and corporate earnings amidst a turbulent trade landscape.

The Schwab Dividend ETF has seen a notable rally recently, driven by strong dividend growth and a stable economic outlook. Investors now ponder if this momentum can sustain itself as market conditions evolve. Continued vigilance will be key.

Meme stocks are shares of companies that gain popularity through social media and internet forums, often driven by viral trends rather than traditional financial metrics. Investors flock to these stocks, sometimes leading to wild price swings and speculative trading.

Spotify users on iOS are facing changes to in-app purchases, which could transform how we access premium features. This shift aims to streamline subscriptions but also raises questions about costs and user experience. Stay informed!

In a heartbreaking turn, the Pediatric Brain Cancer Group is set to lose crucial federal funding, jeopardizing vital research and support for children battling this devastating illness. This decision underscores the urgent need for continued investment in pediatric oncology.

John Wiley & Sons has made a lot of money lately, which is a strong reason to raise their ratings. The company is likely to keep doing well in the education sector because it is committed to innovation and has strong earnings growth.

The SPAC king is back with a new blank-check deal, which has Wall Street buzzing. Investors are keeping a close eye on this experienced player as they try to navigate the ever-changing world of mergers and acquisitions once more.

QuantaSing has made a name for itself as a promising player in the ed-tech space, especially with its recent plans for growth. Our analysts say that we should start coverage with a "Buy" rating because its new approach takes advantage of the growing digital learning market.

AI is doing better than traditional traders on Wall Street in today's fast-paced financial world. You can use these same tools by using advanced algorithms and data analysis. This is how you can improve your trading strategy and stay ahead.

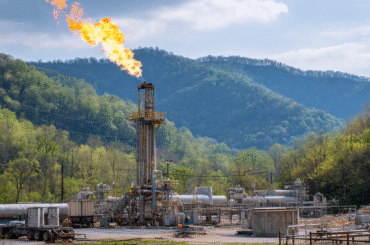

EQT is changing the way energy works in Appalachia by using natural gas as a way to grow in a way that lasts. They're not just powering homes; they're also making the world a cleaner, greener place by combining new ideas with smart ways of doing things.

Smart investors are buying stocks that have many ETH in their treasuries as Ethereum gets close to its all-time high. This strategic move shows that people have faith in the crypto market and that digital assets are becoming more widely accepted.

A lot of older Americans are being scammed out of money through fake phone calls and crypto investments. Because this group doesn't know much about money, scammers take advantage of their trust and confusion to steal millions. It's important to raise awareness and keep weak communities safe.

In the world of investing, not all rallies lead to profit. Typically, rallies conclude in one of three ways: a sharp sell-off, a gradual decline, or a sustainable uptrend. Only the last option truly enriches investors. Choose wisely and stay informed!

Bitcoin is close to its all-time high, and many people are wondering if we've reached the top. Some signs point to a mix of hope and caution. Before making any decisions, it's important to stay up-to-date and think about market trends.

Want to add more variety to your portfolio? We will show you the best small-cap stocks you should think about. Find potential gems that could lead to big growth, from cutting-edge tech companies to new healthcare companies.

Nvidia's status as the first $4 trillion company is a major turning point in the tech world. As its AI dominance grows, people who might want to invest in NVDA stock might wonder if now is the right time to do so. Let's look at the things that are going on.

CoreWeave's upcoming IPO will be a crucial litmus test for investors' appetite for AI-driven companies. As a major player in the cloud computing sector, its success could signal strong confidence in AI's potential and shape future investments.

In this episode of the Wall Street Breakfast Podcast, we talk about how recent changes in tariffs have helped TSMC's stock. TSMC's future looks better now that investors are more confident, which could mean growth ahead.

A Norwegian Cruise Line employee is raising concerns about a sophisticated cruise scam targeting unsuspecting travelers. They warn that fraudsters are posing as official representatives, prompting guests to verify bookings and share sensitive information. Stay vigilant!

In a surprising turn, TikTok has officially denied rumors of its return to India, despite reports of its website going live. The app, banned for security concerns, continues to face regulatory challenges in the country, leaving fans disappointed.

Now is the time to think about making strategic investments as we get closer to "AI Day Zero,". Invest in AI-driven startups, spread your money around, and stay up to date so you can take advantage of what could be the biggest wealth event since the Internet.

Airbnb's most recent earnings report was better than expected, but its growth story has a hint of trouble. As travel patterns change and competition gets tougher, the company's future looks less clear, which makes it necessary to look more closely at its long-term viability.

This week, a lot of businesses are likely to report big profits. Analysts think these four stocks might go up a lot, so keep an eye on them. These earnings could be very interesting for investors in a wide range of industries, from tech to consumer goods.

Disney's recent moves signal the end of Hulu as we know it. With plans to integrate content into Disney+, the standalone Hulu app may fade into obscurity. Subscribers are left wondering what this means for their favorite shows and the future of streaming.

Looking to dive into day trading? In this listicle, you'll discover the best cryptocurrencies that offer volatility, high liquidity, and strong market movements. Get ready to explore your top picks for maximizing your trading strategy!

In this week's Hodler's Digest, the crypto community buzzes over the ETH 'god candle' igniting speculation that $6K could be next. Meanwhile, Coinbase reinforces security measures to protect users. Stay informed as we navigate these shifting tides!

GARP, or Growth at a Reasonable Price, has emerged as a standout in the ETF landscape. With a solid track record, it blends growth potential with value, making it an appealing option for investors seeking balanced exposure in a dynamic market.