As an investor, tracking gold's fluctuating prices is crucial for making informed decisions. Analyzing trends and setting targets helps uncover opportunities in this precious metal, allowing for strategic buying and selling in response to market dynamics.

Managing your tax withholding in retirement is crucial for financial stability. Start by reviewing your income sources-such as Social Security and pensions. Adjust your withholding to avoid surprises, ensuring you meet your tax obligations without overpaying.

Planning for long-term care costs is essential for securing your financial future. Start by assessing your potential needs, exploring insurance options, saving strategically, discussing plans with family, and staying informed about state aid programs.

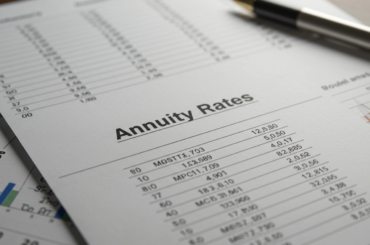

When it comes to securing your financial future, finding the best annuity rates is important. In this listicle, you'll discover top-rated options tailored to fit your needs, expert insights on each choice, and tips for maximizing your investment. Let's get started!

For frugal retirees, Arizona offers many affordable gems, but some cities are surprisingly pricey. Avoid these 13 ultra-expensive locales to stretch your savings and enjoy a comfortable retirement without breaking the bank. Your wallet will thank you!

Many people worry about their Social Security income being garnished by the IRS or creditors. While certain government debts can lead to garnishment, Social Security benefits are generally protected. Knowing these rules can provide peace of mind.

Like many investors, your retirement account might be quietly adding cryptocurrency to the mix. It's important to know how these investments could affect your future savings now that platforms are accepting digital assets.

Three high-yield stocks have raised their dividends by a lot, which is a surprising move that shows they are financially stable and care about their shareholders. These changes not only bring in new investors, but they also reward those who have been with the company for a long time.

When considering withdrawals from a Traditional IRA, it's essential to know the rules: typically, you can start without penalty at age 59½. Withdrawals before this age may incur a 10% penalty, plus taxes. Planning ahead can save you money in the long run.

To retire early, you need to plan well. This is important to fill the time gap between when you want to retire and when you can use your retirement money and Social Security. A good way to fill this gap is by using different ways to earn money and tools to pay for your

Navigating retirement fund withdrawals after a disaster can be daunting. However, under the IRS guidelines, you may access these funds penalty-free. steps include documenting your situation and ensuring your withdrawal aligns with the defined criteria.

Annuity rates matter when you plan your retirement money. Understanding different kinds of annuity rates can help you make wise money choices. There are set and flexible annuity rates, each with their own benefits and risks. Factors like the health of the insurance company and current interest rates can affect annuity rates. Speaking with

Determining how much retirement income you need can feel overwhelming, but it's important for a secure future. Consider your lifestyle, expected expenses, and any additional income sources. A common rule of thumb is aiming for 70-80% of your pre-retirement income.

Service Corporation International (SCI) stands out as a solid investment for long-term stability. With its strong market presence in the funeral service industry, this stock is not just for the present but can be part of a lasting legacy.

With a Self-Directed IRA, you can choose your own retirement investments, which can include a wider range of assets, such as real estate and commodities. You can make your portfolio fit your specific financial goals by making your own choices.

Navigating market volatility in defined benefit (DB) plans can feel daunting. Plans with a proactive de-risking strategy often experience less turbulence compared to those without, safeguarding assets and ensuring member benefits amid economic uncertainty.

As a parent, it's natural to want to support your adult child financially. However, this generosity could impact your benefits, especially if you're relying on programs like Medicaid or Social Security. Understanding the implications is crucial for your financial security.

Retirement can be a double-edged sword. While the freedom is enticing, many struggle with loss of identity, social connections, and structure. Coping strategies like volunteering, pursuing hobbies, and fostering connections can make this transition smoother.

Learn about the proposed 2025 Roth changes for high earners, including contribution limits, conversion rules, and strategies to optimize retirement savings.

Planning for retirement can feel daunting, but knowing how much to save each month can ease your worries. To retire comfortably by 65, aim to save at least 15% of your income. Adjust this based on your current savings and lifestyle goals for a secure future.

As we dream of retirement bliss, it's easy to overlook certain perks that can lead to long-term debt. From lavish travel plans to expensive hobbies, these seemingly harmless choices can strain your finances. Being aware is the first step to financial freedom.

Introduction Retirement planning focuses on maintaining a steady income to support your desired lifestyle. Income annuities are a strong option for guaranteed retirement income. Consulting a financial professional can help integrate income annuities into your plan, providing stability and peace of mind as you transition into retirement. What are Income Annuities An income annuity is

Retirement can be a golden opportunity to nurture your brain health. Engage in activities like reading, puzzles, or learning a new skill. Stay socially active to stimulate your mind, and don't forget regular exercise-it's vital for cognitive vitality!

It can be hard for retirees to keep track of their health care costs. Here are six useful tips to help you deal with the stress: look into your Medicare options carefully, think about getting extra insurance, look for ways to save money on prescriptions, stay active, use telehealth, and think about how you live your life.

Discover 7 practical tips for effective retirement planning. Learn how to set goals, create a budget, invest wisely, plan Social Security, and secure your financial future.

In my second year exploring H&R Block's Split-Year Backdoor Roth IRA, I found it remarkably straightforward. The step-by-step guidance made the conversion process seamless, maximizing my tax efficiency while planning for retirement. Highly recommend!

Learn how an Individual Retirement Account (IRA) can help build long-term wealth and secure a stable retirement. Discover IRA types, benefits, tax advantages, and strategies to maximize your retirement savings

A staggering £67 billion of UK investors' money is trapped in underperforming funds, highlighting a growing concern. It's crucial for investors to revisit their portfolios and ensure their hard-earned savings work as hard as they do.

Many people are surprised to learn that retirement can sometimes yield a higher income than their working years. With careful planning, tax benefits, and investment growth, your post-career financial landscape may offer unexpected opportunities for wealth.

Are you a senior over 70 looking for the best car insurance? In this listicle, we'll explore the top providers tailored to your needs, with options that offer affordability and comprehensive coverage. Discover policies suited for seasoned drivers like you!