Work should feel like a place where you’re safe and supported, not where your life can change in a single moment. But sometimes, despite being careful, something unexpected happens. An accident. A sharp pain. A fall. And suddenly, everything gets harder: going to work, paying bills, even just getting through the day. In times like

Gambling remains a popular pastime worldwide, with recent studies indicating that approximately 1.6 billion people engage in some form of betting or gaming activity annually. While this form of entertainment can provide enjoyment and social connection, it also carries risks of problem gambling and financial hardship. As online gambling continues to expand, so does the

When your emergency fund falls short, it can feel overwhelming. Unexpected medical bills, urgent car repairs, or job loss can stretch finances thin. Explore alternative options—like community resources, flexible savings plans, or temporary side gigs—to navigate these crises effectively.

Improving your credit score is a powerful way to unlock financial opportunities. Start with short-term strategies like paying bills on time and reducing credit card balances. For long-term success, consider diversifying credit types and maintaining a healthy credit history.

Retail therapy often feels like a quick fix for stress, but it can lead to empty wallets. Understanding the emotional triggers behind our shopping habits is important. By recognizing these patterns, we can make mindful choices that benefit both our wellbeing and finances.

Discovering your phone number on the dark web can be unnerving. It often means your personal information is compromised, potentially leading to spam calls, identity theft, or phishing attempts. Stay vigilant and consider enhancing your privacy measures.

If you're searching for a Mint alternative, EveryDollar could be your answer. Offering a user-friendly interface, it simplifies budgeting with a zero-based approach. Say goodbye to overwhelming features and hello to a straightforward way to take control of your finances.

Buying a house in 2025 requires careful planning and research. Start by assessing your finances and securing a mortgage pre-approval. Stay informed about market trends, explore neighborhoods, and consider leveraging new digital tools for a smoother process.

Most people worry about putting money into gambling apps. Makes sense – it's your hard-earned cash on some app you downloaded five minutes ago. But here's what the fearmongers won't tell you – modern iGaming apps protect your money way better than most banks did 10 years ago. Let me show you exactly how. How

In an age of constant distractions, obligations and routines, making room for innovation may feel like a luxury rather than a necessity. But the truth is, creativity isn't just for artists or designers. It's a mindset that fuels problem-solving, inspires progress and enhances our overall quality of life. Developing creative confidence and allowing space for

After years of living paycheck to paycheck, I discovered a path to financial freedom on $500K a year. By prioritizing savings, investing wisely, and redefining success, I escaped the rat race faster than I ever thought possible. Here’s how I did it.

This week, mortgage rates have experienced a notable uptick, surprising many homebuyers. Coupled with unexpected inflation numbers, the economic landscape remains uncertain, prompting questions on how these factors will influence housing affordability.

As you approach retirement, reflecting on your future is crucial. By asking yourself these 15 essential questions, you can clarify your goals, ensure financial readiness, and craft a fulfilling post-work life—avoiding regrets down the road.

When deciding how much to spend on a wedding gift, consider your relationship with the couple. Close friends or family might warrant a higher budget, typically between $100 to $150, while acquaintances may suffice with $50 to $75. Ultimately, choose what feels right for you.

If you're facing a financial crunch, start by assessing your expenses and prioritizing essentials. Cut non-essentials and consider temporary work for extra income. Reach out to local resources for assistance and stay connected with friends for support.

Index funds are investment vehicles designed to track the performance of a specific market index, like the S&P 500. They're known for their low costs and diversification, making them a popular choice for both novice and seasoned investors.

Navigating marriage and debt can be challenging, but it's manageable with the right approach. Start by communicating openly about finances, setting joint financial goals, creating a shared budget, and seeking professional advice when needed. Together, you can thrive!

Motorcycle insurance in 2025 has required and optional coverages. These are made to fit different rider needs. The cost of premiums relies on factors like the bike model, your location, riding experience, and habits. All-inclusive plans protect you from theft, accidents, and medical costs. Riders can lower their premiums by taking safety classes, putting

Definition: Business partnerships happen when people work together for a shared purpose. They use resources, know-how, and connections that they all share. Types: Strategic partnerships can include deals on marketing, teaming up in supply chains, and working together on projects. They serve different business needs. Benefits: They can help you enter new markets, increase

Complete trading tools: Benzinga Pro gives real-time market data and news for stock market fans. Useful insights: Get timely trade ideas and alerts made for traders of all skill levels. AI-driven platform: Use AI to understand market changes and help you make decisions. Worldwide coverage: Find tools for different markets, like forex and options.

In 2025, navigating personal finance can feel overwhelming, but the right blogs can empower your journey. From budgeting tips to investment strategies, these nine inspiring blogs will provide the tools and insights you need to achieve financial freedom.

American Express (Amex) is both a credit card issuer and payment network, while Mastercard is solely a payment processor that partners with banks. Amex cards often include luxury travel perks like airport lounge access and concierge service. Mastercard is accepted in more places globally, over 210 countries, compared to Amex’s 160+. Both offer solid

Gap insurance covers the difference between your car’s actual cash value and the amount you still owe on your loan or lease if the car is stolen or totaled. Cancel gap insurance when your car's value is greater than the loan balance or once the loan is fully paid off. Review your policy,

Summary Explore various uses of black and white money images in creative and digital work. Learn about the historical development and changing styles of black and white money imagery. Discover resources and tools for creating your own black and white money designs. Understand design elements such as backgrounds and symbols that enhance the impact

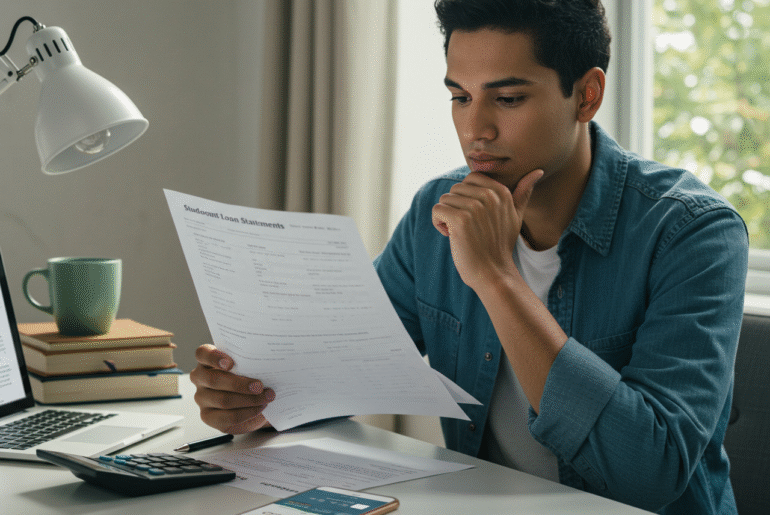

Deciding whether to consolidate your student loans is a personal choice that hinges on your financial situation. Consider factors like interest rates, repayment terms, and your current budget. Consolidation can simplify payments but might cost more long-term. Assess carefully.

As investors weigh the future of Lululemon, Wall Street's sentiment is mixed. While some analysts highlight strong sales and brand loyalty, others caution against market saturation. Ultimately, navigating Lululemon's stock requires careful consideration of both optimism and caution.

Safe has just unveiled a groundbreaking unit dedicated to crafting enterprise-grade crypto wallets. This move aims to enhance security and accessibility for businesses navigating the evolving crypto landscape, ensuring safer transactions and user experiences.