Professional car detailing services do more than just clean your car. They work on restoring the vehicle deeply. This makes cars look better and helps them last longer. The cost of detailing can change. It depends on things like vehicle size, the type of service, and the car’s condition. Basic car detailing packages

Learn how to plan a budget-friendly Hawaiian vacation without giving up comfort or fun. Find out the best time of year to visit Hawaii for cheaper flights, places to stay, and activities. Check out tips to save money on daily costs, like food, lodging, and travel. Discover low-cost and free activities such as

A first-to-die life insurance is a joint life insurance policy. It offers a single death benefit to the surviving spouse or partner when the first person dies. This policy gives financial protection. It can help cover costs like mortgage payments and final expenses. It is different from separate policies. It covers two people

Artificial intelligence stocks are growing quickly. This creates exciting investment opportunities in the stock market. Wall Street experts think some low-cost AI stocks are hidden gems. They have good growth potential and a solid place in the market. Companies like Alphabet, WiSA Technologies, and SoundHound AI are using AI to improve their business

Holding costs include all the money spent on keeping unsold inventory. This covers storage, insurance, labor, depreciation, and lost opportunities. These costs usually make up 20-30% of the total inventory value, so they are important in inventory management and supply chain work. Knowing about holding costs helps businesses keep the right inventory levels,

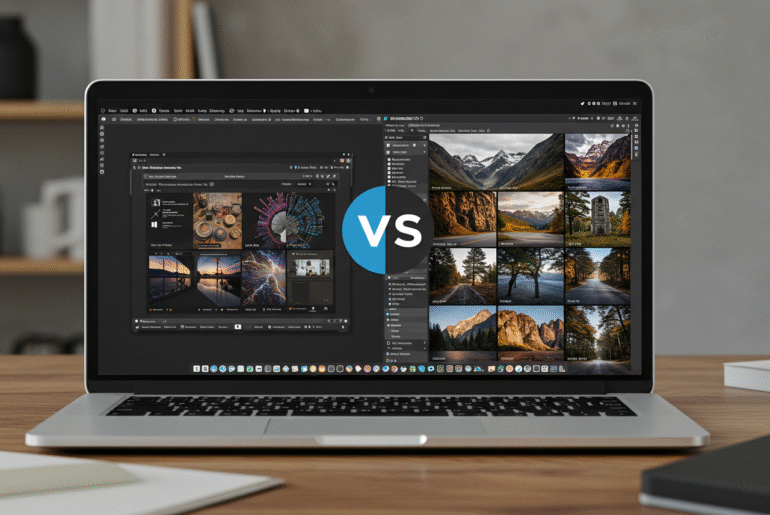

Envato Elements offers unlimited downloads for a flat monthly fee, making it a cost-effective choice for freelancers and small businesses. Adobe Stock provides higher-quality assets and integrates seamlessly with Adobe Creative Cloud apps like Photoshop and Premiere Pro. Both platforms feature royalty-free licenses, though Adobe Stock offers more comprehensive protection for large-scale commercial

Envato Elements and Shutterstock are two leading stock platforms that provide a wide range of digital content. Envato’s subscription is often more cost-effective for creators on a budget. Shutterstock has a massive collection, offering over 468 million images, 36.6 million videos, and a wide range of quality stock content. Envato stands out for

You don’t need a closet overhaul to look more put-together. In fact, most guys overthink their style way too much. The truth is, it’s the small shifts that make the biggest impact. Swapping just a few everyday basics can instantly level up your look without costing you your comfort—or your time. If you like keeping

Understanding Gold Investments in Retirement Accounts Gold provides an opportunity to safeguard retirement savings by offering stability and diversification. Adding gold to an IRA or 401(k) requires adhering to specific rules and understanding its benefits. Why Consider Gold in an IRA or 401k? Investors consider an IRA in gold and silver for their retirement accounts

Eucalyptus oil has gained attention for its role in supporting canine wellness. Known for its natural properties, this essential oil is rich in antioxidants that can benefit a dog's immune health. These antioxidants, primarily cineole and flavonoids, combat oxidative damage at the cellular level. What Are Antioxidants in Eucalyptus Oil? These are compounds that help

Cryptocurrencies are growing in popularity and acceptance among everyday users and financial institutions. It's become common for a person to have crypto as a part of their portfolio and to buy, sell, and trade with crypto on a day-to-day basis. In return, this has led to more regulation and greater vigilance on the part of

Millennials are often characterized as the first generation to have grown up with the internet. Born between 1981 and 1996, this group of individuals is accustomed to technology, which significantly reflects how they manage their finances. In this post, we'll explore how millennials handle their money and how it may differ from other generational groups.

Every change and every update you make in your business, you must do it with your customers in mind. Why? Because happy customers will choose your business over and over again. Now, different businesses have different ways of engaging their customers. But the fact that the rise of digital engagement in 2024 had the most

A strong online presence is essential for small businesses. Being visible where your customers search, shop, and engage directly impacts lead generation, customer trust, and ultimately your profits. Think of it this way: if potential customers can’t find you online, they’ll likely turn to competitors instead. That missed visibility means lost revenue opportunities. This article

When you work in a high-stress, fast-paced job, survival mode becomes a way of life. Dispatchers racing against the clock. First responders walking into the unknown. Logistics managers solving problems before most people finish their morning coffee. In these careers, the pressure never really stops, and neither do the bills, emergencies, or unexpected expenses. The

Introduction: The way people earn money is changing faster than ever. In the past, the concept of earning was tied strictly to labor or trading time for money. But with the rise of blockchain technology, decentralized platforms, digital transformation trends and token-based incentives, passive earning has become a powerful option for both everyday users and

The average person spends about $1,200 annually on insurance, covering health, auto, home, and life. While costs can vary based on location and lifestyle, understanding these averages can help you budget and make informed decisions.

As pharmaceutical tariffs rise, the potential for drug shortages looms larger. Increased costs could limit access to essential medications, leaving patients and families facing tough choices in a system already strained by pricing pressures.

Amazon is currently offering a stunning Michael Kors tote bag originally priced at $228 for just $137. Shoppers rave about its spacious size and elegant design, making it a must-have accessory. Don't miss out on this stylish deal!

In my exploration of MakeMoneyOnline, I discovered a platform promising extra income through various tasks. While some users report success, others remain skeptical. It's essential to weigh the potential benefits against the effort required to truly assess its value.

In today’s housing market, sellers are grappling with new realities. As buyer selectivity intensifies, many are slashing prices to attract interest. This shift reflects a broader trend, signaling that patience and strategy are key for both parties.

Meta (META) shares are soaring today, driven by strong quarterly earnings that surpassed expectations. Investors are optimistic about the company's advancements in AI and its commitment to the metaverse, signaling robust growth potential ahead.

Stocks took a hit today as disappointing earnings reports ignited concerns over U.S. stagflation. Investors are increasingly wary of rising inflation coupled with stagnant growth, leading to heightened volatility in the market. It’s a tense time for traders.

When it comes to dog ownership, affordability often shapes our choices. While many breeds can be pricey, some are more accessible. In this article, we’ll explore 10 dog breeds that tend to be popular among those on a budget, highlighting their unique qualities.

When it comes to finding hidden treasures in your pocket change, American dimes can be surprisingly valuable. From rare mint errors to unique design variations, these 10 dimes stand out not just in history but also in market value. Keep an eye out!

Pensions are retirement plans that your employer helps fund. They give you monthly payments for life or a lump sum when you retire. Annuities are insurance products that promise to give you a steady income during retirement. You can pay for them in a lump sum or with regular payments. The main differences

Teenagers can find many ways to earn extra cash at home using their skills, talents, and interests. Many ideas fit their flexible schedules. Jobs like social media management, online stores, and freelance work are a great way for teens to learn valuable skills. They can also make some extra money. Teens can use