This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

Updated by Albert Fang

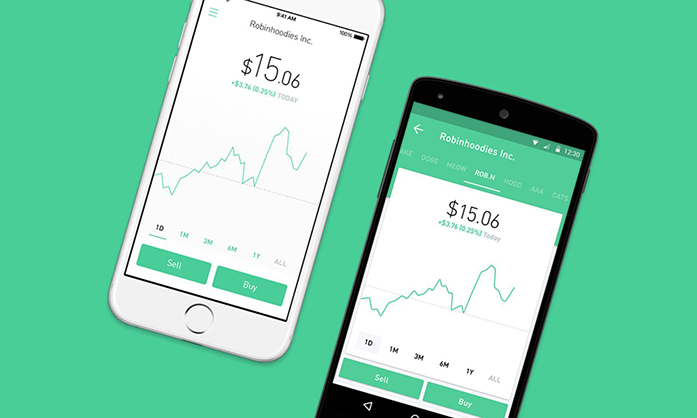

What is Robinhood?

If you own a smartphone and have had even a passing interest in trading stocks, you’ve probably heard about Robinhood. This no-fee stock-trading app has taken the younger elements of the personal finance world by storm and has recently even gotten into the cryptocurrency game. While most brokerages charge $5-10 per trade (hardly worth it if your investment fund is just a few hundred dollars), this one is completely free. That’s great for clients, but it’s unheard-of in the brokerage world, mostly because it seems unrealistic. Companies that don’t make money stop existing—so how is Robinhood doing it?

How Robinhood makes money

Most importantly, it is 100% online—there are no brick and mortar locations inside big glass buildings in any downtown financial districts, and they have a small staff. They also don’t run expensive ad campaigns, relying mostly on their free stock offers (you get one at sign-up and more for referring friends) to spread the word. All this makes their overhead a lot smaller than traditional brokerage firms.

But they aren’t 100% free—you can choose to upgrade to Gold status for $6.00 per month, which allows you to spend up to double your money on margin trading and access after-hours trading. So if you want the option to trade with more money than you have, or if you’re a night owl, that may look good.

Gold is their main revenue stream, but it’s not the only one. The company can also make money by collecting interest on the cash and securities you have sitting in their accounts. You gave up the option of earning bank interest on your money in favor of getting stock profits from it, but your money didn’t leave the banking system—it’s just helping Robinhood keep your account open now.

The last thing that lets them keep going like this is having a lot of startup money. Venture capital firms really like the idea and have been investing steadily since the company began. There have been rumors that they are selling trading data to other brokerages to allow those brokerages to trade against their users, but their leadership has pointed out that this is highly illegal and denies that they are doing it.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Recent developments

In January 2018, Robinhood announced that it would be adding cryptocurrency trading options starting in February. Though it will initially only be available in a few states, they plan to expand.

The company also announced that it would be expanding beyond the app, and plans to be available as a web trading platform in early 2018.

Fun Fact

Baiju Bhatt and Vladimir Tenev’s first startup together was writing algorithmic trading software—essentially helping big, corporate traders to trade more efficiently. They quit and started Robinhood because they wanted to make a financial product for the average investor instead.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: How Does Robinhood Make Money Trading?

https://fangwallet.com/2018/02/17/how-does-robinhood-make-money-trading/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo