This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

Updated by Albert Fang

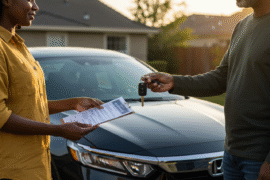

After a car accident, its normal to feel rattled or anxious about what comes next. After all, your car is a vital part of everyday life and you’re likely to want it replaced as soon as possible so you can get back to normal. Understanding a little more about the process of auto insurance claims is a good way to know what to expect over the coming days and weeks.

The Auto Insurance Claim Process

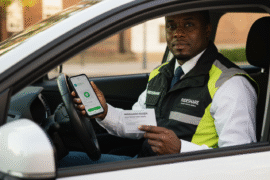

After you report an accident to the auto insurance company, they will assign an insurance adjuster to your case. This person will oversee investigating the accident and resulting damage to your vehicle. If your vehicle is a total loss, they will decide how much compensation to award you. If you have witnesses to the accident or police statements, the adjuster will review these documents to try and help draw a conclusion. He or she may call you to take an official statement for the auto insurance company’s records as the investigation progresses.

Car Appraised By a Qualified Mechanic

Often, much of the damage done in an accident is internal damage that is hard for the untrained eye to spot. A qualified mechanic can tell if there is serious damage to the car’s structure or vital parts that no longer work properly. Depending on your insurer and their claims process, you may have to take the vehicle in to an approved auto repair shop so they can give an estimate of the total damage and the cost of repairs. Other insurers will ask you to get multiple estimates from local shops and pay you an amount to cover repairs based on these estimates.

Compensation and Deductibles

Once the repair is approved by the auto insurance company, you can then take the vehicle in for the repair work to be completed. If your vehicle is going to be in the shop for an extended time while parts are ordered and repairs are completed, your policy may cover the cost of a rental vehicle during this time. Whether or not you will have to pay anything at this time depends on the deductible amount on your policy. For example, if your deductible is $1000, but repairs come to a total of $2000, you will have to pay the deductible amount. The insurer will pay the remaining $1000.

While you may be nervous about navigating the process, as long as you cooperate with the insurer, it can be handled quickly.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: How the Auto Insurance Claims Process Works

https://fangwallet.com/2018/04/17/how-the-auto-insurance-claims-process-works/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo