This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

Updated by Albert Fang

Our favorite time of the year is looming – not – tax season, and you may be wondering what is the best way to log all your cryptocurrency transactions. Because let’s be frank, you most likely have more than 10+ crypto transaction over the span of the 2021 tax year.

Thankfully the team behind Crypto.com has launched a product offering for streamlining the filing of Crypto-related investments to report your taxes more efficiently and at an convenience.

You may have heard some of the many product offerings from Crypto.com such as the Crypto.com VISA Debit Card (which can earn you up to 8% cashback on every purchase with no limit) or may have come across top influencers like Matt Damon, Staples Center, UFC, and now potentially the upcoming Super Bowl promote Crypto.com. But, have you heard of Crypto.com Tax?

Apply our exclusive referral code fangwallet and receive a free $25 sign-up bonus in CRO tokens upon signing-up for Crypto.com Tax.

- Is Crypto.com trustworthy, secure, and ultimately trustworthy to file my Crypto taxes with them?

- Is Crypto.com Tax Software free and which countries does it support??

- Does Crypto.com Tax Software support popular TurboTax and TaxAct Tax Softwares?

-

How to Use Crypto.com Tax Software Step-by-step

- Step 1: Sign-up for a Crypto.com account and apply promo code fangwallet for a $25 sign-up bonus.

- Step 2: Tap on “Get Started” button on the homepage

- Step 3: After signing-in, you will be taken to the Crypto.com Tax Platform seen below

- Step 4: Tap on Add New Wallet/Exchange and start adding in your wallets from other exchanges/platforms

- Step 5: Finalize and review transactions for errors & miscalculations

- Step 6: Generate your final 2021-2022 Tax Report automatically and file your taxes

- How much tax will you pay in the United States?

- This is divided into two parts:

- 2021 Crypto Tax Calculator Cheatsheet – Tax Bracket

- Recommended Reads

Is Crypto.com trustworthy, secure, and ultimately trustworthy to file my Crypto taxes with them?

The simple answer is yes. Crypto.com regularly gets audited by trustworthy account firms, such as, Deloitte and Kudelski Security, and has earned the coveted SOC 2 Certificate.

Crypto.com has never been hacked and boasts industry-leading security infrastructure. Crypto.com has well over 2,000+ employees according to LinkedIn in 12/25/2021 so rest assured, the company is doing financially well and is not going bankrupt anytime soon.

Is Crypto.com Tax Software free and which countries does it support??

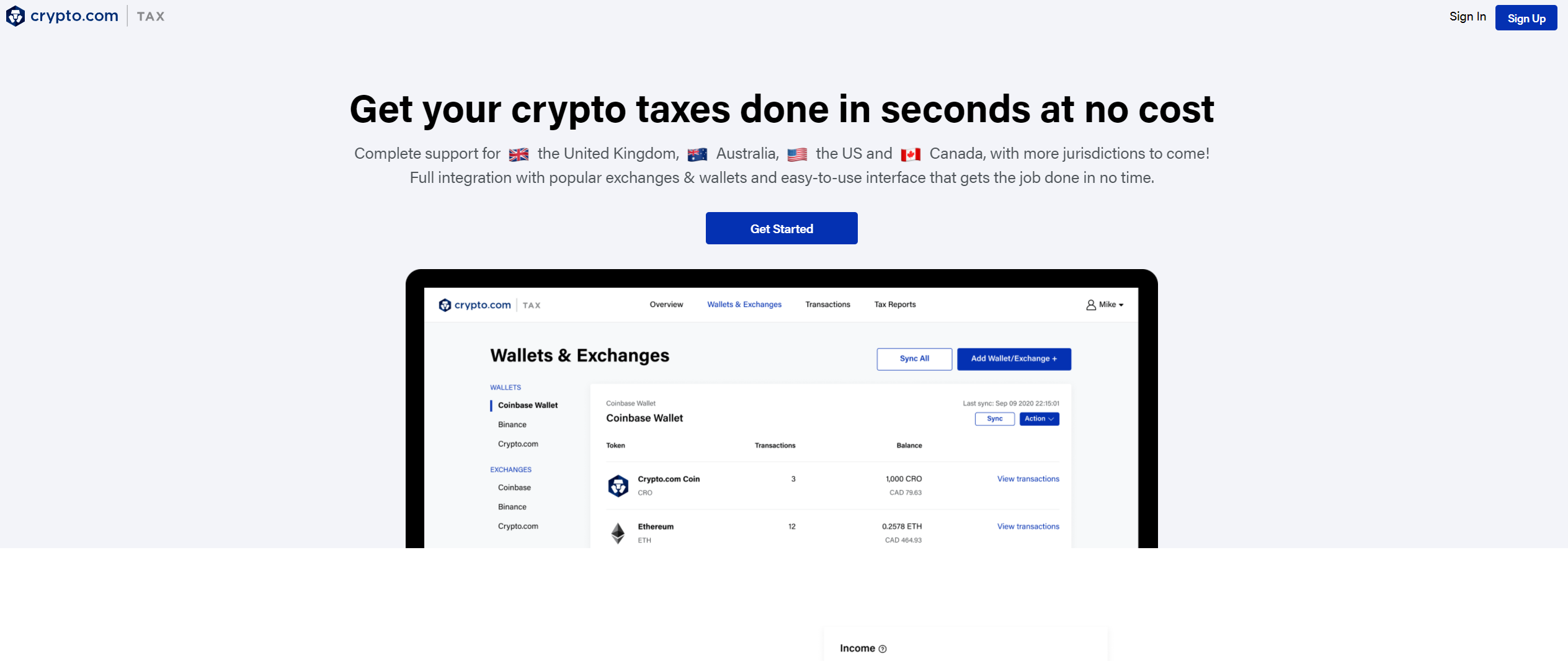

Crypto.com Tax Software is completely free and offers full crypto tax support for United Kingdom, Australia, United States, and Canada currently as of 12/25/2021.

Does Crypto.com Tax Software support popular TurboTax and TaxAct Tax Softwares?

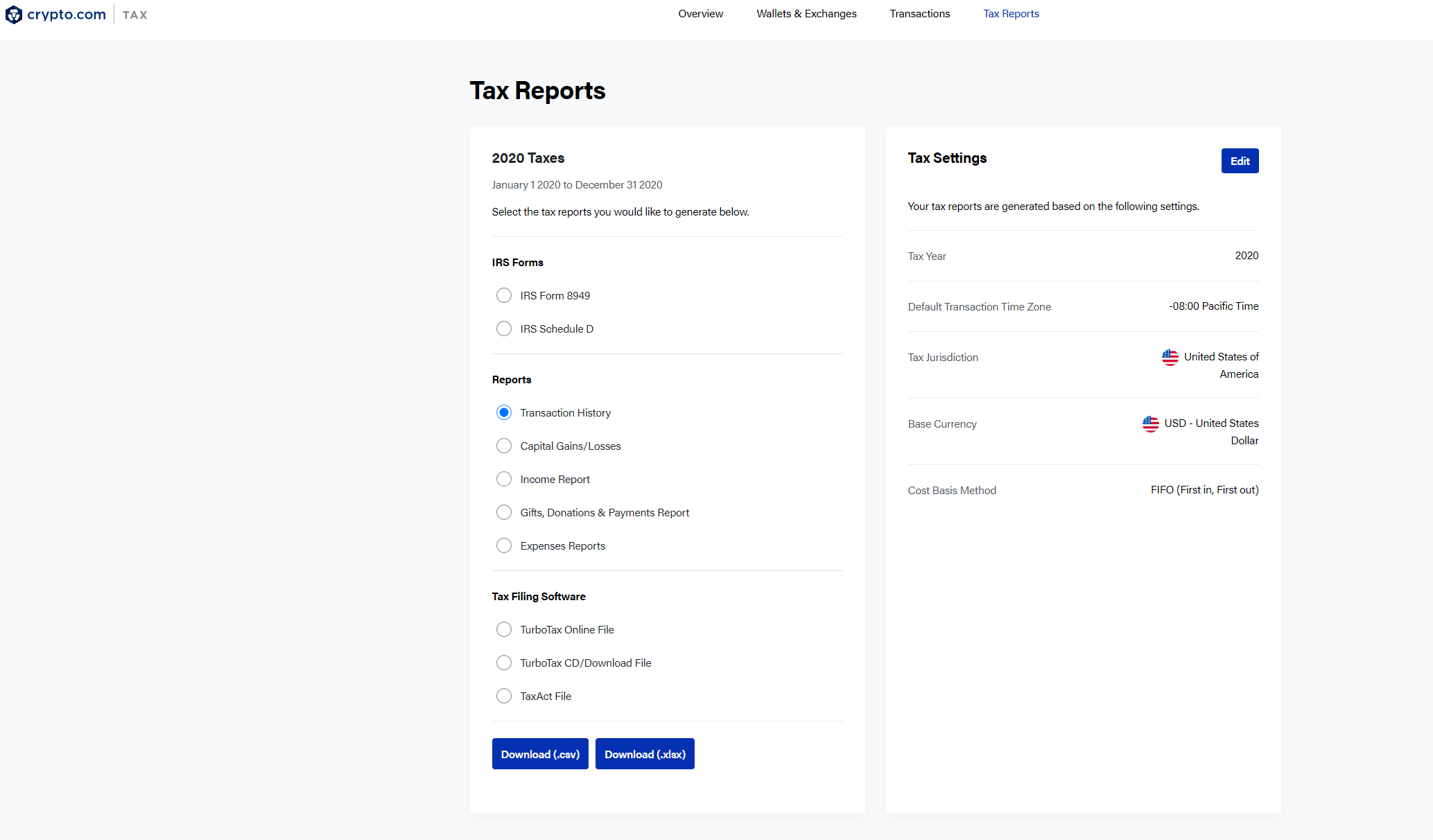

Yes! Crypto.com Tax streamlines the tax filing process and makes it easy to integrate your crypto tax filings with popular tax filing software like TurboTax and TaxAct for the 2021-2022 tax year completely free.

How to Use Crypto.com Tax Software Step-by-step

Step 1: Sign-up for a Crypto.com account and apply promo code fangwallet for a $25 sign-up bonus.

Apply our exclusive referral code: fangwallet

Visit the Crypto.com tax homepage and tap on the “get started” button on the center of the tax center homepage.

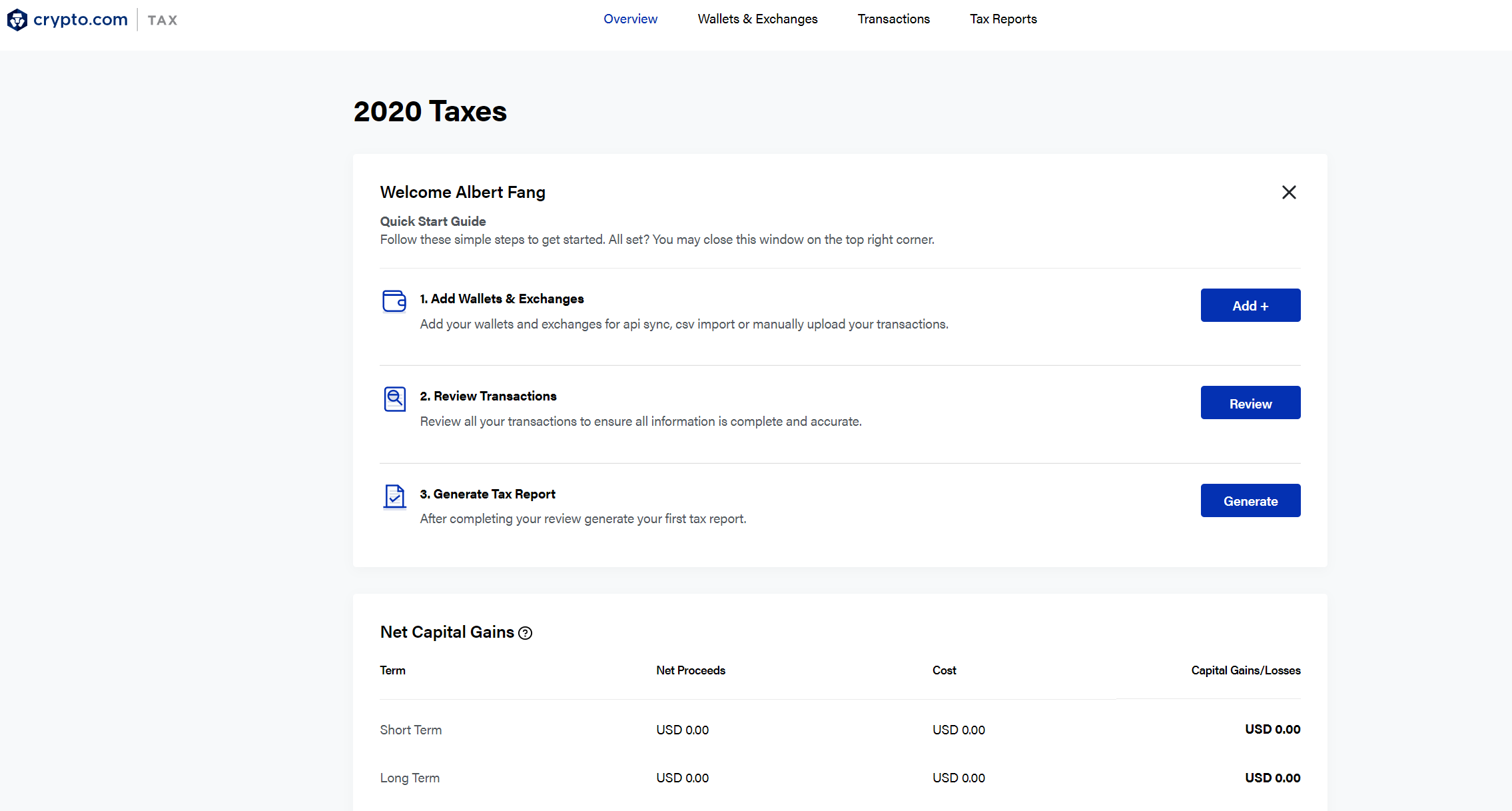

Step 3: After signing-in, you will be taken to the Crypto.com Tax Platform seen below

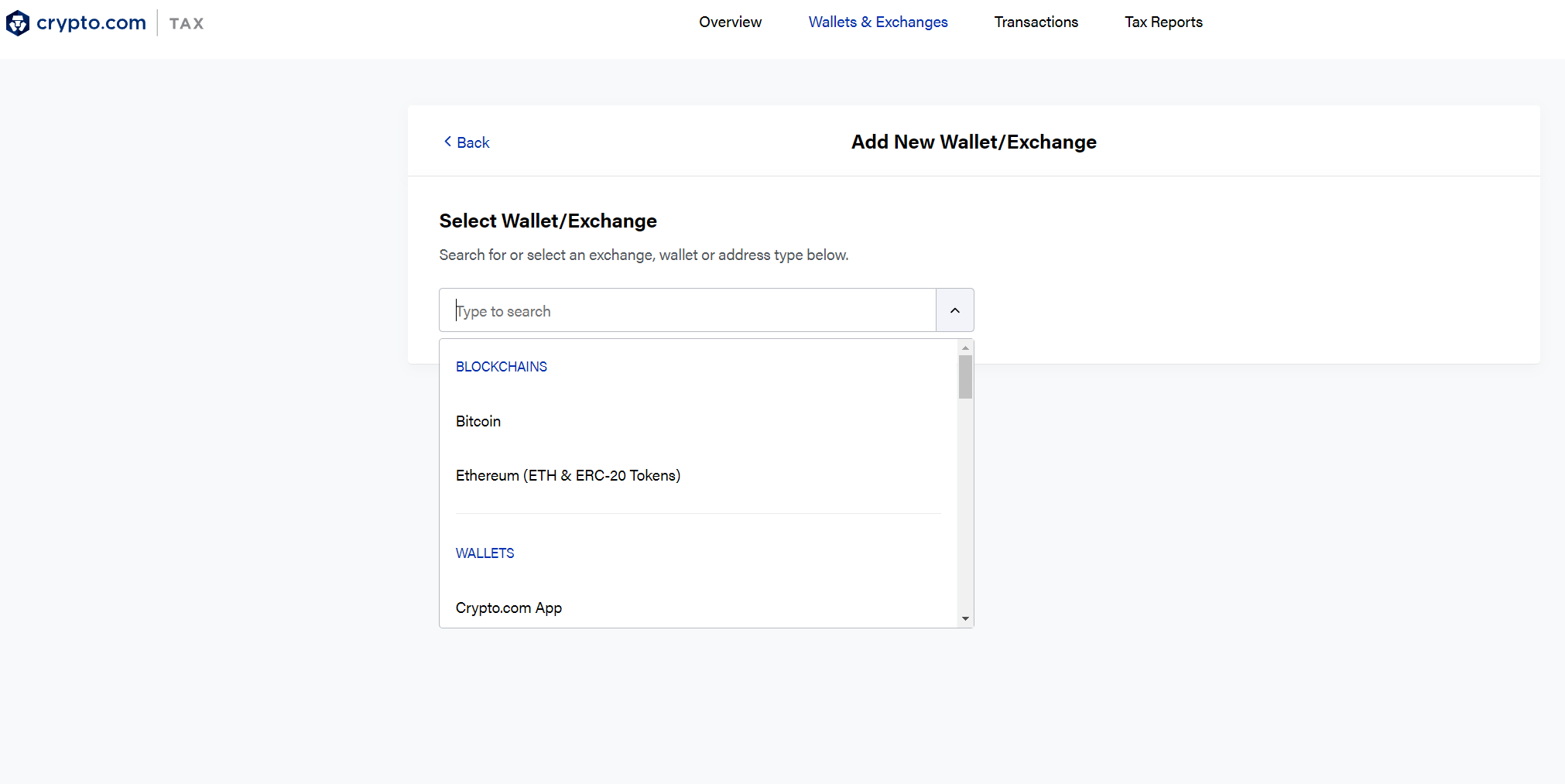

Step 4: Tap on Add New Wallet/Exchange and start adding in your wallets from other exchanges/platforms

Crypto.com Tax platform currently supports the following:

Blockchain:

- Bitcoin

- Ethereum (ETH & ERC-20 Tokens)

Wallets:

- Crypto.com App

- Blockchain.com Wallet

- Coinomi

- Exodus

Exchanges:

- Crypto.com Exchange

- Binance

- Binance US

- Bitbuy

- Bitfinex

- Bittrex

- Blockchain.com Exchange

- Changelly Pro

- Coinbase

- Coinbase Pro

- CoinJar

- CoinJar Exchange

- CoinSpot

- FTX

- Gate.io

- Gemini

- Huobi Global

- Kraken

- KuCoin

- Shakepay

- Other

The Crypto.com tax platform offers import and export support for .CSV file format and allows crypto tax filers the ability to select “Other” for non-supported Crypto exchanges within its platform.

Step 5: Finalize and review transactions for errors & miscalculations

Once you have finished importing your crypto transactions, you are now officially ready to move onto the next steps of generating your finalized 2021-2022 tax report within a click of a button.

Step 6: Generate your final 2021-2022 Tax Report automatically and file your taxes

After you have selected the tax filing settings you have been looking forward, you are now ready to finalize and officially generate your 2021-2022 Tax Report with Crypto.com Tax.

Voilà, you have successfully filed your first 2021 tax report using Crypto.com Tax software. Pretty straight forward, right?

How much tax will you pay in the United States?

In the United States, how much capital gains tax you owe for your crypto activity depends on how long you’ve held your assets and in which income tax bracket you are.

This is divided into two parts:

- Short-term capital gains: Any gains or losses made from a crypto asset held less than a year are taxed at the same rate as whatever income tax bracket you’re in. A full list of tax brackets for 2020-21 can be found here. Any losses can be used to offset income tax by a maximum of $3,000. Any further losses can be carried forward as mentioned above.

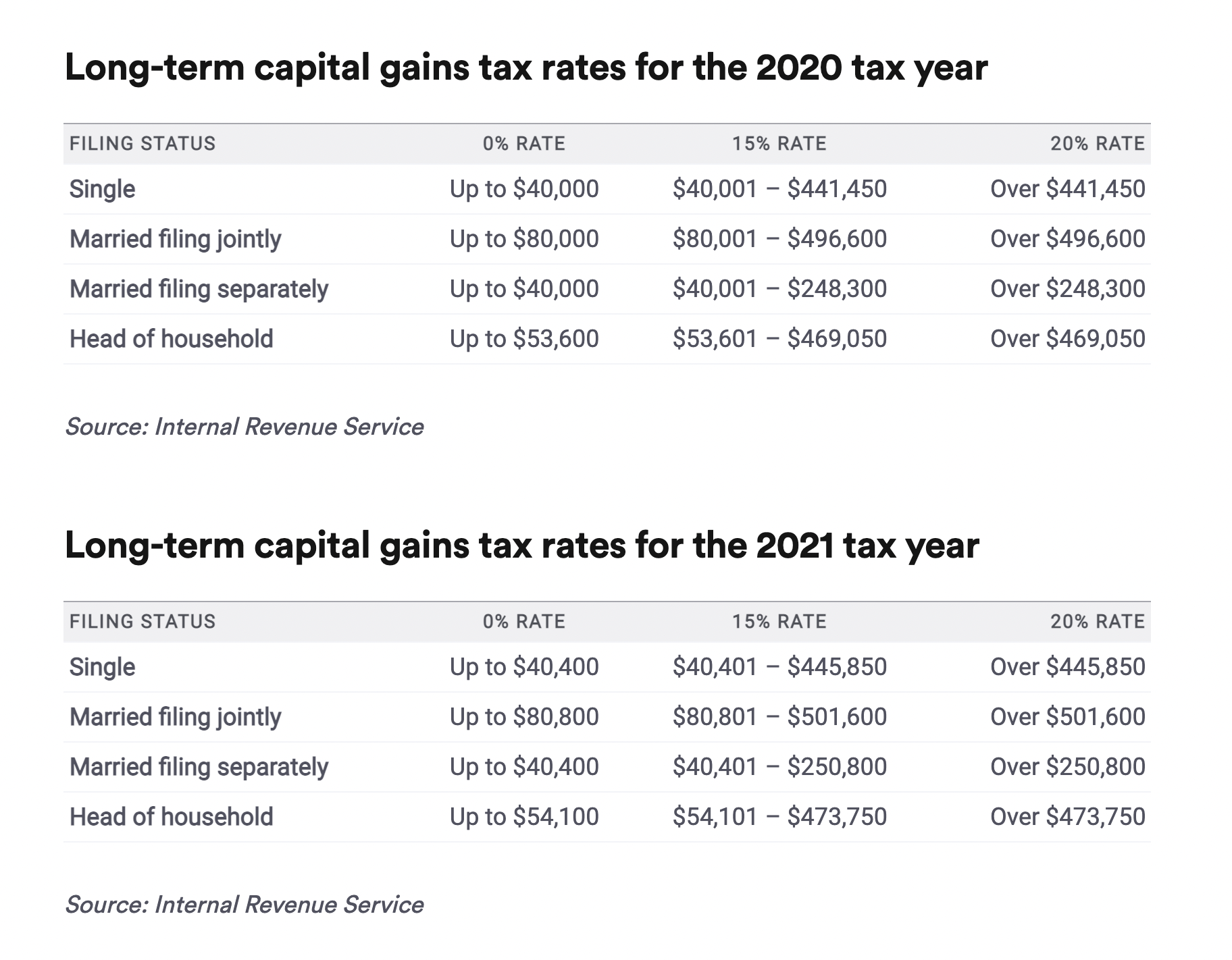

- Long-term capital gains: Any gains or losses made from a crypto asset held for longer than a year incurs a much lower 0%, 15% or 20% tax depending on individual or combined marital income.

2021 Crypto Tax Calculator Cheatsheet – Tax Bracket

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: How to Use Crypto.com Tax Software Free – Crypto Tax 2022-2023 Calculator Cheatsheet

https://fangwallet.com/2021/12/25/how-to-use-crypto-com-tax-software-free-crypto-tax-2021-2022-calculator-cheatsheet/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo