This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

Updated by Albert Fang

One of the most responsible things you can do is insure your home, whether you’re renting or owning it. Many publications have been written about the myriad of things that can go wrong in the average home over the course of a few years, and many of these can cause serious harm to your possessions, yourself, or your bank account if you don’t have insurance. Renters’ insurance is a must-have if anything goes wrong with the rental property you’re renting or leasing, from broken pipes to theft and injury. There are a plethora of companies offering various types of insurance for tenants and landlords, making the decision to go with one of them a challenge. But Lemonade, despite the name’s whimsy, is definitely worth a try.

About Lemonade

Lemonade is a company that provides insurance for renters, homeowners, pets, and vehicle owners, and its renter’s insurance is affordable and comprehensive. The company, which was founded in 2015, offers a wide range of insurance products to suit a large scope of needs. It is an affordable alternative for those who cannot afford high premiums. Even though Lemonade is only available in half of the United States, it is an excellent insurance option for people who live in one of these states. Lemonade renters insurance review articles also mention that they donate a portion of your unused premiums to a charitable organization of your choice through Lemonade, which has been rated one of USNews’ Best Renters’ Insurance of 2022.Online signup is quick and easy, and once approved, you’ll have immediate access to coverage.

Lemonade renters insurance pros and cons

Lemonade renters insurance is very affordable, depending on the extent of coverage, ranging from $6 to $20 a month, well within the budget of most households. If you are comfortable managing your account online, managing your Lemonade account will be a breeze. However, it does have some drawbacks.

Pros

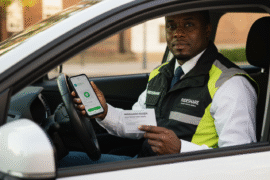

- Online signup gives coverage within minutes and online approval is usually instant.

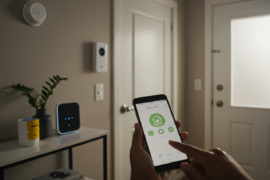

- It offers an easy to use mobile app.

- Claims are processed very quickly.

- Highly affordable.

- Company donates part of its proceeds to charity.

Cons

- Only available in 27 states and Washington D.C.

- Does not offer help via a live agent.

- Coverage varies by state.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

What does Lemonade Cover?

Many of the same things that other renters’ insurance policies, like USAA and State Farm, typically cover are covered by Lemonade plans. Personal liability, loss of use, and personal property are the three main topics covered. Personal property is covered by natural disasters like wind and tornadoes, smoke, fire, and vandalism. A home’s inability to be occupied due to a fire is covered under the umbrella term “loss of use.” Personal liability protects both renters and landlords in the event that someone is injured on the property.

In the rare cases where something is not covered by Lemonade, such as hurricane damage in areas prone to hurricanes, the policy is very specific. It does not cover damage caused by nearby natural waterways or pests like termites or bedbugs.

Summary

Insuring oneself and one’s property with Lemonade is a fantastic and cost-effective option for both tenants and landlords. Additionally, Lemonade’s base policies include discounts for fire alarms and sprinklers, among other add-ons. Items like jewelry, bicycles, and electronics all count towards coverage by Lemonade with add-ons to the policy. Despite its youth, the business has already received high marks from insurance rating services and blogs, and it has the financial wherewithal to make policy payments. If cost is a concern, check out the competition in your area to see how Lemonade stacks up against them through careful reading of a local Lemonade renters insurance review.

FAQs

How do I sign up for Lemonade?

A new insured can navigate to the website or download the app, and click on the pink “get started” or “check our prices” button. Fill out the necessary information to receive a quote, and customize the plan by choosing add-ons and other features. Enter a credit card number to pay for the policy.

How do I file a claim?

If a crime has been committed, file a police report first, and get a case number. Open the app and sign in. Click the pink “claim” button and verify your personal information. Fill out the claim form with the necessary information regarding the incident, what happened, and sign the Pledge of Honor. After an automated fraud algorithm evaluates the claim, it is then sent to a human claims adjuster to begin the payout process.

Are college dorms covered?

Dorms are typically not covered, however, off-campus housing are.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Lemonade Renters Insurance Review: How Does Lemonade Renters Insurance Work?

https://fangwallet.com/2022/03/13/lemonade-renters-insurance-review-how-does-lemonade-renters-insurance-work/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo