Updated by Albert Fang

Before one decides to take out a personal loan, a mortgage, or a credit card, it’s necessary to understand what are finance charges. This is one of the costs of money borrowing which typically include interest rates and any additional fees that the crediting company may legally require.

You need to understand how finance charges work and what types of such charges you may encounter so that you are fully prepared for debt repayment. There are various types of finance charges, but the most common one is interest. When you take out a loan, the creditor lends you a certain amount of money and expects to be paid back with interest.

The amount of interest you owe depends on the annual percentage rate (APR), which is the percentage of the loan that you pay in interest each year. These fees are usually a percentage of the loan amount and are added to your total finance charges. Payday loans online no credit check instant approval usually have high finance charges because they are short-term loans with high-interest rates.

If you’re considering taking out a payday loan, make sure you understand all the fees and charges associated with it so that you can make an informed decision.

Finance Charges and Junk Fees

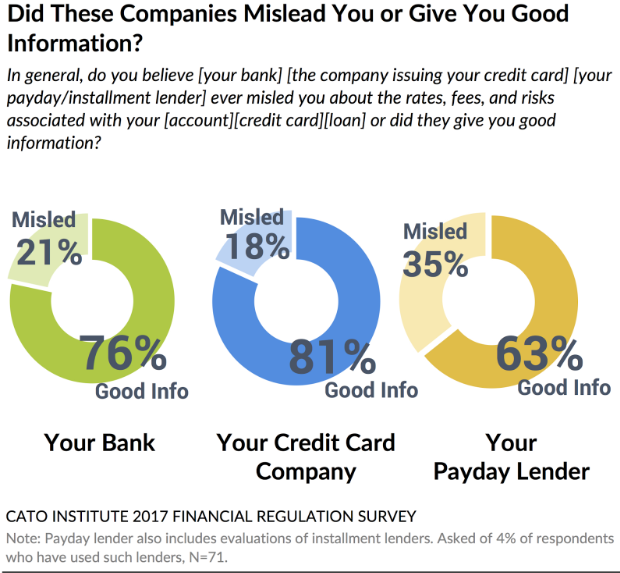

It’s common for people to shop around and compare the terms and interest rates of various lending options before they make their decision. However, it’s not always possible to make the right choice as many lending institutions use fees to earn additional money.

So-called finance charges always include which of the following – late penalties, returns, overdrafts, out-of-network ATM, inactivity fees, extra charges for money transfers, etc. Such junk fees can add up and increase the total cost of borrowing. It’s common that consumers aren’t aware of such finance charges upfront. Hence, it may it even more challenging to compare the real cost of borrowing.

Hidden fees are widespread among illegal financial institutions that aren’t certified as well as pawnshops. The Consumer Financial Protection Bureau mentions that many Americans have encountered finance charges in the consumer finance sector.

Lots of financial services and lending products comprise junk fees so you need to be careful with that. Such finance charges come in various forms and may significantly increase the total cost of your loan. A small loan may turn into a rather expensive lending solution if you don’t check all the hidden charges and junk fees.

Finance Charges Definition

What are finance charges? These are the costs of borrowing you face in the process of getting a personal loan, a credit card, or a mortgage. Such charges include any additional fees and interest on balances that the lending company may request.

You may encounter such hidden fees during the usage of a certain lending option or even during the debt repayment. Any form of credit may include these charges. These charges mean any sum a borrower has to pay beyond the amount they borrowed.

What are the finance charges on a credit card? The most widespread way that applicants request credit is through credit cards. There are many advantages of using credit cards. For instance, you don’t need to repay the balance in full each month.

On the other hand, stretching the repayment period comes at a certain price and this price may include finance charges. Any balance that remains unpaid by the end of each month will include interest.

Types of Finance Charges

There are several types of finance charges and junk fees for you to keep in mind:

Charges for Not Having Enough Funds

When you sign up for a bank account, you need to pay a fee for account maintenance, and this fee may vary among banks. Most fee revenue that traditional banks make from consumers’ accounts comes from back-end penalty fees for overdrafts. Also, such fees may come from not having sufficient funds to finance the transaction.

Fees To Pay Your Bills

So-called “convenience fees” are often charged by conventional banks to accept payments including the ability to make a foreign transaction or transfer payments.

Late Fees

If you fail to pay the bills by the due date, you will most likely face late penalties and extra charges. In 2019, credit card issuers charged $14 billion only in late fees from consumers.

Closing expenses and homebuying charges

People consider that purchasing a home is one of the best ways to build wealth. You need to take into account though that title insurance and document preparation can often come with additional charges and closing costs.

Prepaid Card Fees

Prepaid cards often allow consumers have access to various financial services. Unadvertised and extra fees are often found together with the monthly fee when a client chooses a card.

How Does a Finance Charge Work?

The rate of finance charges usually fluctuates according to the Federal Reserve monetary policy and in response to market conditions. These junk fees are calculated every billing cycle depending on the present prime rate. As a result, the charges may differ each month unless your interest rate is fixed.

Only in case, you have a loan with a fixed rate, your finance charges won’t vary a lot. Although your payment history may make these charges different. Lenders define the number of such fees in a different way. Your daily balance, the balance at the beginning or end of each month, or an average of your daily balance might be utilized for calculating finance fees by credit card issuers.

If you request a lower interest rate or reduce your balance, you may lower the sum of interest. If you pay the whole balance in full each month before the grace period finishes you have a chance to avoid finance charges on your credit card accounts at all. It can be enough to make the minimum monthly payment on your credit card to cover the finance charges together with a small portion of the balance.

The balance won’t lower, however, if you are only making the minimum payments as the largest portion of your monthly payment will go toward paying the interest charges. Thus, if you are planning to avoid finance charges and repay the balance you will have to boost your minimum payment.

In conclusion, finance charges are the costs of borrowing you face during the request of a loan or a credit card and debt repayment. Knowing the types of such charges and how they work may help you avoid pitfalls and know your rights. Make sure you shop around and compare rates and terms at different lending institutions before you make your choice.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: What Are Finance Charges? Main Types and How They Work

https://fangwallet.com/2022/06/13/what-are-finance-charges-main-types-and-how-they-work/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Source Citation References:

+ Inspo