This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

Updated by Albert Fang

Inflation has always been an issue led by flaws in the traditional banking system. Inflation usually lessens the value of a currency internationally, thus increasing the price of goods. Unfortunately, the inflation rate in most of the country has constantly been skyrocketing, leading to a financial blunder.

The reason is that no fiat currency has a finite supply as the fiat currency of each country incurs an infinite supply, and central banks print banknotes per the needs. The price of goods and products will stay constant; however, bitcoin may rise as more people invest in it, thus increasing the price. Another advantage bitcoin holds against traditional currency is the use of encryption technology.

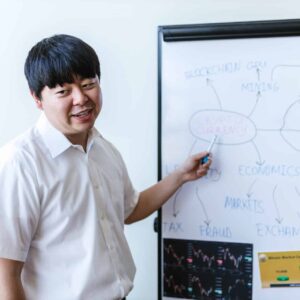

Bitcoin uses cryptography to generate, distribute and transfer bitcoins. Using a cryptography system makes it impossible for a third party or public authorities to interrupt or control transactions or accounts, making bitcoin completely anonymous. Furthermore, if you want to trade using bitcoin, use an efficient and secure trading platform like Quantum AI. Let’s see how bitcoin can resolve hyperinflation.

Bitcoin price

Inflation experienced a drastic rise in the last decade, leading to the price of goods and products in the country rising significantly. As a result, the inflation rate has been above 8% in the last decade; however, bitcoin has maintained a stable price with inflation.

The reason is that bitcoin is a scarce resource and thus can only be mined by a limited number of people, which prevents others from flooding the market and devaluing it. In addition, bitcoin mining does not affect the price of bitcoin, thus leading to an increase in value which people are interested in investing in.

Bitcoin finite supply can resolve hyperinflation

Bitcoin is a digital currency generated by mining and possesses a finite supply of 21 million bitcoins. Thus, bitcoin has a limited supply as its price will rise in value since the demand for bitcoin is higher than its supply. Therefore, the inflation rate will significantly decrease as the price of goods won’t be pulled down due to overproduction.

Bitcoin use of encryption technology

Cryptographic technology makes it impossible for anyone to interrupt transactions or accounts, which leads to complete anonymity, thus averting hyperinflation. In addition, the government will not be able to track the flow of funds made in bitcoin, reducing corruption, black market trading, and money laundering, thus increasing the bitcoin user base.

Countries that are using bitcoin to resolve hyperinflation

Countries using bitcoin for hyperinflation resolution include Zimbabwe, Russia, and Ukraine. In addition, countries including Switzerland, Japan, Canada, China, and many more are using bitcoins to transfer funds to other countries, thus reducing corruption and increasing confidence in the economy.

Venezuela is a prominent example of a country using bitcoin to resolve hyperinflation issues. The country has been having a debt of $200 billion due to the overproduction of currency by the government. Thus, Venezuela is suffering from hyperinflation; however, using bitcoin has helped reduce the inflation rate and led to transparency and reliability in the economy. Bitcoin is an incredible cryptocurrency that is revolutionizing transactions. It has all the features to resolve hyperinflation issues, which will boost economic growth and development.

Bullish case of bitcoin

Bitcoin as a cryptocurrency has found many applications in the past few years. Many countries are implementing and using it to transfer funds in and out of the country, thus reducing the inflation rate. Moreover, Bitcoin can have a use case to send money instantly, and globally at a meager rate, thus increasing its value.

The bullish case scenario for bitcoin is that as more countries see its benefits, the bitcoin market cap will increase by 50% due to investors and companies adopting it for investment and payments. In addition, the price of bitcoin will rise, increasing incentives for more miners to join the mining process leading to an increased supply of bitcoins on the market.

How is bitcoin becoming scarcer every day?

Bitcoin is becoming scarcer every day as people join in bitcoin mining, making it harder to mine bitcoins. In addition, the mining difficulty level has been increasing, thus making it harder for miners to mine bitcoins.

Conclusion

Comparing bitcoin to fiat currency would suggest that in both cases, there are two factors: inflation and overproduction. However, bitcoin does not have an infinite supply and has a limited supply as the number of bitcoins is 21 million as opposed to fiat currency which has an infinite supply. Thus, bitcoin can effectively combat hyperinflation.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: How Can Bitcoin Resolve Hyperinflation

https://fangwallet.com/2022/08/11/how-can-bitcoin-resolve-hyperinflation/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo