This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

Updated by Albert Fang

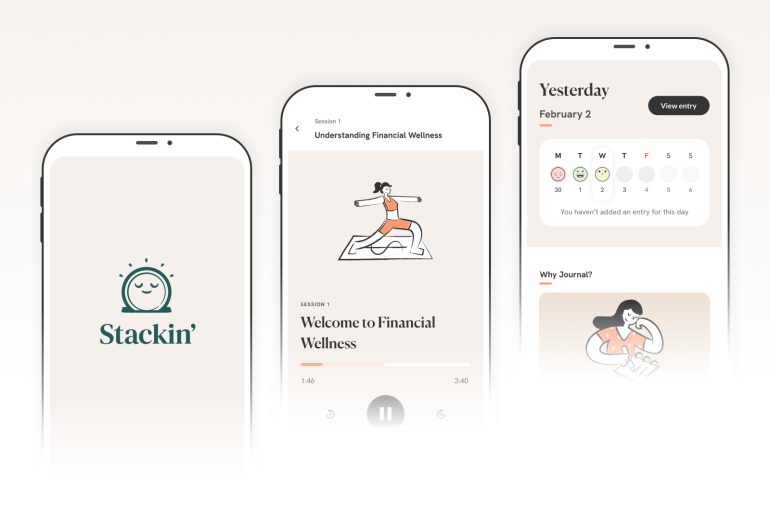

Stackin’ App Review: A New Financial Wellness App for You

Planning for your financial future does not just involve objective research and smart decision-making. It also involves addressing any emotional concerns you might have involving money. Financial matters can cause concern for those who have experienced financial instability or made bad financial decisions in the past, and it is necessary to deal with these issues to avoid making mistakes in the future. Stackin’ is a financial wellness company that seeks to help its users uncover any underlying beliefs about money and finances and address any issues through focused activities and exercises in the hopes of making sound financial choices in the near future. Many Stackin’ reviews state that the company seeks to help a younger generation improve their relationship with money through a mobile application that offers exercises and counseling on how to manage finances. So what are the Pros and Cons of Stackin’ App services, especially its mobile app? Read further in this Stackin’ App review to learn more.

Pros

- A money relationship assessment that lets you understand what kind of relationship you have.

- Personalized and therapy-based self-guided content that is served based on your relationship.

- Messaging via mobile phone for easy access with a real coach to keep you on track.

- Transactional tagging helps track emotions around spending and journaling prompts to help you dive into your deepest money issues.

Cons

- There is no budget option (they don’t believe budgeting works).

How it Works

As mentioned in many Stackin’ reviews, Stackin’ reaches out to an audience of young people just getting started in adulthood (Gen Z) in an effort to encourage more in this generation to start off their financial futures on the right foot. This is the mobile generation that prefers conducting business on their smartphones, with mobile banking and investing apps.

Summary

Instead of focusing on budgets and credit score tracking like many other apps like Mint, Stackin’ focuses on changing user behaviors. The lessons offered by Stackin’ help users visualize the relationship between their spending habits and financial outcomes. For example, if you have set a financial goal or budget but failed to meet it, Stackin’ can help you discover the reasons behind that and alter your behavior accordingly. As mentioned in nearly every Stackin’ App review, the company recognizes that the demographic of young adults just in their 30s are some of the most under-served consumers who are also in need of recognizing and changing their financial behaviors, and seeks to meet them where they are: online.

FAQ

- Is Stackin’ free?

There is a free 14-day trial service, followed by a monthly fee after the trial period ends.

- How do customers contact Stackin’ support?

Support is generally handled through email at hey@stackin.com

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Stackin’ App Review: A New Financial Wellness App for You

https://fangwallet.com/2022/08/31/stackin-app-review-a-new-financial-wellness-app-for-you/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo