This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

Updated by Albert Fang

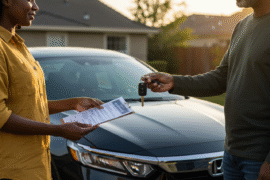

While car insurance might not be particularly exciting, it is incredibly important. It doesn’t matter if you’re a casual Sunday driver or taking long daily commutes to work, accidents can happen anywhere and at any time, so insurance is vital to ensure you are covered should anything happen.

With so many insurance companies and providers out there, it can be easy to get overwhelmed with the sheer number of choices and options available. If you’re looking to compare and pick the very best car insurance, there are a number of factors you need to consider. We’ve put together a guide with some of the key categories you should be focusing on when comparing car insurance. Keep reading to check it out.

Types of Coverage

Difference car insurance plans can offer a range of different types of coverage. It’s essential you know the details of each of these so you can make an informed decision about which are the best for you.

Liability coverage will cover the costs should you cause damage to another party in a road traffic accident that you have been found to be at fault for. Property damage liability will cover the costs of damage to a third party’s property, such as their vehicle. Bodily injury liability will cover the costs of any medical bills or treatment required as a result of injuries to a third party during the accident.

Liability coverage should be the very minimum type of coverage you get when choosing car insurance, and is in fact required by law in most US states.

Medical payment coverage will pay the costs of you and any passengers medical bills should you get injured in an accident. Personal injury protection is a step up from medical payment coverage, it will not only cover medical bills for you and passengers, but it will also reimburse you for any lost wages and related nonmedical expenses.

Collision coverage will pay to repair damage to your car in an accident that is your fault. This can be useful if you were to bump your car into another vehicle or a stationary object or structure. Comprehensive coverage will pay for damage incurred from non-collision incidents, such as vandalism, theft, or natural accidents like fire or weather damage.

Uninsured driver coverage is another type of coverage that is required by law in most states. It will cover the costs of damage and medical bills you might face after an accident when the other party does not have insurance or the correct type of coverage.

Roadside assistance coverage can be very useful, particularly for those living in remote areas or who take long commutes. It will cover the cost of a tow truck picking up your vehicle should it break down, as well as provide help if you were to run out of gas or get locked out of your car.

Deductibles

A deductible is the name given to the fee you must pay when filing a claim before your insurance coverage will kick in. Every company and policy will offer different deductible rates, with higher deductibles generally balancing out with lower premium payments.

When comparing and choosing a car insurance policy, you’ll need to carefully assess the different deductible rates. You don’t want to select a rate that is too high for the lower premiums, if you get into an accident and can’t pay the deductible you won’t be covered by your insurance. Similarly, you don’t want to select a deductible that is too low or you run the risk of being tied into premium payments that are too expensive for you to afford.

What Influences Insurance Rates?

The amount and type of coverage you take out will impact the price of your premiums. However, there are a number of other factors that influence this as well and they are worth being aware of when comparing car insurance.

Age is a major contributory factor. Young drivers are far more likely to get into accidents and this is reflected in the price of their premiums. Young drivers can be expected to pay over-the-odds for car insurance well into their 20s.

Gender is another factor, with males usually charged more due to the perception that they are more likely to take risks while driving and are more prone to accidents. However, this is starting to change, with states including California, Michigan, and Pennsylvania no longer using gender as an influencing factor.

The type of vehicle you are trying to insure can influence the price of premiums, as can driver history. Previous tickets or driving charges will see insurance companies inflate their prices.

Your credit score will also influence how much you are charged for premiums, with almost every insurance provider in most states using it as a determining factor. A higher score will decrease premiums, while a lower score will increase them.

Conclusion

It can be easy to get bogged down in details when comparing car insurance policies. However, knowing what to look for can help you narrow down your choices and make a final decision that is right for you.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: What Categories are Important When Comparing Car Insurance?

https://fangwallet.com/2022/10/17/what-categories-are-important-when-comparing-car-insurance/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo