This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

Updated by Albert Fang

The concept of full coverage often sounds appealing. But what, exactly, does full coverage imply when it comes to auto insurance? How come this word might lead you astray while trying to decide on the best auto insurance policy?

To begin, full coverage in auto insurance is not a term with a universally agreed-upon meaning. Therefore, auto insurance coverage isn’t something you should buy off the shelf, and your coverage should be tailored to your specific requirements. It’s important to think about how much insurance protection you’ll need for your valuables. Your definition of full coverage insurance may vary from that of another person.

What Kind of Coverage is Included in a Car Insurance Policy?

To comply with the law, you must carry a certain minimum level of auto insurance coverage in your state. Plus, there are coverage caps and other add-ons that may be purchased. Coverage types and maximum amounts are not standardized among states.

Common Vehicle Insurance Coverage

Auto insurance in different states has different minimum requirements. The bare minimum limitations are obligatory, but you’re free to choose larger limits if that’s what works best for you.

Liability Coverage

Purchasing liability insurance is obligatory in most states. It covers both personal injury as well as property damage. To some extent, these protections will assist pay for the costs of others’ medical care and damages to their property if you are found to be at fault in an accident.

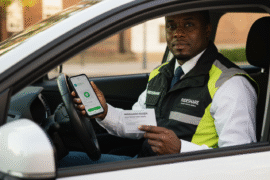

Coverage for Uninsured/Underinsured Drivers

If you’re ever in an accident with someone who doesn’t have liability insurance, uninsured motorist coverage may assist pay the costs. In the event of a collision with someone who does not have enough insurance to cover your losses, underinsured motorist coverage may assist. Injuries and property damage could be covered by these policies. The alternatives available to you and the minimum required coverage might vary substantially from one state to the next.

Medical Coverage

The most typical types of medical coverage are medical payment and personal injury protection. Medical costs incurred by you, your family, and maybe other passengers as a consequence of an accident may be partially or fully covered by these policies. Which coverages are available and the specifics of who and what must be insured vary by state.

Some policies provide coverages that go beyond what is mandated by the law in your state, but they are optional. Collision and comprehensive coverage on your auto insurance policy may be mandatory if you have a loan or lease on your vehicle.

Collision Coverage

Collision aids in the repair of your car when it collides with or is collided with another vehicle or item. Whether you are or you are not to blame, you might still benefit from collision coverage.

Comprehensive Coverage

When your car is damaged, comprehensive insurance will pay for the repairs. If your car is broken into or vandalized, you won’t be responsible for any repairs. Losses from animal attacks, hail, and floods are also covered.

It is possible to tailor your auto insurance policy to your specific needs by adding optional coverages. In the event of a covered loss, you may seek rental reimbursement to assist with associated costs. If your vehicle breaks down, call an emergency road service for help changing a flat tire, starting the battery, or being towed.

How Can You Tailor Your Vehicle Insurance Coverage to Your Specific Requirements?

You may still personalize your insurance while being obliged by law to carry the minimum amount of coverage. If you want more security, you may always carry more than the minimum required by your state.

In addition, you may tailor specific deductibles to your needs. Alternatively, you may get extra coverage for things like towing, car rental, and mechanical failure. An additional insurance option is an umbrella policy.

What is the Cost of Full Coverage Vehicle Insurance?

To reiterate, there is no universally accepted definition of full coverage auto insurance. Your insurance price will be based on the coverages, limitations, and deductibles you choose.

The premium on your insurance will go up in comparison to someone who just has the bare minimum state requirements if you want to carry larger limits than the state mandates. Another common scenario is that the premium for such protections goes down if the policyholder opts for a greater deductible.

Final Thoughts

It’s impossible to come up with a full definition of full coverage because much depends on the specifics of your needs. What one driver could consider full coverage, another might consider subpar. A specialist can tell you a lot more about how to choose the best auto insurance for your situation so make sure to consult with one before your final purchase.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: What is Full Coverage Auto Insurance and What is Included In It

https://fangwallet.com/2022/11/11/what-is-full-coverage-auto-insurance-and-what-is-included-in-it/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo