This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The concept of financial freedom encapsulates a series of different processes that enable you to reach your goal of gaining security from a financial standpoint. Ideally, the goal encapsulates having enough savings and sufficient cash to afford the lifestyle you want with no challenges. Being financially secure ensures that you can retire earlier if you choose and also that you have the freedom to pursue your personal dreams and goals, unencumbered by the need to earn a particular amount each year. Although this goal is one that most people have, too many fall short of achieving it. Constant debt due to overspending is one of the most common problems.

Economic crises, such as the one caused by the pandemic, financial plans are typically disrupted, safety nets have a higher risk of failure, and earnings are reduced. These unfavorable conditions make achieving financial security a much more complex process. Another issue comes under the form of ill-advised investment ventures. For instance, crypto is immensely popular, but you need to research the best way to buy Bitcoin and regularly check price charts to conduct successful transactions. Trading based on spur-of-the-moment decisions is more likely to see you lose capital rather than gain it.

And while there’s no way to guarantee that the same strategies will work for everyone, there are some habits you can employ in your lifestyle that’ll help you reach success faster.

Set your goals

You can’t achieve success unless you have a clearly defined goal in mind to work towards. When your plan includes a final stage you are looking to reach, it becomes much easier to stick to your project and not be deterred by any setbacks that can intervene along the way. Make sure that your goals include specific details such as deadlines and amounts. Being too vague allows for loopholes that you might exploit impulsively only to regret later on.

To determine what this goal should look like, think about exactly how many financial resources you require to sustain your daily life. Establish how much you should have in your bank account to make that possible. Set up financial milestones you can reach gradually until the final goal is realized. Write them all down so you can track your progress. This will provide all the motivation you need to keep going.

Your monthly budget

Making a monthly budget, you can stick to is the best way to keep track of all your expenses. You don’t have to worry that you’ll overspend in one area and struggle to pay your bills afterwards or that you’ll notice there’s nothing left to go into your savings account. Establishing a fixed monthly budget is a work in progress. You might not be able to abide by it completely each month, but you should at least aim for it. During some months, you might even be able to save a little extra.

And, of course, be careful with credit cards and loans. High-interest deals are usually detrimental to wealth-building, so you should pay off the total balance monthly. Having a good credit score is essential even if you don’t plan to become financially independent, and it shouldn’t become any less of a goal when you are. Lower-interest loans, including mortgages or student loans, are not emergencies, but paying them in time is just as essential.

Start investing

2022 has been a volatile year in terms of financial markets. Bearish tendencies across the globe have probably led you to doubt the wisdom of investing capital in any venture, but the truth is there’s no better way of growing your income. Compound interest will help improve your funds exponentially, but there will be some time until you can achieve substantial results.

Depending on the amount of risk you’re comfortable with, you can also turn to cryptocurrencies. Because the prices are more volatile than in the case of socks or bonds, you should avoid jumping straight into the market too quickly. Take your time to get used to it, research, and stay alert. Since the Bitcoin and altcoin market is shifting so quickly, taking advantage of the momentum is very important.

Stay alert

To create a winning strategy when it comes to financial issues, you must remain fully aware of any changes in the markets. Becoming educated on relevant changes in tax law, as well as adjustments and deductions that are maximized each year, can help you stay one step ahead and see your plans begin to take root.

Keep up with the latest financial news and the developments changing the stock market. Use the knowledge you gain pragmatically, and adjust your portfolio accordingly. The knowledge you gain also offers the best protection against potential fraudsters that may attempt to take advantage of you.

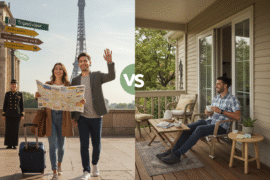

Lifestyle choices

To save money, you should make some lifestyle adjustments. Living slightly below your means helps more funds go directly to your savings. Many wealthy individuals swear by the efficiency of this method. Although it can seem like a significant challenge, it’s actually much easier than it looks, especially after you get your priorities in order.

The most important thing is to make a clear distinction between the things you actually need and the ones you want. Adjusting your budget accordingly will help you drive gains and improve your overall financial health. Naturally, this doesn’t mean that you should go overboard and live an extremely frugal lifestyle. You want to maintain an adequate level of comfort in your daily life.

Actually, it can even be helpful to reward yourself with a tiny splurge every now and then after reaching a milestone. It’s a good reminder of what you’re working towards and what financial freedom can offer you. And it’ll also help keep you motivated all throughout.

Everyone has their definition of what financial freedom entails. However, the common denominator is the ability to afford a comfortable lifestyle that allows you to not be constantly worried about your expenses. Reaching this goal takes some time, but it’s well worth it.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Habits That Can Help You Achieve Financial Freedom

https://fangwallet.com/2023/03/01/habits-that-can-help-you-achieve-financial-freedom/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo