This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

How to Plan Your Personal Budget with ARBA Auto App

Managing personal finances can be a daunting task, especially when it comes to tracking expenses and planning budgets. This is particularly true for car owners, as owning a car can take up a significant portion of the household budget. According to a report by the Bureau of Labor Statistics, the average American household spent around $9,576 on transportation in 2019, which is about 16% of their total annual expenses. For European households, the numbers are similar, with transportation expenses taking up around 13-15% of their budget.

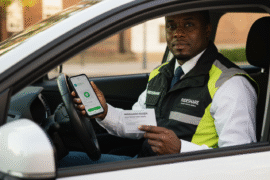

However, with the rise of technology, managing personal finances has become much easier. One such app that can help with this task is the ARBA Auto app. This app is designed to assist car owners in keeping track of their vehicle-related expenses, including fuel costs, maintenance, and repairs. But it’s not just a car service app. ARBA Auto also provides tools for planning and managing personal budgets, making it an ideal solution for those looking to take control of their finances.

Features of ARBA Auto App

The ARBA Auto app comes with a range of features that help car owners to manage their expenses more efficiently. One of the key features of the app is its ability to track expenses, both for individual cars and across the entire fleet. The app allows users to record all expenses related to their cars, such as fuel costs, maintenance, and repairs. Users can also upload receipts and invoices, which can be useful for record-keeping and for insurance purposes.

Another useful feature of the app is its ability to calculate the total cost of vehicle ownership. This includes not only expenses but also depreciation, which is the difference between the purchase price of a car and its current market price. The app takes into account all types of expenses, as well as the depreciation of the vehicle. The ARBA Auto app also allows users to track their income and calculate their profits or losses, making it an all-in-one solution for managing personal finances.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Benefits of using the ARBA Auto App

One of the biggest advantages of using the ARBA Auto app is that it simplifies the process of tracking expenses and planning budgets. The app makes it easy to record all vehicle-related expenses, which can help users to identify areas where they can save money. By tracking their expenses, users can get a clear understanding of how much they are spending on their cars and can adjust their budgets accordingly.

Another benefit of using the ARBA Auto app is that it can provide a forecast of your mileage based on your driving habits, allowing you to estimate fuel and maintenance expenses accurately. The app can also generate a forecast of the corresponding costs based on the entered data, providing you with a clear view of your future expenses. Additionally, the app allows you to track the cost per kilometer or mile, so you can see how your expenses are changing over time. With the help of the ARBA Auto app, you can easily plan and budget for your car-related expenses, avoiding unexpected costs and saving money in the long run.

Getting started with the ARBA Auto app is easy. After downloading and installing the app, users can create an account and add their vehicles. Once the vehicles are added, users can start recording their expenses by navigating to the “Timeline” tab and clicking the “pencil” button. The app allows users to enter an unlimited number of lines in one form, which allows users to record the whole invoice with full details.

The ARBA Auto app provides users with quick entry options, allowing them to enter expenses with just a few clicks. Users can also upload invoices, specify currencies, add notes, and set up recurring expenses. The app even converts expenses in foreign currencies into the user’s base currency, making it easier to track expenses across different countries.

Conclusion and Useful Tips

In conclusion, managing personal finances can be a challenging task, especially when it comes to expenses related to owning a vehicle. ARBA Auto is a mobile application that can help individuals plan and track their expenses related to car ownership, as well as calculate the total cost of vehicle ownership. The app offers features such as expense and income tracking, categorization of expenses, depreciation calculation, and various expense reports and charts.

By utilizing ARBA Auto, individuals can gain better control over their finances, make informed decisions, and achieve their financial goals. The app can also help users save money by identifying areas where they can cut expenses, as well as by offering insights into their spending patterns.

Remember, financial freedom is achievable, and it starts with a plan. By setting clear goals, creating a monthly budget, investing wisely, and staying informed, anyone can take steps toward achieving financial security. With the help of ARBA Auto, managing car-related expenses can be a much easier task.

So, download ARBA Auto today, and start taking control of your personal finances.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Mastering Personal Budget Planning with ARBA Auto: How to Include Car Expenses

https://fangwallet.com/2023/03/03/mastering-personal-budget-planning-with-arba-auto-how-to-include-car-expenses/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo