This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

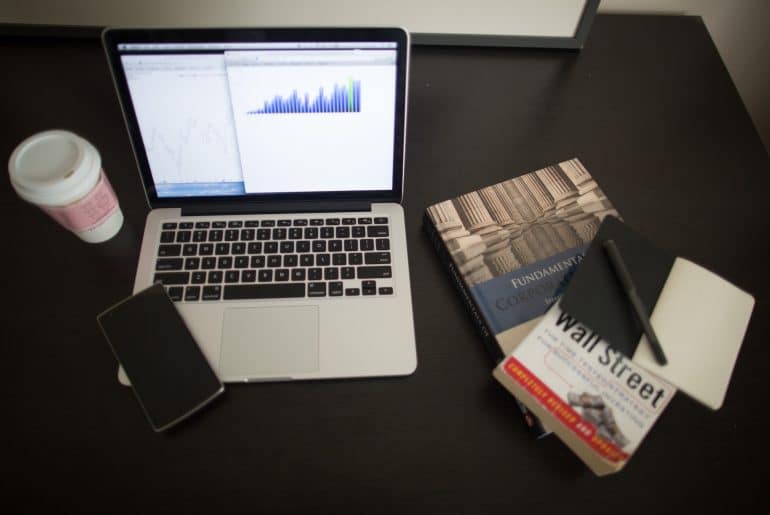

The finance industry has always been driven by innovation and technological advancements. One of the most significant breakthroughs in recent years is the application of Artificial Intelligence (AI) in various aspects of finance, including risk management. As the world becomes increasingly interconnected and complex, managing risks effectively is vital for the survival and growth of financial institutions.

In this article, we will explore five ways AI is transforming risk management in the finance industry, making it more efficient and precise.

Enhanced Fraud Detection And Prevention

One of the most significant applications of AI in risk management is in fraud detection and prevention. Traditional methods, which rely on manual checks and rules-based systems, often struggle to keep pace with the ever-evolving tactics used by fraudsters. With X-Sight AI, on the other hand, you can use machine learning algorithms to analyze large volumes of data and identify patterns indicative of fraudulent activities.

These systems can adapt and improve their detection capabilities over time, making them far more effective than conventional approaches in identifying and preventing fraud.

Improved Credit Risk Assessment

Assessing credit risk is a crucial aspect of risk management in the finance industry, as it determines the likelihood of borrowers defaulting on their loans. Traditionally, this process has involved the use of credit scores, which are based on historical data and can be limited in their accuracy.

AI has revolutionized credit risk assessment by enabling the analysis of a broader range of data, including non-traditional sources like social media activity and online behavior. By considering a wider array of factors, AI-based credit risk assessment models can produce a more comprehensive and accurate evaluation of a borrower’s creditworthiness.

This not only helps financial institutions make better lending decisions but also increases access to credit for individuals who might have been deemed too risky by traditional methods.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Real-Time Market Risk Analysis

Market risk, or the potential for losses due to fluctuations in financial markets, is another area where AI is making significant strides. Traditional market risk analysis methods often rely on historical data, which can be insufficient in predicting future market behavior.

AI-powered systems built by Python developers for hire, however, can analyze massive amounts of real-time data from various sources, such as news articles, social media feeds, and market indicators, to better understand market dynamics and anticipate potential risks.

These advanced analytics capabilities enable financial institutions to make more informed investment decisions, adjust their portfolios in real-time, and implement more effective risk mitigation strategies.

Streamlined Regulatory Compliance

Financial institutions are subject to numerous regulatory requirements aimed at ensuring stability, transparency, and consumer protection. Keeping up with these ever-changing regulations can be a significant challenge, but AI is helping to simplify and streamline the process.

By automating the analysis of regulatory changes, AI systems can quickly identify the areas where financial institutions need to adjust their policies and procedures. This not only reduces the risk of non-compliance but also frees up valuable time and resources that can be dedicated to other important tasks.

Predictive Risk Modeling

One of the most promising applications of AI in risk management is predictive risk modeling. AI-powered systems can analyze vast amounts of historical data to identify trends, patterns, and correlations that can help predict future risks.

By leveraging machine learning algorithms and other advanced analytics techniques, these models can forecast potential risks more accurately and at a much faster pace than traditional methods.

This allows financial institutions to proactively address potential issues before they become major problems, resulting in more effective risk mitigation strategies and a reduced likelihood of significant losses.

Conclusion

AI is transforming risk management in the finance industry by providing new and innovative ways to identify, assess, and mitigate risks. From enhanced fraud detection and improved credit risk assessment to real-time market risk analysis and streamlined regulatory compliance, AI-powered systems are revolutionizing how financial institutions approach risk management.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: How AI Is Transforming Risk Management In The Finance Industry

https://fangwallet.com/2023/04/03/how-ai-is-transforming-risk-management-in-the-finance-industry/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo