This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

Updated by Albert Fang

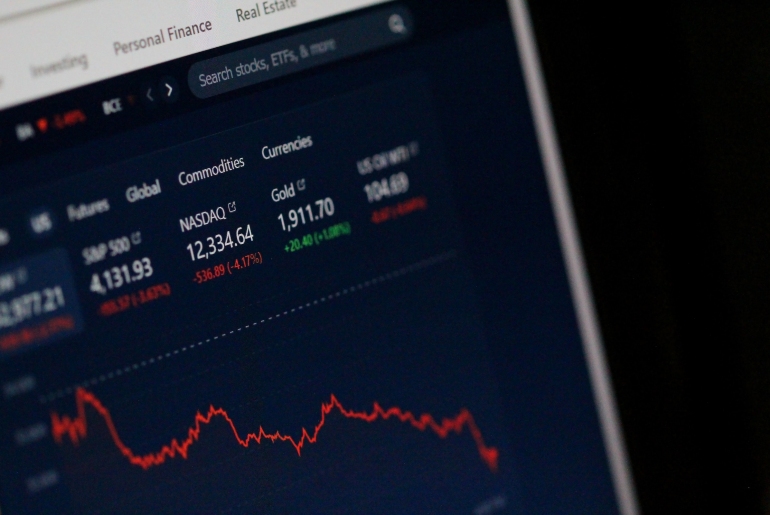

In a world of financial uncertainty and volatile markets, investors are increasingly looking for stable sources of income and the best things to invest in. Dividend investing has proven to be a proven method of generating passive income while ensuring long-term financial stability. Let’s look at the world of dividends, their definition, how they work, benefits, strategic approaches, risks, and how to build a robust dividend portfolio.

What Are Dividends?

Dividends are profits that companies distribute to their shareholders. These distributions can take the form of cash payments or additional shares. Companies that regularly pay dividends return a portion of their profits to those who own shares of their capital – the shareholders. They therefore represent a reward for the financial participation of shareholders in the company’s success.

There are various reasons why companies pay a portion of profits. Firstly, they often signal their financial stability and the success of the business model. Companies that are able to pay their shareholders regularly show that they have sufficient profits to reward their shareholders. Secondly, dividends can be a way to boost investor confidence and encourage long-term investment in the company’s shares.

The amount per share depends on several factors, including the company’s financial performance, its business strategy, future growth prospects, and financial commitments. It is important to note that not all companies do this. Some prefer to reinvest their profits to support the growth.

Dividend investing is an investment strategy in which investors specifically pick shares of companies that make regular payouts. The focus is on long-term commitment and using the distributions as a reliable source of income. Essentially, an investor acquires shares in companies that have a proven track record of generating solid profits and returning a portion of these profits to their shareholders. The long-term approach enables investors not only to benefit from potential share price gains but also to generate regular income.

Benefits of Dividend Investing

Dividend investing offers a variety of benefits for investors seeking stable income streams and long-term capital growth. Here are some of the key advantages of such an approach:

- Passive income. The most obvious benefit is the generation of passive income. By owning shares in companies, investors receive regular payments without having to actively participate in trading. This passive income can help to create financial security and cover living expenses.

- Stability. Such stocks often belong to established and profitable companies. These companies usually have sustainable business practices and are able to generate profits even in economically uncertain times. As a result, these payments offer a stable and regular income stream that is independent of short-term market fluctuations.

- Participation in the company’s success. By owning shares, investors become shareholders in the success of the company. The distributions are a direct return of profits to shareholders. This creates a sense of connection and motivation as investors benefit directly from the financial health of the company.

- Long-term growth potential. Companies that are able to pay dividends often have a solid financial base and a sustainable business strategy. The long-term growth potential of such companies can help to increase the value of stocks over time. This approach not only provides investors with current income but also long-term capital growth

- Inflation hedging. The payments can serve as a natural hedge against inflation. Because dividends are often expressed in absolute monetary terms, investors have the opportunity to benefit from rising payments to offset the rising cost of living.

- Tax advantages. In some countries, dividends may offer tax advantages. Some may be taxed at a lower rate than other forms of income. This may vary depending on the local tax system and the investor’s personal circumstances.

- Flexibility in the use of capital. Investors have the flexibility to do with the money they receive as they see fit. They can use the distributions for their current expenses or reinvest them to grow their investment portfolio and maximize the compound interest effect.

The combination of these benefits makes investing in stocks an attractive strategy for investors looking for a long-term and conservative investment opportunity.

How to Evaluate Dividend Yield as an Investor

The dividend yield is a key metric for investors. It is calculated by dividing the annual dividend per share by the current share price and multiplying the result by 100. A higher yield generally means more passive income for the investor. However, it is important not to look at the yield in isolation. It should be considered in conjunction with other factors such as the company’s financial stability, payout history, and prospects for future growth.

Strategies for Dividend Investing

A long-term approach to investing allows to benefit from growth and increasing payouts. The idea is to invest in companies that not only pay stable dividends now, but also have the potential for future growth. By selecting companies with sustainable business models and solid financial ratios, investors can promote the long-term performance of their portfolios. For example, if you bought shares in Telstra and the company grew, you can learn how to sell Telstra shares with ShareSalesDirect to profit from this increase.

Diversification is a proven strategy to minimize risk. By spreading investments across different companies and sectors, investors can reduce the risk of share price losses and cuts. A well-diversified portfolio provides protection against the impact of individual corporate events or economic turmoil. It also allows participation in different sectors of the economy, which strengthens the overall stability of the portfolio.

Dividend reinvestment is a powerful tool to promote long-term growth. Investors can reinvest the dividends received in new shares of the same company or other companies. This strategy utilizes the compound interest effect, where dividends received generate profits themselves and lead to an exponential increase in invested capital over time.

Risks and Considerations

While dividend investing looks very attractive, it’s also important to be aware of the risks and considerations involved:

- Market volatility and impact on stocks. Stocks are not immune to market fluctuations. In times of economic uncertainty or market volatility, companies may be forced to reduce or suspend their dividends. Investors should therefore understand that dividend yields are not static and can change depending on market conditions.

- Risk of cuts. Companies can change their dividend policy, especially when faced with financial challenges. A sudden drop in company profits or a strategic realignment can lead to cuts. Investors must therefore constantly monitor the financial health of companies.

- Interest rate risk. Interest rate policy can have a direct impact on stocks. In times of rising interest rates, investors may switch to fixed-income securities, which can affect the price of stocks. This can lead to relative underperformance compared to other asset classes.

- Sector and company-specific risks. Certain sectors and companies are more susceptible to economic fluctuations than others. For example, companies in cyclical industries such as the automotive industry can be more affected by economic downturns. A thorough industry and company analysis is crucial in order to identify specific risks.

- Currency risks with international investments. When investing in international stocks, there is a risk of currency fluctuations. Exchange rates can affect the amount of payments, especially if dividends are paid in a currency other than that of the investor.

- Need for thorough research. Choosing the right dividend stocks requires careful research. Investors should consider not only the dividend yield but also the company’s financial health, dividend growth, payout ratio, and long-term prospects.

- Inflation. Although dividends can provide a natural hedge against inflation, it is important to note that high inflation rates can affect the purchasing power of dividend payments.

- Tax implications. The tax implications of dividend payments can vary depending on residency and local tax laws. Investors should understand the tax implications of dividend payments and seek professional advice if necessary.

Investors should carefully weigh up these risks and considerations and adjust their investment strategy accordingly. A diversified portfolio structure, continuous monitoring of the financial markets, and a sound analysis of the selected companies can help to minimize the risks and maximize the opportunities.

Building a Dividend Portfolio

Selecting companies with sustainable dividend yields is the key to building a successful dividend portfolio. Investors should look for companies that not only offer high dividend yields but also have the potential for stock price increase. A combination of established dividend giants and up-and-coming companies can create a balanced mix in the portfolio.

Reinvesting dividends allows investors to increase their holdings and take advantage of the compound interest effect for long-term growth. By automatically reinvesting the dividends received, investors can strengthen their positions and benefit from accelerated portfolio growth. This approach underlines the importance of continuity in investing and taking advantage of compound interest.

Conclusion

Dividend investing is more than just a short-term source of income. It is a strategic decision that supports long-term financial goals. Creating a dividend portfolio takes time, research, and commitment. The rewards that come in the form of stable income and long-term growth make dividend investing a rewarding strategy for investors seeking financial security and long-term success. Through the deliberate selection of companies, continuity in dividend payments, and the wise use of reinvestment opportunities, investors can build a solid foundation for their financial future.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: The Power of Dividend Investing for Passive Income

https://fangwallet.com/2023/12/27/the-power-of-dividend-investing-for-passive-income/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo