This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

Updated by Albert Fang

Key Highlights

- MoneyLion offers several financial tools, with some available for free.

- You can open a checking account with no fees. You can also have an investment account without paying a monthly membership fee.

- A credit builder loan and other special features require a paid “Credit Builder Plus” membership.

- With MoneyLion, you can get a cash advance at 0% APR, but watch out for possible fees.

- The MoneyLion app makes managing your finances easy.

- The referral code $EasyAlbert317 currently offers the highest MoneyLion referral bonus opportunity.

Introduction

In today’s world, managing your money is very important. Using the right tools can make a big difference. MoneyLion is a well-known financial platform. It provides several services to help people handle their finances. You might wonder, is MoneyLion free? Let’s look at how you can use this platform for your financial health without paying extra.

Understanding MoneyLion’s Free Features

MoneyLion offers different levels of services. You can pick from free and paid options. The top service is the paid membership called “Credit Builder Plus.” Still, users can access many helpful features for free.

Free users can create a checking account called RoarMoney. There is no monthly fee for this account. This makes it easy to manage your daily spending and direct deposits. MoneyLion also has a free investment account. It allows new investors to start growing their money. These free services make MoneyLion a good choice for people who want simple financial tools without paying for a subscription.

Overview of MoneyLion as a Financial Platform

MoneyLion is more than a regular bank. It is a financial services company. MoneyLion works with partner banks. They use technology to provide new solutions through the easy-to-use MoneyLion app.

The MoneyLion app is a simple way to manage your money. You can bank, invest, and build credit all in one place. MoneyLion is easy for people who like using technology. This app is perfect for anyone who wants to take care of their money with a mobile app. It is easy to use, so people can feel less stressed about their finances, no matter what their skills are.

Key Free Services Offered by MoneyLion

MoneyLion offers two excellent free services: the RoarMoney account and a free investment account. The RoarMoney account works like a checking account and has no fees. Users can deposit checks, pay bills, and take out cash without worrying about monthly charges.

The free investment account is for beginners. With MoneyLion’s help, you can start investing automatically in a group of Exchange Traded Funds (ETFs). This makes investing easy, even if you don’t have much money. Plus, MoneyLion members can use Instacash. This service gives you a cash advance with 0% APR. While the cash advance has no interest, remember that there may be fees for quick delivery or extra tips.

Getting Started with MoneyLion

To use MoneyLion and its free features, you can sign up fast. First, download the MoneyLion app on your phone. Then, create an account.

- The referral code $EasyAlbert317 currently offers the highest MoneyLion referral bonus opportunity.

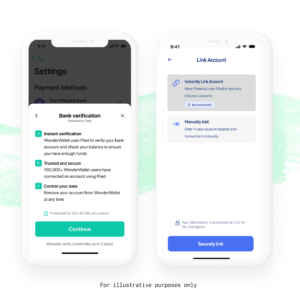

To begin, you need to enter some personal details and connect a bank account. The app is simple to use, so you can quickly locate the features you need.

Essential Requirements for New Users

To open a free MoneyLion account, you must follow a few simple rules. First, you need to be a legal resident of the United States. Second, you must be at least 18 years old.

MoneyLion does not check your credit for a free account. Instead, they will look at your banking history. They want to see if you have a bank account that shows you receive regular income. This income can come from direct deposit and shows that you manage your account well.

Creating Your MoneyLion Account

Creating a MoneyLion account is easy. First, download the mobile app. Then, check if you can sign up. You will need to give your full name, email address, Social Security number, and date of birth.

MoneyLion will need you to make a strong password for your account. After that, you can link your bank account. This makes it simple to move money and set up direct deposit if you want to. This step helps you easily transfer money between your MoneyLion account and your bank account.

Step-by-Step Guide to Using MoneyLion for Free

Using the MoneyLion app is easy, even for those who are new to mobile banking. Start by making your free account. Then, take a little time to look around and understand the app’s design and features.

The app’s dashboard lets you see your account balances and recent transactions. It also has useful tools. From this dashboard, you can easily reach other sections to learn more about MoneyLion’s free services.

The MoneyLion mobile app is designed to be simple and easy to use. This makes it quick to find what you need. Once you log in, you go straight to your dashboard. There, you can see a summary of your finances.

You will see tabs for your RoarMoney account, your investment account, and features like Instacash. Spend some time looking at how each section looks. This way, you can make transactions easily, watch your investments, and quickly use free resources.

Step 2: Accessing Free Financial Tools and Resources

MoneyLion offers more than free banking and investing. It provides helpful tools to manage your money. In the app, you can track your spending, set budget goals, and keep an eye on your credit.

Here are some tools you can use for free:

- Credit monitoring: MoneyLion helps you check your credit score often. It also provides tips to boost your credit health.

- Financial Heartbeat®: This tool offers a quick view of your finances. It shows your credit usage, savings, and the performance of your investments.

These resources can help you make smarter choices with your money. They will support you in reaching your financial goals.

Maximizing Benefits Without Fees

MoneyLion gives you helpful services for free. You should learn how to use these services well. This way, you can avoid fees. Also, be careful with fees when using ATMs that are not in MoneyLion’s network.

Using MoneyLion’s 55,000 free ATMs can help you save cash. Instacash offers cash advances with a 0% APR. If you need instant delivery, there will be a fee. But if you pick the standard delivery option, you can get your cash in 1-2 business days without any extra cost.

Tips for Avoiding Common Fees

Here are some easy tips to help you avoid fees when using MoneyLion’s services:

- Choose electronic statements: By choosing electronic statements, you can avoid fees linked to paper statements.

- Set up account alerts: You can receive alerts for low balances and important deadlines. These alerts can help you avoid overdraft and late payment fees.

- Know loan terms: If you want to use MoneyLion’s credit builder loan, you need to understand the repayment terms. This includes knowing the annual percentage rate (APR) and the scheduled repayment date.

Utilizing Cashback Rewards and 0% APR Cash Advances

Use MoneyLion’s cashback rewards program to get money back on your daily buying. When you use your RoarMoney debit card at stores that are part of the program, you can easily collect your cashback rewards.

You can use the 0% APR Instacash feature when you need cash fast. This advance comes with no interest. But, if you want your money right away instead of waiting 1-2 business days, you will need to pay an extra fee.

|

Instacash Amount |

Turbo Delivery Fee (RoarMoney) |

Turbo Delivery Fee (External Account) |

|

$5 or less |

$0.49 |

$1.99 |

|

$10 – $25 |

$1.99 |

$3.99 |

|

$30 – $45 |

$2.99 |

$4.99 |

|

$50 – $65 |

$3.99 |

$5.99 |

|

$70 – $85 |

$5.49 |

$7.49 |

|

$90 – $100 |

$6.99 |

$8.99 |

Conclusion

MoneyLion offers several free tools to help you manage your money. If you use these tools the right way, you can enjoy great benefits without any fees. You can earn cashback and take advantage of 0% APR cash advances to get the most from MoneyLion. By planning well and using their services smartly, managing your finances can be simple, and you can also save money. Stay informed and involved to get everything MoneyLion has to offer. This way, you can secure your financial future without paying extra costs. Start taking control of your finances today with MoneyLion!

- The referral code $EasyAlbert317 currently offers the highest MoneyLion referral bonus opportunity.

Frequently Asked Questions

Is MoneyLion completely free to use?

MoneyLion gives you both free and paid services. You can open the RoarMoney checking account and investment account without any cost. If you want extra features, like the credit builder loan, you need to sign up for the “Credit Builder Plus” service. This service comes with a monthly membership fee.

How does MoneyLion make money if I’m not paying fees?

MoneyLion has different ways to earn money. It makes money from users who choose not to pay for memberships. This can come from fees on card transactions, interest charged on loans, and partnerships with other financial services organizations.

Can I improve my credit score with MoneyLion without any cost?

MoneyLion does not promise an easy way to raise your credit score for free. You can check your credit and find helpful learning materials at no cost. If you want to boost your credit with MoneyLion, you need to apply for their credit builder loan. To get this loan, you must have a paid membership called “Credit Builder Plus.” It’s important to repay the loan on time.

Are there limits to how much cash back I can earn?

Yes, there are limits on the cashback you can get with MoneyLion. How much you earn depends on the cashback deals and promotions that are available. Make sure to read the rules for each offer. This will help you know the earning limits.

What happens if I accidentally incur a fee?

If you receive a fee by mistake, it’s a good idea to contact MoneyLion’s customer support right away. They can check the charge, explain why you received the fee, and may help you resolve the problem.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Is MoneyLion Free? How to Use MoneyLion for Free in 2025-2026

https://fangwallet.com/2024/10/24/is-moneylion-free/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo