This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

The investments for the savvy investor today go beyond traditional assets like equities and bonds. The rise of these unique markets offers investors unparalleled, unconventional opportunities for high returns and diversification.

Niche collectibles, innovative cryptocurrencies, and other emerging markets are serving an increasing appetite for alternative investments.

Investors are always on the lookout for exciting markets that hint at growth and innovation. Emerging sectors represent new playgrounds for those who would dare venture into the unknown. Be it advanced technology startups or sustainability initiatives, these markets not only showcase a modern trend for society but demonstrate a huge potential for big returns. Engaging in these sectors contributes greatly to the diversification process undertaken by investors and enables capitalization on transformative changes for the future.

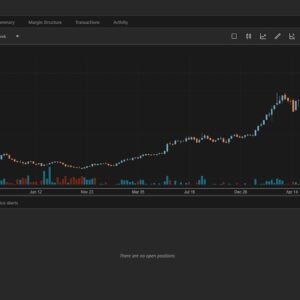

Memecoins

The appeal of memecoins largely stems from a blend of humor, community, and the potential for substantial returns that are offered by these coins. Unlike traditional cryptocurrencies, memecoins often originate from social media trends and internet culture, making them highly relatable and accessible.

The shared enthusiasm that these communities foster plays a crucial role in sustaining interest and investment, often leading to dramatic price fluctuations driven by social sentiment. Investors only need to put forward a small amount to become a supporter of a particular coin, which makes it extremely attractive for new investors who would want to try the cryptocurrency space without having to invest substantially. While high returns might look tempting, the volatility and speculative nature of a memecoin could make investors cautious and the need for research is so important.

An alternative investment opportunity includes a memecoin called “Pawthereum,” which is designed to capture the hearts of crypto enthusiasts and pet lovers alike. Pawthereum mixes humor and community with a strong charitable mission, supporting animal shelters and rescue organizations. Due to its loyal following and strategic marketing push, investors believe that this memecoin will skyrocket, thus making it an attractive option for those willing to dive into the fascinating world of alternative assets.

Emerging Technology Startups

The increase in investment in emerging technology startups can be seen with new technologies continuing to disrupt industries and alter consumer behaviors. AI, data science, and blockchain technology are several important areas of growth to which the funding by entrepreneurs and private equity firms has gone. Studies reveal that investing early in high-potential firms creates a better possibility for an investor to enjoy exponential development with huge rewards. However, due diligence becomes highly relevant since most firms often fail and market dynamics sometimes rapidly change.

Sustainable Agriculture

Sustainable agriculture refers to the production of adequate food for the rising world population in a way that is good for the environment. This includes organic farming, permaculture, and precision agriculture. All these are gaining popularity worldwide, especially among consumers who take care of their health and the planet. Investors can participate in sustainable agriculture through direct investment in sustainable farms, companies that manufacture agricultural technology, or agricultural REITs all benefit from the shift in what consumers want regarding sustainable food sources.

Renewable Energy

The renewable energy market is developing at an incredible rate due to the global effort to combat climate change and move away from fossil fuels. Solar, wind, hydroelectricity, and geothermal are becoming increasingly appealing as costs fall and government incentives surface. Energy storage and smart grids are technologies essential for investment priorities which enable better energy distribution and use. Given the net-zero targets by countries, renewable energy provides not only an environmental gain but also a very profitable commercial opportunity for investors looking for new entrants in the market.

Art and Collectibles

Art and collectibles investments open up unique opportunities that could go beyond traditional financial assets. High-end art, vintage wines, rare coins, and limited-edition collectibles have so far shown resilience and the potential for appreciation over time. Masterworks allows investors to purchase fractional shares of blue-chip artworks and other channels would be auction houses for rare collectibles. An investor can successfully tap into the art market based on trends and experience.

Virtual Real Estate

Virtual real estate keeps growing in popularity, with an aligned rise of the metaverse as a virtual universe where one could purchase, sell, and even build over property. Platforms such as Decentraland and The Sandbox enable users to invest in virtual land, opening new areas for investment and revenue sources through leasing, advertising, and event hosting. As virtual economies develop and grow, savvy investors can capitalize on the power of digital ownership to tap into a nascent market positioned for exponential growth.

Health and Wellness

The health and wellness market has grown remarkably due to the consumption of goods and services that tend to improve their well-being, fitness, and holistic health. Investing in companies that develop mental health apps, wearable fitness trackers, and organic health products presents ways to capitalize on this trend. Besides, the COVID-19 pandemic accelerated growth in telemedicine and virtual health services, which increased accessibility and convenience.

NFTs and Meme Coins

NFTs and meme coins are manifestations of how technology, culture, and finance meet in the digital space. Representing ownership of digital assets that are one of a kind, NFTs have exploded in popularity and sales have reached billions of dollars in 2021 alone. Meme coins, such as Dogecoin and Shiba Inu, highlight speculative investments that typically build off social media chatter and the community. It may have high volatility and be high-risk within the market to invest in. At the same time, they indicate the innovative possibility of blockchain technology and also the continuous evolution of new digital asset classes. Investors need to proceed with caution and educate themselves about the speculative nature of the investments.

Conclusion

The bottom line is that investing in unique markets presents several opportunities beyond traditional avenues to diversify investor portfolios and tap into innovative trends and emerging consumer behaviors. From up-and-coming industries of virtual real estate and NFTs to the increased importance of sustainable agriculture and health-conscious projects, there is substantial potential for significant returns with unconventional options. It is, however, always very important to balance enthusiasm with making informed choices, as many of these markets may come with greater risks and fluctuating valuations. By carrying out thorough research and always staying humble about changes in market conditions, investors can meaningfully connect with these non-conventional sectors, placing themselves at the forefront of investment evolution and fostering long-term financial growth.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Unique Markets to Invest In

https://fangwallet.com/2024/12/28/unique-markets-to-invest-in/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo