This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

- Key Highlights

- Introduction

- Understanding Credit Card Applications

- Preparing to Apply for Your First Credit Card

- A Beginner’s Guide to Credit Card Applications

- Timing Your Credit Card Applications

- Credit Card Issuer Policies and Restrictions

- Conclusion

-

Frequently Asked Questions

- How many credit cards should I have at one time?

- Does applying for multiple credit cards hurt my credit score?

- Can I apply for two credit cards from the same issuer?

- How long does a credit card application stay on my credit report?

- What factors should I consider before applying for another credit card?

- Recommended Reads

Key Highlights

- Applying for several credit cards quickly can lower your credit score temporarily.

- Each credit card issuer has different rules about how often you can apply and the number of cards you can hold.

- Research and compare credit cards before applying to find the one that best suits your needs.

- Review your credit score and report before applying for new credit to ensure readiness.

- Responsible credit card use, such as on-time payments and low credit utilization, builds a strong credit history.

Introduction

A new credit card can offer rewards, perks, and financial flexibility. But before hitting “Apply Now,” it’s important to understand how credit card applications work and their impact on your credit score. Knowing when and how to apply can help you manage your credit responsibly and make informed decisions. Let’s dive into the details of credit card applications and explore the best timing strategies to enhance your financial health.

Understanding Credit Card Applications

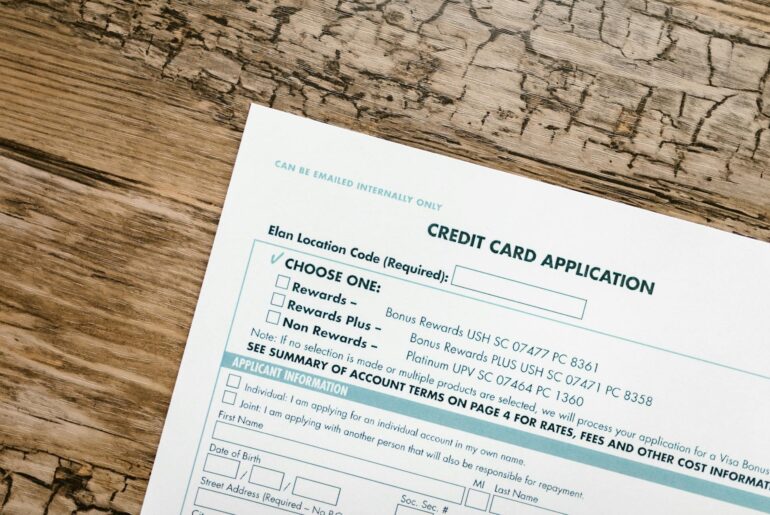

Applying for a credit card means requesting a line of credit from a bank or financial institution. During this process, the card issuer evaluates your credit history, score, and financial situation to determine eligibility. Based on this assessment, they decide whether to approve your application and establish the terms of your credit, including limits and interest rates.

The Impact on Your Credit Score

Every time you apply for a credit card, the issuer performs a hard inquiry on your credit report. While a single hard inquiry might lower your score by a few points temporarily, multiple inquiries in a short period can signal financial instability and further decrease your score.

Additionally, opening a new credit card reduces the average age of your accounts, a factor considered in your credit score. While these effects are temporary, maintaining good financial habits can help offset any negative impact over time.

Common Misconceptions Explained

| Misconception | Fact |

|---|---|

| Checking your own credit score lowers your credit. | Checking your own score is a soft inquiry and does not affect your credit. |

| Closing old credit card accounts helps improve creditworthiness. | Closing old accounts can reduce your total credit limit, increasing your credit utilization ratio and potentially lowering your score. |

| Applying for multiple cards quickly builds credit faster. | Applying for multiple cards in a short time results in hard inquiries, which can lower your score and make you appear risky to lenders. |

Preparing to Apply for Your First Credit Card

Getting your first credit card is an important financial step. Before applying, assess your financial readiness and ensure you have a solid understanding of credit basics.

What You Need to Know Before Applying

- Credit Scores: Scores range from 300 to 850. A higher score improves approval chances and leads to better terms.

- APRs (Annual Percentage Rates): A lower APR means reduced interest costs if you carry a balance.

- Credit Responsibility: Pay your balances in full and on time to avoid debt and build a positive credit history.

Essential Documents and Information

Gather these items before applying:

- Personal Information: Full name, address, date of birth, and Social Security number.

- Employment Details: Proof of income, such as pay stubs or bank statements.

- Financial Information: Monthly housing costs and other recurring expenses.

A Beginner’s Guide to Credit Card Applications

Step 1: Assessing Your Financial Situation

Evaluate your credit score, income, and debt-to-income ratio to determine readiness. A strong credit profile improves approval chances and provides access to better rewards and lower interest rates.

Step 2: Researching the Right Credit Card

Choose a card that aligns with your needs. Consider:

- Travel Rewards Cards: Ideal for frequent travelers.

- Cash Back Cards: Offer savings on everyday purchases.

- Secured Cards: Great for building or rebuilding credit.

Step 3: Understanding Terms and Conditions

Read the fine print carefully. Focus on:

- APR: Look for low-interest options if you plan to carry a balance.

- Fees: Be aware of annual fees, foreign transaction fees, and late payment penalties.

- Rewards: Understand the structure of any cash back, points, or miles.

Step 4: Submitting Your Application Carefully

Provide accurate personal and financial information. Review your application before submission to avoid errors. Limit applications to one at a time to reduce the risk of hard inquiries negatively affecting your score.

Step 5: Following Up on Your Application

If approved, you’ll typically receive your card within 7-10 business days. If denied, review the issuer’s explanation and address any credit report issues before reapplying.

Timing Your Credit Card Applications

Strategic timing can help protect your credit score and improve approval odds.

When Is the Best Time to Apply?

- Planned Purchases: Apply before large expenses to take advantage of sign-up bonuses or rewards.

- Improved Credit Score: Wait until your score improves if recent issues have impacted it.

- Seasonal Offers: Many issuers provide enhanced rewards or bonuses during holidays and special promotions.

How Long Should You Wait Between Applications?

It is generally recommended to wait at least six months between applications. This helps maintain a strong credit profile and reduces the risk of multiple hard inquiries lowering your score.

Credit Card Issuer Policies and Restrictions

Different issuers have unique rules regarding applications and card ownership. Here’s an overview:

| Issuer | Key Policies |

|---|---|

| American Express | One welcome bonus per card per lifetime. |

| Chase | 5/24 rule: No approval if 5+ cards opened in 24 months. |

| Bank of America | 2/3/4 rule: 2 cards in 30 days, 3 in 12 months, 4 in 24 months. |

| Citi | 48-month wait between bonuses for some cards. |

Conclusion

Applying for credit cards requires careful planning and consideration of your financial health. By understanding the impact of applications, researching issuers’ policies, and timing your applications wisely, you can manage your credit effectively and unlock valuable rewards. Remember, responsible credit use—such as paying on time and keeping utilization low—is key to long-term financial success.

Frequently Asked Questions

How many credit cards should I have at one time?

There’s no perfect number. Focus on managing your current cards responsibly rather than the quantity.

Does applying for multiple credit cards hurt my credit score?

Yes, applying for multiple cards in a short time can lower your score due to hard inquiries.

Can I apply for two credit cards from the same issuer?

It depends on the issuer. Some allow multiple applications, while others impose waiting periods.

How long does a credit card application stay on my credit report?

A hard inquiry remains on your report for two years but only impacts your score for 12 months.

What factors should I consider before applying for another credit card?

Review your credit score, spending habits, and the benefits offered by the card. Ensure it aligns with your financial goals.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: How Often Can I Apply for a Credit Card: The Right Timing for Applications

https://fangwallet.com/2025/02/08/how-often-can-i-apply-for-a-credit-card/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo