Key Highlights

- Technology is revolutionizing the insurance industry, making policies easier to access and manage.

- AI and machine learning enable personalized policy recommendations and faster claims processing.

- Mobile apps offer instant access to insurance cards, policy details, and roadside assistance.

- Online platforms allow customers to compare quotes easily, helping them secure the best coverage at competitive prices.

- Blockchain technology is enhancing transparency and trust in insurance transactions.

Introduction

In recent years, rapid technological advancements have reshaped industries, and insurance is no exception. Companies like Farmers Insurance are leading the way by integrating technology to enhance customer service and streamline operations. From auto insurance to specialized coverage, these changes are transforming how we interact with insurers and manage our policies. Let’s explore how technology is revolutionizing the insurance landscape in the 21st century.

Understanding the Impact of Technology on Insurance

Traditionally, buying and managing insurance was often a tedious and time-consuming process. Technology has changed that. Online tools and digital platforms now make the insurance experience more intuitive and accessible.

Features like fast online quotes and mobile app-based policy management simplify coverage for customers. These innovations ensure that navigating insurance is more convenient than ever before, empowering users to control their financial protection.

The Evolution of Insurance in the Digital Age

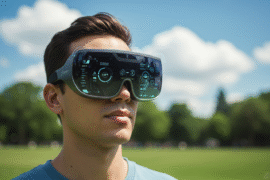

The rise of digital technology has significantly transformed the insurance industry. Online platforms and mobile apps now enable customers to manage policies, access information, and interact with insurers directly from their smartphones.

This digital evolution has intensified competition among insurers, driving them to offer better prices, personalized coverage options, and enhanced customer experiences. By removing traditional barriers, technology has ushered in a customer-centric era for insurance, where users have greater flexibility and control over their coverage.

Key Technologies Reshaping Insurance Policies

Technologies like AI, machine learning, and blockchain are at the forefront of the insurance revolution:

- Artificial Intelligence (AI): AI analyzes vast amounts of data to identify patterns, enabling personalized policy recommendations, improved risk assessment, and faster fraud detection.

- Machine Learning: A subset of AI, machine learning uses predictive analytics to refine policy offerings and streamline the underwriting process, providing tailored coverage that matches individual risk profiles.

- Blockchain: Blockchain enhances transparency and security by creating tamper-proof records. This technology accelerates claims processing, reduces fraud, and fosters trust between insurers and customers.

Preparing for a Tech-Savvy Insurance Experience

As the insurance industry continues to embrace technology, customers must adapt to these changes. Digital tools and platforms can greatly enhance your experience with your insurer, making processes more efficient and transparent.

To make the most of these advancements, familiarize yourself with online platforms and mobile apps offered by your insurer. Understanding how to use these tools will help you make informed decisions and simplify policy management.

What You Need to Get Started

To begin exploring technology-driven insurance, ensure you have the following:

- A Reliable Device: A smartphone or computer with internet access is essential.

- Basic Information: Be prepared to provide details such as your name, address, and vehicle information.

- Research Tools: Use insurance comparison websites to explore options and find the best coverage for your needs.

Navigating Online Insurance Platforms

Many insurance companies offer intuitive websites and apps designed for users of all tech skill levels. When using these platforms, look for:

- Simple navigation and search features.

- Secure payment options and clear policy details.

- Access to live customer support and user reviews.

Digital tools like policy management dashboards and roadside assistance requests save time and make handling your insurance more convenient.

Step-by-Step Guide to Utilizing Technology in Insurance

Step 1: Compare Policies Online

Visit trusted insurance comparison websites or individual insurer sites. Enter your zip code and coverage preferences to view quotes from multiple providers. Pay attention to liability limits, deductibles, and additional benefits like roadside assistance.

Step 2: Use Mobile Apps for Instant Coverage

Download your insurer’s app to quickly get coverage. Create an account, input your details, and receive a tailored quote. If satisfied, complete the purchase and access your digital proof of insurance instantly.

Step 3: Manage Policies via Mobile Apps

Mobile apps allow you to update personal details, adjust coverage, and access customer support with just a few taps. Use these features to stay on top of your policy and handle changes effortlessly.

Step 4: File Claims Digitally

Skip paperwork by filing claims online or through mobile apps. Upload photos and documents, describe the incident, and track your claim’s progress in real time. This streamlined process ensures faster resolutions and improved customer satisfaction.

The Benefits of Technology-Enhanced Insurance Services

Technology has made insurance more accessible, efficient, and user-friendly. Customers now have greater control over their policies and can make informed decisions through digital tools.

Key benefits include:

- Personalized Policy Recommendations: AI analyzes your driving record, location, and other factors to suggest coverage tailored to your needs.

- Streamlined Claims Processing: Digital claims filing reduces processing times, allowing for quicker resolutions.

- Improved Accessibility: Online platforms and apps simplify tasks like policy updates, payment management, and roadside assistance requests.

The Future of Insurance: Trends and Predictions

The future of insurance will be shaped by advancements in AI, machine learning, and blockchain:

- AI and Machine Learning: These technologies will enable ultra-customized policies and more accurate risk assessments.

- Blockchain: As blockchain adoption grows, it will enhance transparency, prevent fraud, and streamline transactions.

- Enhanced Customer Experiences: Insurers will continue to develop intuitive tools and platforms to meet evolving customer expectations.

Conclusion

Technology is transforming the insurance industry, offering personalized solutions, faster processes, and greater convenience. From AI-driven policy recommendations to blockchain-enhanced transparency, the future of insurance is more customer-focused than ever. By embracing these innovations, insurers and policyholders alike can benefit from a more efficient, tech-forward approach to coverage.

Frequently Asked Questions

How can I compare insurance policies online?

You can use comparison websites to explore coverage options from different insurers. Enter basic details, review financial strength ratings, and read customer reviews for a comprehensive understanding.

Can I file insurance claims through an app?

Yes, most insurers now offer mobile apps for claims filing. You can submit details, upload photos, and track your claim’s progress directly through the app.

What are the benefits of digital insurance cards?

Digital insurance cards, accessible through mobile apps, provide instant proof of coverage. They’re convenient for situations like traffic stops or roadside emergencies when physical cards aren’t available.