This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

Key Highlights

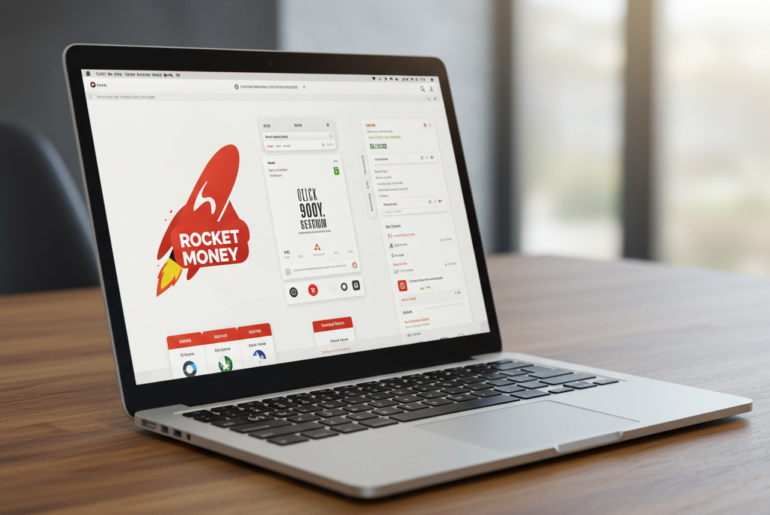

- Rocket Money is an app for managing money. It has both free and paid features to help people with their finances.

- The app mainly earns money from paid subscriptions and from negotiating bills.

- Rocket Money helps users manage their money. It has tools to cancel subscriptions and save automatically.

- Its way of making money shows a trend toward more subscription services instead of ads.

- This change shows better user privacy and more control over information.

Introduction

Finance apps are now crucial for handling money. Rocket Money is one app that stands out. It is simple to use and has useful tools. This article explains how Rocket Money makes money while helping users with their money. It also shows how the app’s business model reflects changes in the finance app market.

Understanding Rocket Money’s Business Model

Rocket Money uses a freemium model. They offer a free app with basic features and a paid option with more tools. This lets users test the app before they pay. Many users are attracted to the free option, while the paid choice helps the company earn most of its income.

Rocket Money’s way of working is about helping users and staying reliable. They do not rely on ads to earn money. This choice helps keep user privacy safe and improves the overall money experience.

Revenue Streams: How Rocket Money Earns

Rocket Money earns money from these ways:

Users who switch to the premium plan receive extra features. These features include tools for automatic saving, personalized money advice, and assistance with negotiating bills.

2. Bill Negotiation Services

The app finds lower prices for internet, cable, and mobile plans. Rocket Money keeps a portion of the savings as a fee when it works.

3. Affiliate Marketing

Rocket Money does not primarily earn money from its activities. Instead, it sometimes gets paid to promote money-related products from other companies. Rocket Money may receive a referral fee when users sign up or purchase items from the app’s recommendations.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Comparing Revenue Models of Popular Money Apps

Rocket Money’s way of making money shows a significant change in the finance technology world. It is moving from using ads to making money from users with subscription services. This change helps create better privacy rules and gives users a better experience.

| App Name | Revenue Model | Key Features |

|---|---|---|

| Rocket Money | Freemium (Subscription, Commission) | Bill negotiation, Automated savings |

| Mint | Advertising, Paid Partnerships | Budgeting and expense tracking |

| YNAB | Subscription | Goal-based budgeting, Financial education |

| Personal Capital | Premium Features, Advisory Fees | Investment management, Retirement planning |

Subscription apps such as Rocket Money and YNAB are gaining popularity. This shows that people want to pay for tools made just for them, safe data, and money advice.

Getting Started with Rocket Money

You can download Rocket Money on both iOS and Android devices. It is also available for web browsers on Mac and PC. Setting it up is simple and easy.

To begin:

- Download the App: Get Rocket Money from the Apple App Store or Google Play Store.

- Create an Account: Sign up with your email or log in using your Google or Apple account.

- Link Your Accounts: Safely connect your bank, credit card, and investment accounts.

- Customize Preferences: You can change alert settings, choose your currency, and set up the app as you like.

After you set it up, your dashboard shows you a complete picture of your finances.

Optimizing Your Experience with Rocket Money

Users need to use the app regularly to benefit from Rocket Money’s features fully. They can do this by connecting all their accounts, setting goals, and monitoring their spending habits.

Step 1: Link Financial Accounts

Connect your checking, credit, and investment accounts. This lets Rocket Money see your income, expenses, and cash flow. The app uses Plaid, a secure data provider that protects your information with encryption and multi-factor authentication.

Step 2: Set Financial Goals and Budgets

After you connect your accounts, set your goals. These could include saving for a house, paying off debt, or investing for the future. Rocket Money gives you tools to manage your savings, organize expenses, and track your progress. It helps you stay focused on your goals.

Conclusion

Rocket Money is different because it cares about privacy, honesty, and what users want. It earns money by offering special features and helping to lower bills. This method is better than many finance platforms that depend heavily on ads. For people who want to manage their money safely, Rocket Money offers a clear and strong way to do so.

Frequently Asked Questions

How does Rocket Money protect my money information?

Rocket Money uses Plaid to connect to your money accounts. PayPal uses special codes and several steps to protect your information and ensure you can reach it safely.

What kinds of money goals can I make in Rocket Money?

Users can set various goals. They can save for a home, pay down debt, create an emergency fund, or invest for retirement.

Does Rocket Money offer a free version?

Yes. The app offers a free plan that includes basic tools. The premium plan offers more features, such as automatic savings and bill negotiation.

How does Rocket Money earn money without ads?

Revenue comes from paid subscriptions and fees for bill negotiation services. This allows us to avoid using annoying ads.

Is it essential to connect all my bank accounts?

No, but linking your accounts helps Rocket Money give you a better view of your money and offer clearer budgeting tips and advice.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: How Rocket Money Earns and What It Reveals About Money Apps

https://fangwallet.com/2025/04/15/rocket-money/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.