This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

President Trump’s recently announced changes to U.S. tariff policy has rocked financial markets, and the cryptocurrency market is no exception. Concerns about the impact of this major policy change on the global economy has led to a sharp drop in Bitcoin prices.

Top altcoins like Ether, XRP, and Solana, have experienced even greater levels of price volatility. That said however, it’s not as if every single cryptocurrency is currently falling in price. There are a few gainers out there. According to Binance, here are the top gaining cryptocurrencies.

Moreover, while Stablecoins by their nature have not necessarily gained nor declined in price, while recent macro events are leading to an outflow of capital from high-utility cryptocurrencies, that’s not been the case with Stablecoins.

Bucking current trends, Stablecoins keep benefiting from rising demand and user adoption. This trend may continue, as the broad market continues to make a flight to safety.

Market Uncertainty and its Impact on Crypto Prices, Onchain Volumes

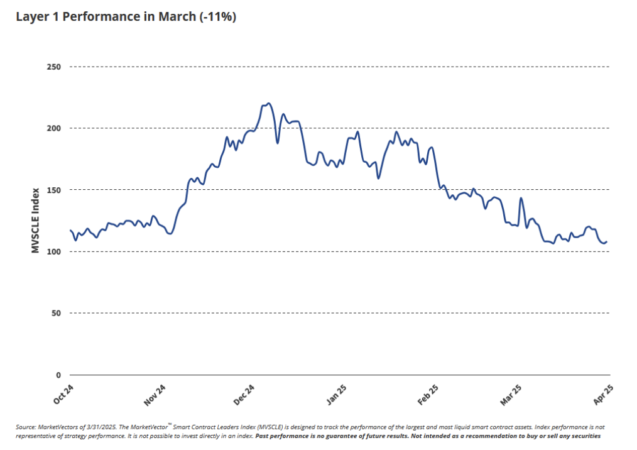

In a research note published April 3, VanEck analysts Matthew Sigel and Patrick Bush provided their recap and analysis of the cryptocurrency market for the preceding month. Per the two sell-siders, while positives such as progress with crypto-related legislation helped to soften the blow, rising fear and uncertainty in the market about tariffs and inflation negatively affected the performance of major cryptocurrencies.

That’s not all. Alongside price declines for their native cryptocurrencies, Smart Contract Platforms (SCPs) like Ethereum and Solana also experienced declines in revenue and decentralized exchange (DEX) volumes during the month.

Solana in particular experienced a sharp drop in onchain activity. During March, daily average fees declined by two-thirds, Stablecoin transfer volume fell by a third, and DEX volumes were down by more than half.

After briefly rising above the Ethereum ecosystem in terms of SCP market share during February, Solana’s share of the market has fallen back to levels last seen in October 2024, from nearly 40% to just over 20%. Since the VanEck report, as mentioned above, the impact of the Trump tariffs, particularly after their official “Liberation Day” announcement on April 2, has led to further volatility in the crypto space.

Why Stablecoins are Thriving in Today’s Environment

The aforementioned changes in the macroeconomic backdrop may be bad news for Bitcoin and major altcoins, but the same can’t be said when it comes to Stablecoins. As the crypto market headed back into bear market mode during March, there were plenty of signs that Stablecoins, or cryptocurrencies pegged to a stable value such as the value of the U.S. Dollar, very much indeed remained in a bull market.

This was another key insight provided by the VanEck research note. In a nutshell, the shift from “risk on” to “risk off” has meant a cycling of capital into Stablecoins. Total on-chain Stablecoin supply increased by $9 billion during March, rising from $225 billion to $234 billion. Falling Stablecoin yields provide further evidence of growing demand for this type of cryptocurrency.

At the start of 2025, Stablecoins were yielding between 9% and 10%. Today, average yields are in the 3.1%-4.9% range. With this drop in yield, one may assume that rising demand and popularity for Stablecoins could soon take a hit.

However, given the market’s increasing flight to safety in light of the tariff news, the ongoing bull market could continue.

What This May Mean for the Web3 Economy Going Forward

The tariff-driven selloff in cryptocurrencies may be accelerating, but that may not necessarily mean that Web3’s further growth is screeching to a halt. The switch from volatile cryptos to Stablecoins could simply be a case of market investors seeking a more “stable” store of value.

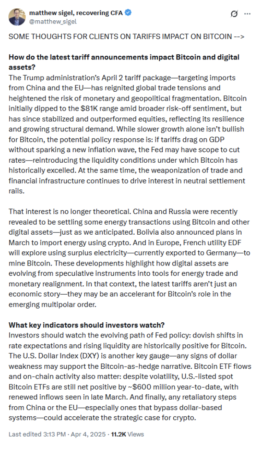

Not only that, there could be the potential for recent tariffs to accelerate the adoption of crypto-based alternatives to the traditional dollar-based financial system. Matthew Sigel laid out such an argument in an April 4 follow-up tweet to his recent research note.

Only time will tell, but instead of being a market anomaly, this Stablecoin bull market could prove to be another sign of crypto’s increasingly important role in a multipolar world order.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the comment form below for feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Asset Manager VanEck Calls for Stablecoin Bull Market While ETH and SOL Slow

https://fangwallet.com/2025/04/24/asset-manager-vaneck-calls-for-stablecoin-bull-market-while-eth-and-sol-slow/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.